Author: Gerry Acuna

QLAC 101

August 15, 2024

If you’ve saved well for retirement, then you may find you can cover your living expenses without needing to withdraw from your retirement accounts. But if you think that by age 73, you won’t need your full required minimum distributions or RMDs, then you might want to consider getting a qualified longevity annuity contract, or QLAC.

Anyone between the age of 18 and 75 can purchase a QLAC, but there may be some people that this annuity makes more sense for. If you’re looking to avoid the market risk on some retirement accounts and ensure a steady, guaranteed income in retirement, a QLAC is probably a good fit for you. If you also have concerns about the longevity of your savings and having enough money later in life, then you may benefit from a QLAC.

Here’s everything you need to know about a QLAC before deciding if it’s right for you.

How a QVAC Could Lower Your RMDs

A QLAC is a deferred fixed annuity contract sold by insurance and financial companies that you purchase with money from a retirement account, like a 401(k) or an individual retirement account (IRA).It’s important to know that Roth IRAs cannot be used to purchase QLACs as they do not come with RMDs to begin with.

RMDs are mandated starting at the age of 73 as of this year, but that will rise to age 75 in 2033. One appeal of the QLAC is that it can reduce the balance in your retirement accounts used to calculate those RMDs. “People tend to spend their RMDs,” says Steven Kaye, a financial planner in Warren, New Jersey. “So a QLAC forces people—in a good way—to leave more money in their IRAs,” he says.

One way to avoid using your RMDs is to use the funds from one of your retirement accounts to purchase a QLAC, which will guarantee that you receive regular payments for as long as you live. “So, if you used 25% of a $400,000 qualified account, your $100,000 purchase of a QLAC would immediately reduce your RMDs by 25%,” says Jerry Golden, investment advisor. “And the income from a QLAC could be deferred until as late as age 85,” he says.

When you choose a QLAC, you’ll be able to set your payout date, which is when you’ll begin receiving payments. Just like with Social Security, the longer you wait to receive payments, the higher the payments will be. Once you have a QLAC, you’ll be able to delay RMDs until the payout date of your QLAC, which can be no later than age 85.

The Tax Benefits of Having a QLAC

Once you withdraw money from your QLAC, you’ll need to pay income taxes on it. However, a QLAC can be an efficient tax planning strategy. For example, by using $100,000 of a traditional IRA to purchase a QLAC, you’ll reduce the balance of your IRA by $100,000, which will lower the amount you’ll need to take out for RMDs. The lower your RMD, the lower your income will be on that, which could significantly reduce the income tax you’ll owe.

QLAC Contribution Limits and Inflation Riders

You are now permitted to buy a QLAC for up to $200,000 from an eligible retirement plan. Previously, you were limited to whichever was lesser of $145,000 or 25% of your account balance. The current $200,000 upper limit is a combined cap that applies to all of your eligible retirement accounts, even if you take money from different accounts or purchase more than one QLAC. But if you and your spouse have your own eligible retirement accounts, then you can each spend up to the $200,000 limit on your own QLACs.

Since a QLAC locks in future payments, you are protecting your retirement money from market dips later in life. But unless you purchase an inflation rider with your QLAC, which will lower the initial amounts you receive from an annuity, your monthly payment may lose value over time.If you’re considering acquiring a QLAC, then you’ll want to work with a financial advisor to make sure you’re picking the right one.

Considering Your Spouse When Purchasing a QLAC

Some QLACs offer a survivor payout, also referred to as contingent annuity payments. These would continue your annuity payments to your designated beneficiary, which is usually a spouse, after your death. Other QLACs offer death benefits that would return any unused premiums to your beneficiaries through a lump sum or series of payments. If you have a spouse or individuals who will depend on your annuity after your passing, then you need to make sure any QLAC you choose has one of these features. Without these features in your annuity, your survivors would get nothing.

In addition to making sure your QLAC comes with a survivor payout or death benefit, you may also consider getting a joint QLAC with your spouse. If you’re married, a joint QLAC would provide income payments that continue for as long as one of you is alive. The only downside to choosing a joint contract is that it decreases your income payments, compared to a single life contract.

When a QLAC Isn’t For You

If you’re 65 and in poor health, you probably don’t want to wait until age 85 to start receiving income payments, so a QLAC may not benefit you at all. “If the probabilities are that you have a longer than average life expectancy, QLACs can be a windfall,” says Artie Green, a financial planner. “But if you have a shorter than expected longevity, of course, that works against you with any annuitization.” QLAC recipients can use their funds on whatever they want, but often they spend it on late-in-life health care or housing costs. The purpose of a QLAC is longevity protection that could minimize or even eliminate the risks of running out of money.

There are really only two scenarios in which a QLAC is a good fit. The first is if you have reached age 73 and do not need your RMDs to cover expenses. The second is if you think you’ll reach 73 and not have enough funds to pull from. QLACs can be a safeguard that guarantees you an income late in life, while also reducing your need for RMDs and even lowering your income taxes on them. At Insureyouknow.org, you may keep all of your financial and retirement planning in one place, making it easy for you to forecast and plan for your future.

What in the World is HELOC?

August 1, 2024

When the pandemic hit and people had to spend more time at home, they also began to spend more on home improvements. As more and more people began to renovate, the prices of construction and supplies also rose. “Right now, HELOCs might be the best way to pay for home renovations for most homeowners,” says Brian Mollo, owner and chief executive officer of Trusted House Buyers.

A HELOC, or a Home Equity Line of Credit, allows homeowners to borrow against their home’s values and have access to cash they might need. It is essentially a second mortgage or if you already own your home outright, a new primary mortgage. The homeowner is borrowing against the equity of their home minus the amount still owed on the primary mortgage, if there is one.

“Because most HELOCs have a variable interest rate, you may end up seeing the actual interest rate fall, as the draw period is 10 years,” he says. A personal loan or home equity loan by contrast comes with fixed rates that won’t respond to market changes. Of course, rates could also rise, so it’s important that you could afford rate hikes if that happens.

If you’re considering a HELOC, here’s everything you need to know about the line of credit.

Borrowing From Your Home’s Equity

When you need a large loan, borrowing from the equity in your home will often get you the best interest rate. While the annual percentage rate, or APR, varies by lender, other factors include your credit score and existing debt. Lenders want to see a credit score of 620 or higher and a debt-to-income ratio less than 40%. The home’s value should also be at least 15% more than what you owe.

Usually, you can borrow up to 85% of your equity, but this varies by lender. For instance, if your home is worth $300,000 with a balance of $200,000 on your first mortgage and the lender allows you to access up to 85% of your home’s value, then you would multiply the home’s value by that percentage, or $300,000 by 0.85 (85%). This equals $255,000 minus what you still owe ($200,000), which means that you could borrow up to $55,000 with a HELOC. You are not required to use the full line of credit. So if you only need $30,000, but the lender is offering up to $85,000, you may opt to only borrow what you need.

Because a HELOC is secured against the value of your home, the interest rate is typically lower than the one you’d pay on a credit card or personal loan, and closer to that of a mortgage rate. In order to secure the best rate, it’s important to shop around with at least three lenders. Check with your bank or mortgage lender first as they likely offer discounts for existing customers. You may want to opt for lenders that offer a fixed-rate option, which lets you lock in your APR and protects your loan from rising interest rates. This will make your long-term financial planning easier.

HELOCs are Meant for Home Improvements

Most often, a HELOC is used for home repairs or renovations that are meant to increase the value of your home. The interest that you pay on a HELOC is also tax-deductible if you use the money to improve your home and the combination of your HELOC and mortgage do not exceed IRS loan limits. Lenders strongly advise against using a HELOC for anything besides home improvements. “We don’t like seeing people break into the piggy bank and take out equity for other uses,” says Melinda Opperman, president of the nonprofit Credit.org. “Homeowners should only do it if they are using the funds to improve their property,” she says.

There are two phases of a HELOC. The first is the draw period, where you make only interest payments for about the first ten years. Payments towards the principal are optional during the draw period. The second phase is the repayment period when you must make both principal and interest payments until you’ve paid off what you’ve borrowed. With the addition of the principal, monthly payments can rise sharply and surprise the borrower. The length of the repayment varies but typically lasts 20 years.In addition to the interest you’ll pay on the loan, there will also likely be closing costs, which are often between two and five percent of the loan amount. Some lenders also charge annual fees, which are usually about $50 a year.

Using a home equity line to pay for a vacation or to fund leisure is an indicator that you’re spending beyond your means. If you use debt to fund your lifestyle, borrowing from home equity is only going to exacerbate the problem. With credit cards, you are only risking your credit, but with a HELOC, you are putting your home at risk. Experts advise against using a HELOC to pay off existing debt for this same reason. When it comes to purchasing a car or paying for a child’s college tuition, then use a car loan or a college loan, as those also will not put your home at risk.

The Risk Involved With a HELOC

Another consideration to make before resorting to a HELOC is whether or not the value of your home could fall as they did in 2008 during the financial crisis. “The amount of credit available to you through your HELOC is directly linked to your home value,” says Tyler Weerden, financial planner and founder at Layered Financial. “So, what happens if prices drop? In this case, the lender can reduce or even freeze your HELOC, all while you’re still required to make the payments,” he says.

While HELOCs do come with risks, they can also be an affordable source of funds for large projects like home renovations. Whether or not the risks are worth the benefits depends on your financial situation. “The big thing to remember when taking out a HELOC is that no matter what you spend that loan on, you are using your home as collateral,” says Omer Reiner, realtor and president of Florida Cash Home Buyers, LLC. “So be sure that you can afford to pay on both your first mortgage and your HELOC every month, otherwise you risk losing your home,” he says.

A HELOC may not be the right choice for you if you are only looking to borrow a smaller amount of money. In that case, you would be better off considering a low interest credit card. Since HELOCs come with the risk that you may lose your home if you cannot make your payments, they are not recommended if you have trouble making your existing mortgage payments.

By investing in your home with a HELOC, you may end up increasing the value of your home if you plan to sell it down the road. If not, then any improvements to your home will increase the quality of your time spent there with those you love. No matter which route you take, make sure that you’re confident in paying back a HELOC. With Insureyouknow.org, you can keep all of your financial records and home improvement planning in one easy-to-review place so that you may make the best plans for both your home and financial future.

Pros and Cons of Owning an Electric Vehicle

July 15, 2024

Almost 1.2 million Americans went electric in 2023, and according to Kelley Blue Book, electric vehicles are the fastest-growing category in car sales. With states such as California putting forth legislation that will require all vehicles to be electric by 2035 and new federal regulations for all government vehicle acquisitions to be electric the same year, EV sales are expected to remain steady.

“For people thinking about going to EV, just get educated,” says CEO of ChargePoint Rick Wilmer, who operates the world’s largest network of EV charging stations in North America and Europe. “If you understand how it works on a basic level, you should be fine.” So if you’re thinking about owning an EV, here are some pros and cons to going electric.

Depending on how large the battery in your EV is and what your electric rates are, it will still cost you money to charge your vehicle at home, but it should be less than what it would be to fill a gas tank. You can calculate the cost of filling up an EV by multiplying the size of the car’s battery by your home’s electricity rate, which can be found on your electric bill in kilowatt hours (or kWh). Then you could compare that price to how much it would cost to fill up a car with gas and yield the same mileage. If you pay the 2024 national average of 17 cents per kWh and have an EV with a 65-kWh battery, then you would pay $11.05, or $0.17 × 65, to fully charge the car’s battery. At the pump, if you paid this year’s average gas price of $3.35 per gallon, then10 gallons of gas would cost you $33.50. Plus, if you utilize public chargers or have access to other free charging stations, then your gas savings could be even higher. At the end of the day, the amount of money you’ll save on gas will depend on how many miles you drive and the difference between what you’ll pay for electricity versus gas.

EVs have less engine than a traditional gas-powered car, so there are less things that can go wrong. Since there’s no engine, there are also no oil changes or certain routine engine maintenance to take care of. This isn’t to say EVs come without maintenance though. You may need to replace your tires more often due to the heavy battery and regenerative braking, which helps charge the battery every time you use the brakes. EV tires typically wear out 20% faster than a traditional car’s. While the cost of replacing a battery can range from $6,500 to $20,000, many EVs now come with battery warranties of up to eight years or 100,000 miles. Putting your savings on gas on maintenance into a sinking fund may help if you end up needing to replace the battery down the road.

Pro: Better for the Environment

EVs don’t burn gas, and even though the battery makes it more material-intensive than a gas-powered vehicle, the environmental benefits outweigh the initial environmental cost. The greenhouse gas emissions from charging the vehicle are also lower than a gas car’s total emissions, especially when the local power plants are using clean energy sources rather than burning fossil fuels.

Con: Investing in Home Charging

Unless you plan to rely completely on charging your EV in public spaces or you live somewhere that already has charging stations available, you’re likely going to have to install a charging station in your home. In addition to the cost of installing the charging station, your electric bill will be higher. How much higher your bill will be depends on your electric rate, the type of charging system you use, and how often you need to charge your battery at home.

Con: EV Range and Charging Difficulties

An EV’s range is how far a full battery charge will get you. Today, you can buy a new EV with a range between 260 and 400 miles. Even on a full battery though, most EVs won’t take you as far as most gas-powered cars on a full tank. The other downside to having to charge the battery versus filling up at a gas station is that fully charging a battery can take up anywhere between 15 minutes and 12 hours depending on the charging speed. Yet another sticking point to getting where you need to go is that it might be difficult to find charging stations along the way as EVs are still new. You’ll likely have to plan your route around where you can stop and charge up.

Con: The Upfront Cost of Buying an EV

While it’s becoming less expensive to buy EVs, they are still more expensive than your traditional vehicle. According to Kelley Blue Book, the average cost of buying a new EV was $49,507 by the end of 2022. “Buyers expect their vehicles to be affordable. Fully 74 percent of those intending to buy an electric expect their next vehicle to cost less than $50,000,” says Deloitte’s Automotive Research Leader Ryan Robinson. “With the average price of a new vehicle already approaching $40,000, that’s a very narrow band for electrics.” As production increases and technologies improve, EV prices are expected to equalize with conventional cars in the coming years. Also, the cost of buying an EV may be offset by the potential fuel and maintenance savings and the federal tax credit. This year, you may claim a tax credit of up to $7,500 on your 2023 taxes for purchasing an electric vehicle.

Are Hybrids the Middle Ground?

If you’re hesitant to buy an EV, then a hybrid car might be an alternative. Since hybrids use less gas, they are still environmentally friendly and will still cost you less at the pump. Another plus is that since they are self-charging, they don’t require charging stations. Even though skipping out on charging stations is a benefit, they do still have a battery that will eventually cost you to replace. Since you can think of a hybrid as being part traditional, there will also still be maintenance costs. They will also cost you more to buy upfront, because a hybrid uses newer technology just like an EV. If you think you can afford the added costs upfront and possibly replace the battery eventually, then the upsides to hybrids are going to be less emissions, gas savings, and hassle-free battery charging.

If you’re unsure of buying an electric vehicle, another solution may be to lease one and see if the EV life is right for you. Otherwise, as long as you think you can reduce the upfront costs of transitioning to an EV, the savings on maintenance and gas over time are appealing, while you would also be doing your part in reducing emissions. At Insureyouknow.org, you may store and access all of your financial information and vehicle maintenance records easily so that if you’re considering going electric, the transition can be seamless.

Understanding What Hospice Care Means

July 1, 2024

When treatment for serious illnesses is causing more side effects than benefits, or when health problems become compounded, then a patient and their family members may begin to wonder about hospice. “We recognized as people consider hospice, it’s highly emotional times,” says medical director for Austin Palliative Care Dr. Kate Tindall. “It might include worries and fears.” But one of the things she hears most often from patients and their families is that they wish they had started sooner. Understanding who qualifies for hospice and what it entails is the first part of deciding what might be best for those with terminal conditions.

What is Hospice Care?

Hospice is meant to care for people who have an anticipated life expectancy of 6 months or less, when there is no cure for their ailment, and the focus of their care shifts to the management of their symptoms and their quality of life. With hospice, the patient’s comfort and dignity become the priority, so treatment of the condition ends and treatment of the symptoms, such as pain management, begins. There are no age restrictions placed around hospice care, meaning any child, adolescent, or adult who has been diagnosed with a terminal illness qualifies for hospice care.

An individual does not need to be bedridden or already in their final days of life in order to receive hospice care. Other common misconceptions about hospice care are that it is designed to cure any illness or prolong life. It is also not meant to hasten death or replace any existing care, such as those already provided by a physician.

Determining When it’s Time for Hospice

Establishing care is most beneficial for the patient and their caregivers when it is taken advantage of earlier rather than later. Hospice can be used for months as long as eligibility has been met. Once there is a significant decline in physical or cognitive function, the goal for treatment should become to help that individual live comfortably and forgo anymore physically debilitating treatments that have been unsuccessful in curing or halting the illness.

Both individuals and their loved ones who would benefit from initiating hospice care are often unaware of the services or are uncomfortable asking about them. “It’s a hard conversation to have,” says professor of medicine and palliative care at the Duke University School of Medicine David Casarett. “Many people really want to continue aggressive treatment up until the very end.” While many wait for their providers to suggest it, it should be understood that if eligibility for hospice has been met, an individual and their caregivers can initiate hospice care on their own.

Establishing Hospice Care

In order to qualify for hospice care, a physician must certify that the patient is medically eligible, which means that the individual’s life expectancy is 6 months or less. Typically, the referral to hospice starts with the attending physician’s knowledge of that person’s medical history, while eligibility is then confirmed by the hospice physician. A hospice care team consists of professionals who are trained to treat physical, psychological, and the spiritual needs of the individual, while also providing support to family members and caregivers. Care is person-centered, with the importance being placed on the coordination of care, setting clear treatment goals, and communicating with all involved parties.

Receiving Care at Home

Hospice care is generally provided in the person’s home, whether it’s a personal residence or a care facility, such as a nursing home. “When people are close to the end of their lives, going to the hospital does not make them feel better anymore,” explains professor of medicine at the University of California Dr. Carly Zapata. “Because there’s not necessarily something that we can do to address their underlying illness.” Staying at home allows the individual to be around their personal things and close to their loved ones and pets, which can provide them with comfort during the end of their life.

What Does Hospice Care Include?

Hospice includes periodic visits to the patient and their family or caregivers but is available 24-7 if needed. Medication for symptom relief is administered, any medical equipment needed is provided, and toileting and other supplies such as diapers, wipes, wheelchairs, hospital beds are provided. What may surprise some people is that hospice patients may even receive physical and occupational therapy, speech-language pathology services, and dietary counseling.

If needed, short-term inpatient care may be established for those who cannot achieve adequate pain and symptom relief in their home setting. Short-term respite care may also become available to help family caregivers who are experiencing or are at risk for caregiver burnout. Bereavement care, or grief and loss counseling, is also offered to loved ones who may experience anticipatory grief. Grief counseling is available to family members for up to 13 months after the person’s death.

Paying for Hospice

The first step in finding a hospice agency is to search for ones that serve your county. If there are several options available, then it’s recommended to talk to more than one and see which agency will best fit the patient’s needs. Adequate research should be conducted since not all hospice agencies provide physical and occupational therapy.

Hospice is a medicare benefit that all Medicare enrollees qualify for, but it may also be covered through private insurance and by Medicaid in almost every state. Military families may receive hospice through Tricare, while veterans with the Veterans Health Administration Standard Medical Benefits Package are also eligible for hospice. Hospice agencies will also accept individual self-pay, while there are also non-profit organizations that provide hospice services free of charge.

Discontinuing Hospice Care

Though it is uncommon, if a patient does improve or their condition stabilizes, they may no longer meet medical eligibility for hospice. If this happens, the patient is discharged from the program. Another situation that sometimes arises is when a person elects to try a curative therapy, such as a clinical study for a new medication or procedure. In order to do that, the patient must withdraw from hospice through what is called revocation. Both children and veterans are exempt from being disqualified from hospice care if they choose to also pursue curative treatments. Any person may always re-enroll in hospice care at any time as long as they meet the medical eligibility.

Opting for Palliative Care

Individuals with chronic conditions or life-threatening illnesses may opt for palliative care, which doesn’t require people to stop their treatments. Palliative care is a combination of treatment and comfort care and can be an important bridge to hospice care if patients become eligible. Because transitioning to hospice care can be an emotional choice, palliative care providers often help patients prepare for that. Many people avoid palliative care because they think it is equal to giving up and that death is imminent, but studies show that for many, palliative care allows them to live longer, happier lives. This is due to the benefits of symptom management and spiritual support.

While hospice care can be difficult to accept, it can provide people with the best quality of life possible in their final days, as well as provide their loved ones with valued support. With Insureyouknow.org, you may keep track of all medical and financial records in one easy-to-review place so that you may focus on caring for your loved one, your family, and yourself during this period of their care.

Five Things Happy Retirees Have in Common

June 15, 2024

The transition into retirement can be difficult, when work no longer provides a sense of identity and accomplishment. The change can be startling, especially when most people don’t switch to part-time schedules on the way out of their full-time careers. “We don’t really shift our focus to, how do we live well in this extra time,” says M.T. Connolly, author of The Measure of Our Age. “A lot of people get happier as they age because they start to focus more on the meaningful parts of existence and emotional meaning and positive experience as finitude gets more real.”

While most people account for how much money they’ll need when it’s time to retire, there are many other factors to consider when planning for a fulfilling retirement. Here are five things that happy retirees have in common.

Feeling a Sense of Purpose

There are several approaches to staying active and finding purpose after leaving a career. “Your retirement schedule should be less stressful and demanding than your previous one, but we don’t need to avoid all forms of work or service,” says Kevin Coleman, a family therapist. “Find some work that you take pride in and find intrinsically meaningful.”

Many retirees, for example, choose encore careers, where instead of working for the money, they are working for the enjoyment of the job. Besides finding a new job, there are other simple ways to feel purposeful during retirement. Purpose can be found by making oneself useful, such as by volunteering in the community, joining a community board, or participating in an enjoyable activity with a group, like a gardening club. Many retirees enjoy volunteering to take care of their grandchildren or helping their older friends with caregiving duties. Finding purpose doesn’t need to be complicated and can be achieved through simple acts of showing up for others and being open to new connections.

Finding Ways to Connect

As nearly 25% of those who are 65 and older feel socially isolated, finding ways to connect are important for mental and physical well-being during retirement. One way to connect is through storytelling. Sharing our stories with the people we care about strengthens our social bonds and helps us feel less lonely. Storytelling also helps people pass down their family memories, especially when we share stories with younger relatives, such as with grandchildren. It’s a nice feeling to think that your memories will live on through your loved ones. “The models we have for aging are largely either isolation or age segregation,” says Connolly. “There’s a loss when we don’t have intergenerational contact. It impoverishes our social environment.” Perhaps the best thing to do as you age is to cherish and foster these relationships with younger relatives.

Making Plans for the Retirement Years

Budgeting for your retirement is crucial to happiness during the retirement years. Successful retirement planning includes paying off debts prior to retiring and saving for unexpected expenses or emergency funds in addition to a standard monthly budget. According to a survey conducted by Wes Moss, author of You Can Retire Sooner Than You Think, the happiest retirees are those who have between $700,000 and $1.25 million in liquid retirement savings, such as stocks, bonds, mutual funds, and cash. His research also found that retirees within five years or less of paying off their mortgages are four times more likely to be happy in retirement. This is because the mortgage payment is typically the most significant expense, so those retirees who own their homes feel safer and more at peace once they no longer have that bill. Plus, not having a mortgage payment due every month dramatically lowers their monthly expenses and can help retirement savings last longer.

Many retirees overlook retirement planning beyond their finances. New research from the Stanford Center on Longevity shows that where someone lives in retirement can affect their longevity. Researchers found that people over the age of 60 who lived in upper-income areas lived longer due to having more access to health and social services. They also credited strong social networks and a sense of community to living longer. So perhaps there’s a city or area that you’ve always dreamed of living in or you’d like to live closer to family. Think about where you want to live when you’re done working and then plan for it before you retire.

Beyond saving up and thinking about where you want to spend your retirement years, setting goals for once you’re in retirement is equally as important. “Research suggests that those who think about and plan for what they will do in retirement in advance are far happier and fulfilled once they actually retire and begin living this phase of life,” says financial planner Chris Urban. “Sometimes it is helpful for people to write down what they plan to do every day of the week, what goals they have, who they want to spend time with and what they want to do with them.”

While your goals before retirement were likely centered around career and finances, it will be important to set different kinds of goals once you’re retired. Having goals doesn’t become less important just because you’re no longer working. “If you really want something, maybe a new romance, then take a concrete step in that direction,” says psychiatry professor Ahron Friedberg. “Don’t ever tell yourself that it’s too late.”

Prioritizing Both Physical and Mental Health

With a full-time career no longer on the schedule, cooking healthy meals at home, getting enough sleep, and finding ways to be more physically active everyday will be easier. It will also be important to keep up on medical appointments and preventive therapies. A study conducted by Harvard shows that even people who become more physically active and adopt better diets later in their lives still lower their risks of cardiovascular illnesses and mortality more than their peers who do not. “Not all core pursuits include physical activity or exercise, but many of the top ones do. I refer to them as the ‘ings’—walking, running, biking, hiking, jogging, swimming, dancing, etc.,” says Moss. “These all involve some sort of motion and exercise.” The most sustainable form of physical activity will be doing more of those activities that you enjoy and that move your body.

In addition to caring for your physical health, focusing on your mental health is just as important, especially as you age. According to Harvard’s Medical newsletter, challenging your brain with mental exercise activates processes that help maintain individual brain cells and stimulate communication between them. So choose something new or that you’ve always wanted to learn. Take a course at a community college or learn how to play an instrument or speak a language. If you enjoy reading, visit the library every week for a new book. If you enjoy helping others learn, then looking into a part-time tutoring job or volunteering to tutor is a way to challenge yourself mentally, connect socially, and feel a sense of purpose.

Prioritizing your overall health includes asking for help when you need it. If you reach a point where you need assistance with daily tasks and activities, then you shouldn’t hesitate to ask for help early. Whether it’s family members or caregiving services, finding help with the things that are becoming difficult for you is the best way to maintain your independence for as long as you can so that you may continue to thrive during your retirement years.

It’s important to think about how you want to spend your retirement before it’s here. While many people only consider their finances when they begin to plan for the future, there are other factors, including how you’ll spend your time, where you’ll live, and your overall health that will impact the quality of your retirement years. With Insureyouknow.org, storing all of your financial information, medical records, and planning documents in one easy-to-review place will help you plan for what can be the best years of your life.

Life After a Stroke: What You Should Know

May 21, 2024

A stroke affects the brain’s arteries and occurs when a blood vessel that brings blood to the brain gets blocked or ruptures. The area of the brain that is supplied with blood by the blocked or ruptured blood vessel doesn’t get the oxygen and nutrients it needs, and without oxygen, nerve cells are unable to function. Since the brain controls one’s ability to move, feel, and think, a stroke can cause injury to the brain that could affect any or all of these functions.

Everyone should know the signs of a stroke and seek immediate medical attention if you think you or someone around you is having a stroke. If you or someone you love has recently had a stroke, then it’s important to understand what happens next.

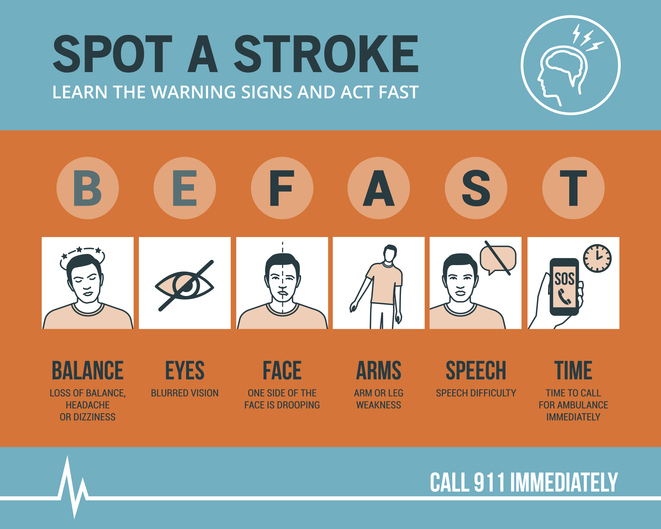

Know the Symptoms of a Stroke and act FAST

The longer the brain is left untreated during a stroke, the more likely it is that someone will have irreversible brain damage. The acronym FAST can help everyone recognize the four main signs that someone may be having a stroke and remember to act fast in seeking medical treatment. That means calling 9-1-1 immediately, as emergency response workers can treat someone on arrival if they think that person is having a stroke.

FAST stands for Facial drooping, Arm weakness, Speech difficulties, and most importantly, Time. If one side of a person’s face is drooping, if the person cannot lift both arms or one arm is drifting downward, and if the person’s speech is slurred or they cannot repeat a simple sentence, then they may be having a stroke. Not all of these signs need to be present to signal a stroke. Just one or two of these symptoms is enough to call 9-1-1, because time is of the essence in the event of a stroke.

Stroke Treatment Begins With Emergency Response Workers

Calling for an ambulance means that the emergency response workers can start life-saving treatment on the way to the hospital. Stroke patients who are taken to the hospital in an ambulance may get diagnosed and treated more quickly than people who wait to drive themselves. The emergency workers may also know best where to take someone, such as to a specialized stroke center to ensure that they receive the quickest possible treatment. The emergency workers can also collect valuable information for the hospital medical staff before the patient even gets to the emergency room, alerting staff of your arrival and allowing time to prepare. All of what the ambulance team can provide saves time in the treatment of stroke, and in the event of a stroke, time is of the essence.

Ischemic Stroke or Hemorrhagic Stroke?

There are two different kinds of stroke, ischemic or hemorrhagic. A medical team will need to determine which kind of stroke the patient is having in order to direct treatment. An ischemic stroke accounts for 87% of all strokes and happens when a blood clot blocks a vessel supplying blood to the brain. Hemorrhagic stroke happens when a blood vessel ruptures and bleeds within or around the brain.

“Fifty percent of strokes present with a clot in a large vessel in the brain, and these don’t respond very well to the old treatment, the IV clot busting medicine,” says M.D. and director of the Sparrow Comprehensive Stroke Center Anmar Razak. “And so nowadays, we do surgery, and what we do is we rush them into the hospital, into the cath lab. We quickly get access through the blood vessels and get up to where the clot is and pull it out.”

With ischemic stroke, the treatment goal is to dissolve or remove the clot. A medication called alteplase or tPA is often administered and works to dissolve the clot and enable blood flow. Alteplase saves lives and reduces the long-term effects of a stroke but must be given to the patient within three hours of the start of a stroke. Then, a procedure called mechanical thrombectomy removes the clot and must happen within six to 24 hours of stroke symptom onset.

For hemorrhagic stroke, the treatment goal is to stop the bleeding. There is a less-invasive endovascular procedure involving a catheter being threaded through a major artery in an arm or leg toward the area of the bleeding in the brain where a mechanism is inserted to prevent further rupture. In some cases, surgery is required to secure the blood vessel that has ruptured at the base of the bleeding.

Rehabilitation After a Stroke

Perhaps the most important part of stroke treatment is determining why it happened or the underlying causes of the stroke. Stroke risk factors include high blood pressure, which weakens arteries over time, smoking, diabetes, high cholesterol, physical inactivity, being overweight, heart disease including atrial fibrillation or aFib, excessive alcohol intake or illegal drug use, and sleep apnea. By making the right lifestyle choices and having a good medical management plan moving forward, the risk of another stroke can be greatly reduced.

That’s because if you have had a stroke, you are at high risk for having another one. One in four stroke survivors have another within five years, while the risk of stroke within 90 days of transient ischemic attack or TIA is as high as 17% with the greatest risk during the first week. This is why it becomes so important to determine the underlying causes of the initial stroke. Your doctor may give you medications to manage a condition, such as high blood pressure, and then recommend lifestyle changes, including a different diet and regular exercise.

Rehabilitation after a stroke begins in the hospital, often within only a day or 2 after the stroke. “There are so many things that patients need to fall into place to be functional and independent again after a stroke,” said Razak. “And they always come down to speed and time.” Rehabilitation can help with the transition from the hospital to home and can help prevent another stroke. Recovery time after a stroke is different for everyone and can take weeks, months, or even years. Some people may recover fully, while others may have long-term or lifelong disabilities. Stroke rehabilitation should be thought of as a balance between full recovery and learning how to live most effectively with some deficits that may not be recovered.

Difficulties from a stroke range from paralysis or weakness on one or both sides of the body, fatigue, trouble with cognitive functioning such as thinking and memory, seizures, and mental health issues like depression or anxiety from the fear of having another stroke. Everyone’s rehabilitation will look different based on their difficulties after a stroke but may include speech, physical, and occupational therapy. Speech therapy helps when someone is having problems producing or understanding speech, physical therapy uses exercises that help someone relearn movement and coordination skills, and occupational therapy focuses on improving daily activities, such as eating, dressing, and bathing. Joining a patient support group may help people adjust to life after a stroke, while support from family and friends can also help relieve the depression and anxiety following a stroke. It’s important for stroke patients to let their medical team and loved ones know how they’re feeling throughout their recovery and what they may need help with.

Stroke rehabilitation can be hard work, but just as in the initial treatment of a stroke, time matters in the possibility of a full recovery. Many survivors will tell you that rehabilitation is worth it and recommend using motivators to achieve recovery goals, such as wanting to see a child’s graduation or returning to working in the garden. With Insureyouknow.org, caretakers may keep track of medical treatments and rehabilitation plans in one easy-to-review place so that they may focus on caring for their loved one during the period of recovery from stroke.

May is American Stroke Month which aims to raise awareness of the second leading cause of death.

Gardening for Mental Well-Being

May 15, 2024

Interest in gardening has increased since the pandemic, as more and more people are searching for ways to disconnect from stressful times and reconnect to nature. It turns out that immersing ourselves in green spaces and caring for plants is a form of caring for ourselves. Time spent in nature has been found to improve mental health so much so that gardening has been prescribed by the National Health Service in Great Britain since 2019. But while scientists are just beginning to pay attention to nature’s overall effect on our health, humans have known about the power of gardening for a very long time.

Historic Gardens and Horticultural Therapy

Ancient and modern gardens all over the world, including Persian pleasure gardens, Islamic paradise gardens, Chinese courtyard gardens and Japanese rock gardens, nurture a sense of separation from the chaotic world and provide a place for inward reflection. In addition to sources of food, the Roman Empire treated gardens as a place to cultivate mindfulness. As extensions of the home, Roman gardens were the first outdoor rooms. They served as spaces to rest and marvel at nature’s wonder. By the Middle Ages, hospital gardens modeled after these Roman gardens were seen as integral parts of the hospital, not just to feed patients and grow medicines but to offer patients time outside. But as efficiency and technology took over medical treatment, these spaces went extinct.

Still, the benefits of gardens were not forgotten. In the 1800s, early American psychiatrists began noting links between horticulture and mental health. Born in 1933, the famous neurologist Dr. Oliver Sacks believed that gardens and nature were more powerful than any medication. As the scientific evidence of spending time in green spaces leading to better health grew, many hospitals began incorporating gardens into their facilities again and horticultural therapy was developed as a therapeutic practice in the 1970s.

Horticultural therapy involves taking care of plants with specific goals for the patient in mind. For instance, tending to a garden and watching it thrive can help people build self-esteem and feel a sense of accomplishment. Gardening can also lead to life lessons, such as when a plant dies, the person can ask themselves, “What could I have done differently?” Connecting the garden to themself can lead them to think that maybe they can do a little more to take care of themself, too. “It’s really the plants that are the therapists,” says Laura Rumpf, a horticultural therapist who treats patients with dementia through gardening. “Even if somebody can’t necessarily name what it is they’re smelling, the body somehow remembers.” For those with dementia for instance, plants can help them to reminisce which leads to telling stories and sharing memories, an important part of connecting to others and validating their identity.

The Scientific Proof of Nature’s Benefits

Gardening involves exercise, which we know is beneficial to our health, and since people tend to breathe more deeply when they’re outside, outdoor activities can clear the lungs, aid digestion, and improve immune responses. Sunlight also lowers blood pressure and increases vitamin D levels, but the benefits of outdoor gardening extend beyond these physical benefits.

A recent study conducted by scientists at the University of Florida found that gardening lowered stress, anxiety and depression in healthy women who attended a gardening class twice a week. “Past studies have shown that gardening can help improve the mental health of people who have existing medical conditions or challenges,” said the principal investigator of the study Charles Guy. “Our study shows that healthy people can also experience a boost in mental well-being through gardening.” In addition to improved mental well-being, interacting with nature has proven cognitive benefits. A 2019 study by University of Chicago psychologist Marc Berman showed that green spaces near schools promote cognitive development in children, while adults assigned to public housing in green neighborhoods exhibited better attentional functioning than those assigned to units with less access to green spaces.

Scientists have a few ideas as to why nature is so good for our mental health. One hypothesis is that since our ancestors evolved in the wild and relied on their environment for survival, we have an innate drive to connect with nature. As a species, we may be attracted to plants because we depend on them for food and shelter. Another hypothesis is that spending time in nature triggers a physiological response that lowers stress levels. Throughout human history, trees and water have been an oasis and signaled relaxation. There is an implicit trust in nature that calms our parasympathetic nervous system. Yet a third hypothesis is that nature replenishes cognitive functioning, which restores the ability to concentrate and pay attention. The truth probably lies in a combination of all of these theories.

Gardening Against Loneliness

Perhaps one of the most overlooked yet obvious benefits of gardening is that it can make people feel less alone in the world. While gardening can bring people together through community gardens, one doesn’t even need to be around other people while spending time in nature in order to feel more connected to others. “Nature can be a way to induce awe,” said psychology professor John Zelenski. “One of the things that may come from awe is the feeling that the individual is part of a much bigger whole.”

Gardening can bring people together through a sense of community, as people who garden are rich with expertise that they are willing to share with other gardeners. Master gardeners and local volunteers dedicate their time to empowering other people in the community who are interested in growing their own plants. Simply sharing a gardening blunder is just one way to connect with a fellow gardener. Social connections are important for our mental well-being because they help lower stress, improve resilience, and provide support, while a strong sense of belonging has been shown to lower one’s risk of depression and anxiety.

Community gardens are a great place to connect with others as they offer room for talking during uncomplicated and repetitive tasks. Since gardening can bring together all kinds of people, time in the garden with others can also remind us that we are more alike than not. “Gardens are a great point of connection,” said the director of a London community garden Sarah Alun-Jones. “We often find ourselves talking about where we grew up, our childhood gardens, food we like to grow and cook… and we learn lots along the way.”

If you’re thinking of incorporating gardening into your routine, it doesn’t need to be intimidating. Simply starting by potting indoor plants or taking walks in green spaces during your lunch break are just two simple ways to connect with nature now. At Insureyouknow.org, you may store all of your gardening plans and records, so that you can become the researcher of your own gardening benefits.

Six Things to Know about SIMPLE IRA

April 30, 2024

Offering a SIMPLE IRA (Savings Incentive Match Plan for Employees) to employees is an effective way for small businesses to offer their employees a retirement plan. At a glance, this plan allows both the employer and employee to make contributions, and there are less reporting requirements and paperwork involved for the small business owner. Besides the ease in which these plans can be established for employees, the main perks are tax incentives for both the employer and the employee. “They are fairly inexpensive to set up and maintain when compared to a conventional retirement plan,” says client advisor at First American Bank Karina Valido. “For employers, contributions are tax-deductible. For participants, contributions and earnings are not taxed until withdrawn.”

Even though the SIMPLE IRA is a straightforward retirement option, here are six things to know about this plan, whether you’re an employer or an employee.

- Employee Contribution Limits in 2024

With a SIMPLE IRA, an employee can, but isn’t obligated to, make salary reduction contributions. In 2024, the maximum amount an employee under the age of 50 can contribute is $16,000. With a SIMPLE IRA, you may also contribute to another retirement plan as long as both contributions don’t exceed the yearly limit. The annual limit for combined SIMPLE IRA and 401(k) contributions in 2024 cannot be more than $23,000 or $30,500 for people who are 50 or older. Since an employer cannot offer both plans, this would only apply to those employees who held a previous account elsewhere.

- Employer Contribution Requirements

Employers must do one of two things: match employee contributions or make nonelective contributions. If an employer chooses to match each employee’s salary reduction contribution, they must do so by up to 3% of their employee’s compensation. While an employer may choose to match less than 3%, they must at least match 1% for no more than two out of five years. If an employer chooses to make nonelective contributions of 2% of the employee’s compensation, they must do so for every employee, regardless of having some employees who are making their own contributions. So if an employer chooses to make nonelective contributions, then they must also match the contributions of those employees who choose to contribute to their own plans.

- SIMPLE IRA Tax Advantages

For employees, salary reduction contributions to their SIMPLE IRA reduces their taxable income and their investments will grow tax-deferred over time. Because it’s a tax-deferred account, you won’t need to pay capital gains taxes when you buy and sell investments within the account. Plus, unlike many other retirement plans, such as a 401(k), employer contributions to a SIMPLE IRA are immediately vested and belong to the employee.

Employers also benefit from tax incentives with the SIMPLE IRA. They can get a tax credit equal to 50% of the startup costs, or up to a maximum of $500 per year, for three years. This credit is in addition to the other tax benefits they will receive from contributing to employee retirement plans.

- All About Withdrawals

During retirement, withdrawals will be taxed as regular income. Before the age of 59 ½, there’s a 10% penalty on withdrawals in addition to the income taxes you would owe. With the SIMPLE IRA, the withdrawal penalty rises to 25% if the money is taken out within two years of the plan being contributed to. Under qualified exemptions, like higher education costs or first home purchases, then you may avoid an early withdrawal fee, but you would still have to pay the taxes.

- Eligibility for SIMPLE IRAs

The Small Business Job Protection Act of 1996 created the SIMPLE IRA. It was designed with small businesses and self-employed individuals in mind and meant to be simple, accessible, and inexpensive. “A SIMPLE IRA is a small-business-sponsored retirement plan that, as the name indicates, is simple to establish and maintain,” explains financial advisor at Marsh McLennan Agency Craig Reid. “Available to U.S. companies with 100 or fewer employees, SIMPLE IRAs are a cost-effective alternative to the mainstream 401(k) plan.”

In order to be eligible for a SIMPLE IRA, an employer must have fewer than 100 employees and have no other retirement plan in place. They must also make contributions each year. For an employee to be eligible, they must receive at least $5,000 in compensation during any two prior years and expect to receive the same during the current year.

- The Difference Between SIMPLE IRA and SEP-IRA

Both a Simplified Employee Pension (SEP-IRA) and a SIMPLE IRA are employer-sponsored retirement plans that offer employees a tax-advantaged way to save for their retirement. Contributions in each grow tax-deferred until they are withdrawn during retirement. They are each designed to be easily established in small businesses, especially when compared to a 401(k).

One key difference between the two plans is that while a SIMPLE IRA allows both the employer and employee to make contributions, the SEP-IRA only allows the employer to contribute. The SEP-IRA, though, does allow higher contributions, which will be limited to $69,000 in 2024, compared to $16,000 in 2024 for the SIMPLE IRA. The other main difference between the two plans is that any employer can offer a SEP-IRA, while only businesses with less than 100 employees qualify for offering the SIMPLE IRA.

If you’re a self-employed individual, a small business owner, or you have recently begun working for a small business that offers you a SIMPLE IRA, it will benefit you to know the upsides of having one and understand the rules around the plan. With Insureyouknow.org, you can store all of your financial information and records in one place so that you may stay organized and allow yourself the best decision-making process in your retirement planning.

Navigating the Impact of Recent Real Estate Legislation

April 15, 2024

During March of this year, the National Association of Realtors (NAR) reached a settlement agreement to resolve a series of lawsuits that had to do with the practice of tying. Tying involves the home seller’s agent setting a commission rate for that homebuyer’s agent if they help facilitate a sale. According to the NAR, 90 percent of the homes on the market in the United States are sold this way as they are listed on the Multiple Listing Service (MLS).

Each year, Americans pay $100 billion in real estate agent commissions. If the settlement is accepted, the new terms may lower the amount agents can collect in home transactions. Since the proposed rules may change how U.S. homes are bought and sold, the new terms are important for realtors and potential homebuyers to understand.

The Problem With Tying

MLSs aren’t new, as the first MLS began in the late 1800s as a way for real estate agents to share information about the properties they were trying to sell. In exchange for the sharing of information, the agents agreed to compensate other brokers who helped them sell their properties. Today, more than 800 MLSs exist where agents list their properties. Sellers benefit from this arrangement because of increased exposure of their properties, while buyers benefit because they receive a database of nearly every home on the market.

The practice of tying, when the buyers’ agent is offered a commission for facilitating the sale of another agent’s property listing, has been shown to reduce competition and drive-up closing fees. Under tying, the commission the buyer’s agent will receive is determined before that agent can actually provide any services to the buyer. This can make it difficult for the home’s buyer to negotiate closing fees as well as require the home’s seller to offer higher commissions in order to sell their home.

Because real estate agents earn their income through these commissions, they are widely known to practice steering, which involves directing their clients toward homes that offer the best possible commissions for themselves. Since only one in 600 MLSs allow their agents to publish the commission they offer to buyers’ agents, buyers are generally unaware of these agreements between agents. The lack of transparent commission agreements makes it difficult for a buyer to know if their agent is steering them away from certain properties.

What the NAR Agreement Would Entail

If the proposed NAR settlement is approved, there will be two significant changes to prevent tying. First, MLSs will not be permitted to display commission rates. Commissions however can still be negotiated through real estate professionals off-MLS. Second, real estate agents will have to explicitly agree to the exact services they’ll provide their clients through written agreements, which will be known as a Buyer Representation Agreement and will include the agreed upon compensation for the realtor. If the changes are accepted, they will go into effect mid-July. Because of this, many realtors are suggesting those who are currently looking to buy to close by the end of June in order to avoid these proposed changes to the homebuying process.

Nearly every realtor who is a NAR member is covered in the agreement, and every member would have to abide by the proposed changes if the settlement is approved. Any members of HomeServices of America would not be covered due to ongoing court cases, as well as any brokerage firms with residential transaction volume above $2 billion in 2022. Any realtor who is unsure if they are involved in the changes or have questions moving forward are urged to get their information from the NAR’s facts.realtor.

What to Know About Traditional Commission Rates

The typical U.S. sales commission rate for real estate agents is five-to-six percent, which are among the highest in the world. But agents have been advertising low-to-zero percent commission rates to appeal to buyers for years. This isn’t because they’re foregoing their profit, but because they’re rewording their commission rate as “buyer credits.” Buyer credits can already be seen offered on many listings and are determined as the buyer sees fit at closing. In other words, commission rates and agent profits have already been negotiated outside of the MLSs for some time now. That’s why many futurists predict that these new guidelines will affect the future of real estate very little.

Because agent compensation will become a negotiation, many predict increased competition among agents, which the practice of tying had reduced for some time. “Fees have been a bit rigid,” said San Diego Real Estate Professor Dr. Norm Miller. “So it is about time we see more price competition on the fee side.” At the average U.S. home price $420,000, a six percent agent commission would be $25,200. If that six percent rate is reduced by half to three percent due to agent competition, then the price to sell or buy a home could be reduced to $12,600. Clearly, that could make buying a home more affordable for many.

The Future of Real Estate

If the settlement is approved, the practices of tying and steering will likely end. Hopefully, homebuyers will be able to better negotiate the amount of commission their agent will receive or choose alternative forms of payment, such as paying by the hour or a flat fee. Homebuyer’s should also be less pressured to list their home through MLSs or use an agent at all. All of this could result in lower costs of housing transactions, but the full extent isn’t clear.

The overall effect on the economy is difficult to predict. The NAR settlement agreement would benefit middle-class families who have a large share of their wealth invested in housing. Because consumers typically share a small amount of their gains in wealth, the benefit to middle-class homeowners who sell their property is unlikely to make an influence on consumer demand. Other economists predict that the process of buying a home could involve more upfront costs if real estate agents begin foregoing commission rates, which could potentially make it less feasible for lower-income and first-time buyers to acquire property.

If you’re in the market for buying a home, the expected changes due to the impending NAR settlement may end up affecting you very little. Besides being able to negotiate your agent’s fees and services upfront, very little is expected to change as a result of the new guidelines. At the end of the day, if you decide to use an agent when buying or selling a home, you’ll want to choose a professional you trust, regardless of these changes. Insureyouknow.org will prove to be a valuable tool in the homebuying process, as you can store all of your financial information and agreements in one easy to access place.

2024 Changes that Would Impact Your Retirement Finances

April 1, 2024

Changes to retirement regulations are making 2024 out to be the perfect time to reexamine your retirement planning and make sure you’re getting the most out of your savings.

“The rules are constantly changing,” says director of Personal Retirement Product Management at Bank of America Debra Greenberg. “It’s always a good idea to familiarize yourself with what’s new to see whether it makes sense to take advantage of it.”

Here’s what you should know about several changes to retirement regulations in 2024.

It Pays to Plan for Retirement

While the changes to retirement regulations may seem small, Americans need all the help they can get right now. According to the National Council on Aging, up to 80% of older adults are at risk of dealing with economic insecurity as they age, while half of all Americans report being behind on their retirement savings goals.

“The IRS adjusts many things each year to reflect cost of living and inflation,” says Jackson Hewitt’s chief tax information officer Mark Steber. “It happens each year and taxpayers shouldn’t be alarmed — they might even have a bigger benefit.” Since retirement contributions are pre-tax, saving for retirement actually lowers your taxable income, which may even place you into a lower tax bracket. Plus, you may even be eligible for a tax credit of up to 50% of what you put into your retirement accounts.

Contribution Limits Will Increase

The contribution limits for a traditional or Roth IRA are increasing in 2024. The limit on annual contributions to an IRA will go up to $7,000, up from $6,500 last year.

Individuals will be able to contribute more to their 401(k) and employer-based plans as well. For those who have a 401(k), 403(b), most 457 plans, or the federal government’s Thrift Savings Plan, the contribution limit is increasing to $23,000 in 2024, which is $500 more than last year. Those who are 50 and older, can contribute up to $30,500 into the same accounts.

Starter 401k Plans are Possible

In 2024, employers who don’t sponsor a retirement plan may offer a Starter 401(k) deferral-only arrangement. A starter 401(k) is a simplified employer-sponsored retirement plan with lower saving limits than a standard 401(k). Employers are not allowed to make contributions, and employee auto-enrollment is required. In 2024, the annual contribution limit to this plan will be $6,000. Beginning this year, employees with certain qualifiable emergencies may also make penalty-free withdrawals from their 401(k) of up to $1,000, though they would still have to pay the income tax on those withdrawals.

529 Plans Can Now be Converted Into Roths

For parents who will no longer need their 529 funds for their children, the Secure 2.0 Act will allow for a portion of the 529 to be rolled into a Roth IRA. Beginning January 1st, the funds can either be used for educational expenses or put toward retirement, as a Roth IRA rollover. You may rollover up to $35,000, free of income tax or any tax penalties. The only limitations are that the 529 must have been in place for at least 15 years, and certain states may not allow the rollover.

Changes to Social Security and RMDs

In January, Social Security checks will increase by 3.2% due to the latest COLA, or cost-of-living adjustment. On average, Social Security monthly benefits will increase by $59 a month, from $1,848 to $1,907. Those who receive survivors or spousal benefits will receive even more.

For 2024, the maximum benefit for a worker who claims Social Security at FRA (Full Retirement Age)is $3,822 a month, which is up from $3,627 in 2023. For 2024, the FRA is 66 years and 6 months for those born in 1957 and 66 years and 8 months for those born in 1958. That means that anyone born between July 2, 1957 through May 1, 1958 will reach FRA in 2024.

The IRS uses a calculation based on the amount in your retirement account and your life expectancy to determine the minimum amount you are required to take out each year, known as RMDs (required minimum distributions). Secure 2.0 increased the age for starting RMDs from 72 to 73, effective in 2023. If you are subject to RMDs, then you must make your withdrawal by the end of this year or by April 1st next year if it’s your first year being eligible. So if you turn 73 in 2024, you’ll have until April 1, 2025 to make your first RMD.

Anyone receiving more Social Security but paying Medicare premiums may not feel much of a difference in their increased Social Security benefits since standard Medicare Part B premiums are rising by 6%. As many participants have their Medicare premium deducted right from their Social Security payment, the $9.80 increase will take a portion of the average $59 benefit increase. The annual deductible will also increase this year from $226 to $240.

Insureyouknow.org It will always be important to review your retirement savings every year, but this is becoming even more important to do in the face of rising costs and changing regulations. With Insureyouknow.org, storing all of your financial information in one easy-to-review place can help you ensure that you are still on track to meet your retirement goals at the start of each annual review.