Category: Insurance

Seasonal Insurance Check-Up: Keep Your Coverage Up to Date

October 29, 2025

If you’ve ever opened an old folder and thought, “Wait, when did I even file this?”, you already get the point. Insurance paperwork has a way of sitting quietly until life outgrows it. People check their policies once a year, feel responsible for a minute, then forget about them. Sounds familiar, right?

Life, though, doesn’t wait. A new job pops up, someone moves, a baby arrives, or maybe there’s a home remodel that changes everything. Those small shifts can make old coverage feel out of step. By the next annual review, it’s easy to realize things don’t quite fit anymore.

Life Changes Faster Than Paperwork

Insurance is supposed to protect what matters now, not what mattered last spring. But most people never notice how fast their details drift. Maybe the car value has dropped, or a phone number changed, or the policy still lists an address that no one lives at. Tiny errors, but they matter when a claim appears.

A quick seasonal review keeps things real. It’s like glancing at your pantry before heading to the store, fast, practical, and you avoid buying what you already have.

How to Do a Seasonal Review Without Losing a Weekend

Step 1. Gather your stuff.

Pull together every policy: car, home, health, life. Keep them in one folder, digital or paper, so you’re not hunting later.

Step 2. Check the basics.

Look at names, addresses, contact numbers, and nominee info. If something looks off, fix it.

Step 3. Match it to real life.

Bought something big? Changed jobs? Maybe started freelancing? Adjust the coverage so it actually fits.

Step 4. Note payments and renewals.

Set a quick reminder on your phone. Late payments sneak up quietly.

Step 5. Keep copies safe.

A cloud folder and one printed set usually do the trick. Tell someone close where they are.

When to Check Even Sooner

Some moments don’t wait for the next season. Big life changes mean the file needs a look right away:

- Marriage or separation

- New house or sold property

- Moving cities

- Starting a business

- A new baby or dependent parent

If your life just shifted, your coverage should shift too.

Why Bother?

People who do this regularly sound calmer when things go wrong. They don’t waste time searching or wondering what’s covered. The habit keeps surprises small.

Here’s what they get out of it:

- Current coverage: Nothing outdated hiding in fine print.

- Fewer claim issues: Information is already right.

- Possible savings: You catch overlaps before paying twice.

- Less stress: Everyone knows where everything lives.

A little check four times a year adds up to peace of mind.

Make It Stick

Pick a date that already matters, your birthday month, tax season, the start of summer. Mark it as “insurance check-up” and actually do it. Once or twice and it’ll feel automatic.

The Bottom Line

Insurance only works when it keeps up with your life. A seasonal check-up isn’t overkill; it’s common sense. Fifteen minutes now can save weeks of frustration later, and that’s a trade anyone would take.

ACA Marketplace: Understanding the Upcoming Insurance Hikes

October 28, 2025

Imagine logging in to renew your health-insurance plan this November and discovering your monthly premium has nearly doubled — all because Congress couldn’t agree to fund the tax credits that have quietly kept your coverage affordable. That’s the stark reality for millions of Americans enrolled in the health insurance marketplaces under the Affordable Care Act (ACA).

Under the ACA, individuals and families who do not get health insurance from an employer or through a public program can shop at a federal or state-based “Marketplace.” Insurers offer plans in metal tiers (Bronze, Silver, Gold)—with varying premiums, deductibles, and out-of-pocket costs. What keeps many of these plans affordable is the federal premium tax credit. If you qualify (mainly based on income as a share of the federal poverty level), you receive a subsidy that reduces the monthly premium you pay.

Because of this subsidy, many enrollees pay only a modest portion of what might otherwise cost thousands of dollars. The Kaiser Family Foundation (KFF) found that thanks to the enhanced tax credits, an individual making $28,000 “will pay no more than around 1 % ($325) of their annual income towards a benchmark plan.” The system ties a person’s share of premium costs to their income, and the subsidy covers the rest. This critical safeguard has kept coverage within reach for millions of lower-income Americans.

Why Subsidies Are in Danger of Expiring

The wrinkle: the enhanced subsidies many people now rely on are temporary unless Congress renews them. These enhancements were introduced by the American Rescue Plan Act in 2021 and extended under the Inflation Reduction Act of 2022. They expanded eligibility (including households earning more than 400% of the poverty level) and reduced out-of-pocket costs for individuals. But unless renewed by year’s end, they sunset at the end of 2025.

Even more urgent: insurers are already filing their proposed 2026 premiums, assuming no renewal of the enhanced tax credits. KFF reported that enrollee net premium payments could increase by 114 % on average—from about $888 in 2025 to about $1,904 in 2026—if the enhanced credits expire.

What People with Low Income Will Face

For low- and moderate-income Americans who depend on the marketplaces, the expiration of enhanced subsidies is more than theoretical—it’s a budget-breaker.

If subsidies are eliminated, many enrollees will see their monthly premium contributions skyrocket. KFF’s analysis shows that without the enhanced tax credits, average annual premium payments for subsidized enrollees would more than double. Some households will lose eligibility altogether. For people earning above 400 % of the poverty level, that subsidy cliff means they go from some assistance to none. KFF explains that “people with incomes over four times the poverty level will no longer be eligible for any financial assistance” if the enhanced credits expire.

The rate increases compound the effect: insurers are proposing median premium hikes of around 18 % for 2026. Those who are already barely making ends meet may find the new premiums impossible. One enrollee in Florida told Health News Florida that she’s already struggling to cover other rising costs. “The rent is going up. The water bill is going up,” said the Florida resident. “I cannot afford a premium hike.”

A missing subsidy cushion means not just higher premiums but a greater risk of losing coverage altogether. As Jason Levitis, Senior Fellow at the Urban Institute, explained, “If you have fewer subsidies, you’re going to have less health coverage and less health care.”

Why Enrollment Has Grown Recently

Enrollment in the marketplaces has surged in recent years, and the subsidy enhancements are a significant reason. Before the enhancement period, around 11 million people used the marketplace; now more than 24 million are enrolled.

Several factors have driven the growth. The enhanced tax credits increased eligibility and lowered what many paid, making coverage far more accessible. Improved outreach and usability—especially as state-based marketplaces matured—helped consumers find and keep plans more easily. At the same time, rising costs in employer-based coverage pushed more people to shop for plans individually. According to KFF, the enhancements cut annual premium payments by an estimated 44 % (about $705) for many subsidized enrollees. “The enhancements made it easier for millions of people to afford health coverage,” said Larry Levitt, Executive Vice President for Health Policy at KFF. “If they expire, we could see those gains wiped out almost overnight.”

In short, more help meant more people using the marketplace. The flip side is that less help could mean fewer people—and higher premiums for those who stay.

What’s at Stake

At the core of the current federal budget impasse (which led to the shutdown beginning October 1, 2025) is a fight over whether to extend the enhanced subsidies. Democrats insist that any funding deal must include the subsidy extension, arguing that letting them expire would cause a major affordability crisis. Republicans are pushing for reopening the government without tying the subsidy question directly to the budget deal, saying the issue should be negotiated separately.

From a consumer standpoint, the stakes are enormous. Without subsidy extensions, millions may lose assistance, face steep premium increases, or drop coverage altogether. KFF’s district-level data show that premiums would at least double in many parts of the country if the enhancements are not renewed. Rising premiums could also cause healthier enrollees to opt out, worsening the insurance risk pool and pushing rates even higher in subsequent years.

For families already squeezed by inflation and rising living costs, this would trigger an affordability crisis. “The cost of health insurance is never going to be low enough for a person who makes just above poverty to be able to afford it,” said Cynthia Cox, Director of KFF’s Program on the Affordable Care Act. “If you want that person to have health insurance, then there needs to be financial assistance.”

If Congress doesn’t act, many Americans will pay far more—or lose coverage altogether. As open enrollment begins, millions will face difficult choices about whether they can keep the coverage that has protected them for years, and whether Washington will act before the bills come due.

Insure You Know

Before you finalize your renewal or new plan selection, it may help to check out Insure You Know — a secure, central place where you can store and manage the critical information your family will need (insurance details, plan documents, contact numbers, and more). Taking a few minutes now to upload your coverage information ensures you’re ready for whatever changes lie ahead, and helps keep everything organized so you’re not scrambling when the numbers on your bill jump or the policy rules shift.

Term vs Whole Life Insurance: Simple Guide for Smart Choices

October 15, 2025

Why Life Insurance Matters

Life insurance is really about looking after the people who depend on you. It is not just a form to fill out or another bill to pay. Imagine suddenly not being there. The bills do not stop, school fees still need paying, loans keep coming. Life insurance helps make sure your family is not left scrambling.

Choosing the right type can feel confusing at first. Term life, whole life. The names almost sound the same, right? But they work very differently. Understanding each one can save a lot of money and prevent unnecessary stress later.

Many young people think, “I’m fine for now, I’ll deal with it later.” It makes sense to think that way, but starting early usually keeps premiums lower and makes managing everything much simpler. It might not be exciting to think about, but it is practical and that is what counts in the long run.

Term Life Insurance: Affordable and Straightforward

Term life insurance is actually pretty simple once you get the hang of it. It covers someone for a set number of years, maybe 10, 20, or 30. During that time, premiums are paid. If something happens to the insured, the family gets the payout. If nothing happens, the policy just ends. That’s really it, nothing more complicated than that.

You can kind of think of it like renting protection. It’s really useful when life gets busy and responsibilities are piling up, paying off a home, taking care of kids, or managing loans.

For instance, imagine a 30-year-old buying a 25-year term policy worth ₹1 crore. The annual premium could be around ₹10,000. If something happens during that time, the family gets ₹1 crore. If nothing happens, the coverage stops. No frills, no fuss. Simple, affordable, and gives peace of mind exactly when it’s needed.

Whole Life Insurance: Protection That Lasts

Whole life insurance is actually a bit different from term insurance. So, it covers someone for their whole life, usually up to age 99 or 100, as long as the premiums are being paid. Part of what you pay goes into a cash value account, and over time, that grows slowly. And here’s the thing, you can borrow from it, take some money out if you need to, or even use it to pay future premiums.

This kind of policy is really good for people who want coverage that lasts their entire life or are thinking about leaving some money for their family later on.

For example, imagine a 30-year-old picking a whole life policy worth ₹1 crore. The annual premium could be about ₹60,000. Over the years, the cash value grows little by little, and whenever the insured passes away, the payout is guaranteed. Yeah, it costs more than term insurance, but it gives security for life and a bit of extra flexibility if something comes up.

Understanding the Key Differences

Here’s the thing, term insurance and whole life insurance aren’t exactly the same, even though people often mix them up. Term insurance is temporary and usually cheaper, kind of like renting a flat. Whole life insurance lasts your whole life and costs more, a bit like buying a house that also builds value over time.

The big difference is in how they work. Term insurance mostly just gives protection. Whole life insurance gives protection plus a bit of savings. Term is good for short-term stuff, like paying off a home loan or taking care of kids until they’re grown. Whole life insurance makes more sense if someone wants coverage for life or wants to leave some money for their family later on.

Why Term Insurance Appeals

Term insurance is attractive because it’s cheap, straightforward, and offers high coverage. Some policies allow conversion to permanent insurance if circumstances change.

The downside is obvious: coverage ends after the term, renewals can be costly, and there is no cash value to access.

Why Whole Life Insurance Appeals

Well, whole life insurance is something people usually pick if they want coverage that lasts their whole life. You get a guaranteed payout, and part of what you pay slowly builds cash value. It can also help with long-term stuff, like leaving money for your family or passing on wealth.

Here’s the thing though, it’s not all simple. The premiums are higher, and the cash value doesn’t grow very fast compared to other ways of investing. And some of these policies can get a little tricky, so it really helps to read the fine print and make sure it works for you.

How to Choose the Right Option

So here’s the thing, picking between term and whole life insurance really depends on your own situation. Term insurance is usually good for young families, people with temporary money responsibilities, or anyone who wants higher coverage without spending too much. Whole life insurance makes more sense if you can handle higher premiums and want protection for your whole life, along with a little savings built in.

Basically, term insurance is all about protection. Whole life insurance is protection plus a small financial cushion. It’s not complicated, but it helps to think about what actually fits your life, your budget, and your family’s needs.

A Practical Strategy

Here’s the thing, some families like to mix things up a bit. They go for term insurance to get the protection and then put the extra money they would have spent on a whole life policy into other investments. Over time, those investments can grow quite a bit while still keeping the family covered.

For example, if someone saves about ₹50,000 every year by choosing term insurance and invests it wisely, that could turn into a decent fund in 25 years. This way, the family gets immediate protection and some long-term growth too. It’s kind of a smart balance if you can plan it right.

Conclusion

Well, term life and whole life insurance do kind of different things, you know. Term insurance works if someone just wants coverage for a certain time and doesn’t want to spend too much. Whole life insurance is more for people who want coverage for their whole life and maybe a little savings along the way.

Here’s the thing, it really helps to think about your family, your money, and what your long-term goals are. Picking the right policy can give some peace of mind and make sure your loved ones are taken care of when it really matters.

From “Promise to Pay” to “Promise to Help – The New Direction of Insurance

October 9, 2025

Insurance used to be pretty straightforward. Something went wrong, a claim was filed, and the company paid out. It was businesslike, dependable, but distant, a transaction built on the idea that help came only after things fell apart.

That mindset is slowly disappearing. Modern insurers are moving from a simple promise to pay toward something broader, a promise to help. It’s a quiet shift, but a powerful one. Instead of showing up after the storm, insurance is learning how to stand beside people before it hits.

What’s Changing and Why

A few years ago, the idea of an insurer sending out real-time alerts or helping clients avoid accidents might have sounded ambitious. Now it is becoming normal. Several forces are pushing this transformation forward.

Customer expectations have changed.

People want services that respond in the moment, not days later. They want their insurer to feel like a partner, not a policy. If their fitness app can track every heartbeat, they wonder why their insurer cannot send a simple safety reminder when a major storm is on the way.

Technology made prevention possible.

Connected homes, smart cars, and wearable tech give insurers tools to spot problems before they happen. It is no longer just about predicting who might file a claim, it is about helping them avoid needing one.

Competition sparked a rethink.

Digital-first insurers, often smaller but more agile, have proven how personal and convenient insurance can be. Established companies are learning to adapt, realizing that loyalty now comes from service, not slogans.

Trust is back in the spotlight.

In truth, insurance has always depended on trust. But trust today is earned differently, not just by paying out quickly, but by showing up early, being transparent, and actually making life a bit safer.

How the “Promise to Help” Looks in Practice

It is easy to forget that most people do not want to think about insurance at all. The “promise to help” changes that by offering useful touchpoints that matter in everyday life.

- Sending storm or flood alerts before damage happens.

- Helping drivers plan safer routes or spot maintenance issues.

- Offering healthy-living rewards that lower costs and build good habits.

- Providing quick repair or recovery options instead of endless paperwork.

- Checking in after an event, not with forms, but with guidance and reassurance.

It is still insurance, but it feels different, more human, more present.

Challenges on the Way

No big change comes without friction. Some insurers still struggle with old systems that do not talk to each other. Others are cautious about how much personal data they collect, and rightly so. Privacy is not just a legal issue, it is emotional.

There is also the challenge of tone. Helping customers without seeming intrusive takes care and empathy. A message that is meant to be helpful can easily feel like surveillance if it is poorly timed or worded.

But the companies that get this balance right are setting a new standard. They are showing that care and commerce can actually coexist.

What This Means for Policyholders

For policyholders, this new direction means fewer surprises and better peace of mind. Instead of being left on their own until something breaks, customers now get small but meaningful touches of support along the way.

They see their insurer less as a faceless institution and more as a partner in protection, a brand that does not just cover life’s troubles but helps prevent them. That sense of security, before and after a crisis, is what builds lasting trust.

How Insurers Can Keep the Promise

To make the shift sustainable, insurers will need to do more than upgrade technology. They will have to reshape how they think about service itself.

- Focus on listening. Every great service begins with understanding real needs.

- Keep technology human. Data is helpful, but empathy is irreplaceable.

- Be transparent. People should always know how and why their data is used.

- Work together. Partnerships with health, home, and repair services make help more real.

- Deliver small wins. A helpful reminder or quick response builds more loyalty than a billboard ever could.

These small, consistent actions turn a new promise into a lived experience.

A More Human Kind of Protection

The shift from a “promise to pay” to a “promise to help” is not just clever branding, it is a sign of maturity in the industry. Insurance is finding its way back to what it was meant to be: a source of reassurance in uncertain times.

When help arrives before the loss, customers notice. When it comes with understanding instead of fine print, they remember. That is how insurance stops being something people tolerate and starts becoming something they genuinely trust.

And maybe that is the kind of promise worth keeping.

What Happens to Your Digital Assets After You Die?

September 24, 2025

We spend so much of our lives online that it’s easy to forget just how much we’ve tucked away in digital spaces. Photos on Google Drive. A lifetime of emails. Bank apps, crypto wallets, even the music and books we’ve bought but never actually “own.” All of these things add up to what people now call your digital assets.

The tricky question is: what happens to them when you’re no longer here?

A Hidden Part of Your Estate

Think about how a traditional estate works. You leave a house, some savings, maybe a car, and your family knows how to claim those things. But with digital property, it is different. Passwords lock things up. Privacy laws keep companies from handing over your accounts. In many cases, providers do not even recognize heirs unless you have given explicit permission.

That means your online life, all those accounts and files, might just sit there untouched. Some platforms will eventually delete them. Others freeze them in time. And unless someone has the right access, even valuable things like cryptocurrency can disappear forever.

Why Families Struggle

It is easy to imagine the problems. Maybe your daughter knows you kept all the family photos in your Google account but cannot get past the two-factor authentication. Or perhaps you held a few thousand dollars in a crypto wallet that requires a private key only you knew. Even something as simple as canceling a subscription can be a nightmare if nobody has your login.

The result? Frustration, wasted time, and sometimes permanent loss.

The Law and the Fine Print

Adding to the confusion are the laws and service agreements. In many places, executors do not automatically get digital access. US states that follow a law called RUFADAA allow it only if you have given written consent, usually in your will. Big tech companies add another layer: Google lets you set up an Inactive Account Manager, Facebook has legacy contact settings, and Apple has its own Digital Legacy program. If you do not turn those on, your family may have no options.

So between legal barriers and tech restrictions, the default outcome is often nothing happens and accounts remain locked away.

How You Can Plan Ahead

The solution is not complicated, but it does take a little thought:

- Make a list of important accounts. It does not have to be detailed, but your family should at least know what exists.

- Decide who should handle them. Pick someone you trust and tell them they will be your digital executor.

- Write it into your will. A line or two giving that person authority can make a big difference.

- Use built-in tools. Set up legacy contacts where available. It only takes a few minutes.

- Keep access information safe. A password manager with emergency access, or a sealed note in a safe, works better than trying to share details in casual ways.

The key is to make sure someone you trust knows how to act when the time comes.

One practical way to protect your digital legacy is by using a secure service like InsureYouKnow. It allows you to store important documents, account information, and passwords in a safe, encrypted digital vault. You can control who has access and receive reminders to keep your records up to date, making it easier for your loved ones to manage your digital assets according to your wishes.

Why It Matters

Digital assets are not just about money. Sure, cryptocurrency or an online business can carry real financial weight, but the sentimental side matters just as much. Family photos, voice notes, or personal letters stored in an inbox can be treasures to those you leave behind. Without a plan, those things may vanish into the cloud forever.

By setting aside an hour or two to prepare, you can spare your loved ones unnecessary stress and give them access to the parts of your life that matter most.

Easy Cybersecurity Tips for Everyday People | InsureYouKnow

September 17, 2025

For a lot of folks, “cybersecurity” sounds like something only big companies or computer geeks deal with. But the truth? Hackers usually go after regular people because it’s easier. A weak password, one wrong click, or an ignored update can open the door to stolen money or lost files.

The good news is: basic habits can block most of it. No tech degree required.

Passwords People Actually Remember

Too many people still use “123456” or their dog’s name. One local teacher did exactly that and her email got hacked. The criminal then tried the same password on her shopping account and social media. It worked.

A better option is something odd but memorable. Instead of “Fluffy123,” think of a goofy phrase like BlueShoesDance99. Long, random, easy to remember. And honestly, password managers are a lifesaver when accounts pile up.

That Extra Lock (2FA)

Two-factor authentication might sound fancy, but it’s just a second lock. A small business owner nearly lost access to his email until 2FA blocked the hacker, who couldn’t get the code sent to his phone.

Most banks, emails, and social apps have it. Turning it on takes maybe two minutes.

Don’t Snooze Updates Forever

Almost everyone hits “remind me later” when updates pop up. A family ignored updates for months until their computer froze with malware. Repairs cost more than the laptop.

Updates may be annoying, but they fix holes criminals know about. Letting them run overnight is the easiest fix.

Those Sneaky Emails

Scam emails are slick these days. A retiree thought her bank was threatening to close her account unless she clicked a link. The logo looked perfect. Luckily, she noticed the sender’s email address was slightly off. One phone call to the real bank confirmed it was fake.

If an email feels urgent or fishy, don’t click. Go straight to the company website or call instead.

Backups Save Heartbreak

One father lost every baby photo after his hard drive failed. No backup. Nothing to recover. Since then, he keeps copies in two places: a small external drive and cloud storage. That way, if one fails, the other survives.

Phones Count Too

Phones hold more personal info than many computers. Losing an unlocked one is like handing over the keys to a stranger. A PIN or fingerprint lock is quick protection. It’s surprising how many people still skip it.

Oversharing Online

Birthdays, street names, even a child’s school—these little details show up in people’s posts every day. Hackers love that because those details often answer security questions. Keeping some things private online makes their job harder.

Quick Checks Make a Difference

A quick weekend check of accounts helps. One person caught a strange $7 charge on his debit card—it turned out to be a test run by a thief. Because he noticed early, the bank froze the card before anything bigger happened.

If Trouble Hits

If an account gets hacked, the worst thing is to freeze. Call the bank, reset passwords, and lock accounts quickly. Backups make recovery much easier. Families who’ve thought about these steps bounce back faster.

Wrapping Up

Staying safe online isn’t about being a tech expert. It’s about a handful of habits: stronger passwords, two-factor logins, letting updates run, backing things up, spotting fake emails, and not oversharing.

It’s the digital version of locking the front door. Not perfect, but it keeps most trouble out.

And remember, protecting digital life also means protecting the important documents behind it—insurance policies, medical files, wills, financial records, even family photos. A secure, organized place like InsureYouKnow.org helps individuals and families keep critical information safe, accessible, and private. Pairing smart cybersecurity habits with a trusted storage solution creates real peace of mind.

How to Organize Insurance Documents for Easy Access and Safety

September 10, 2025

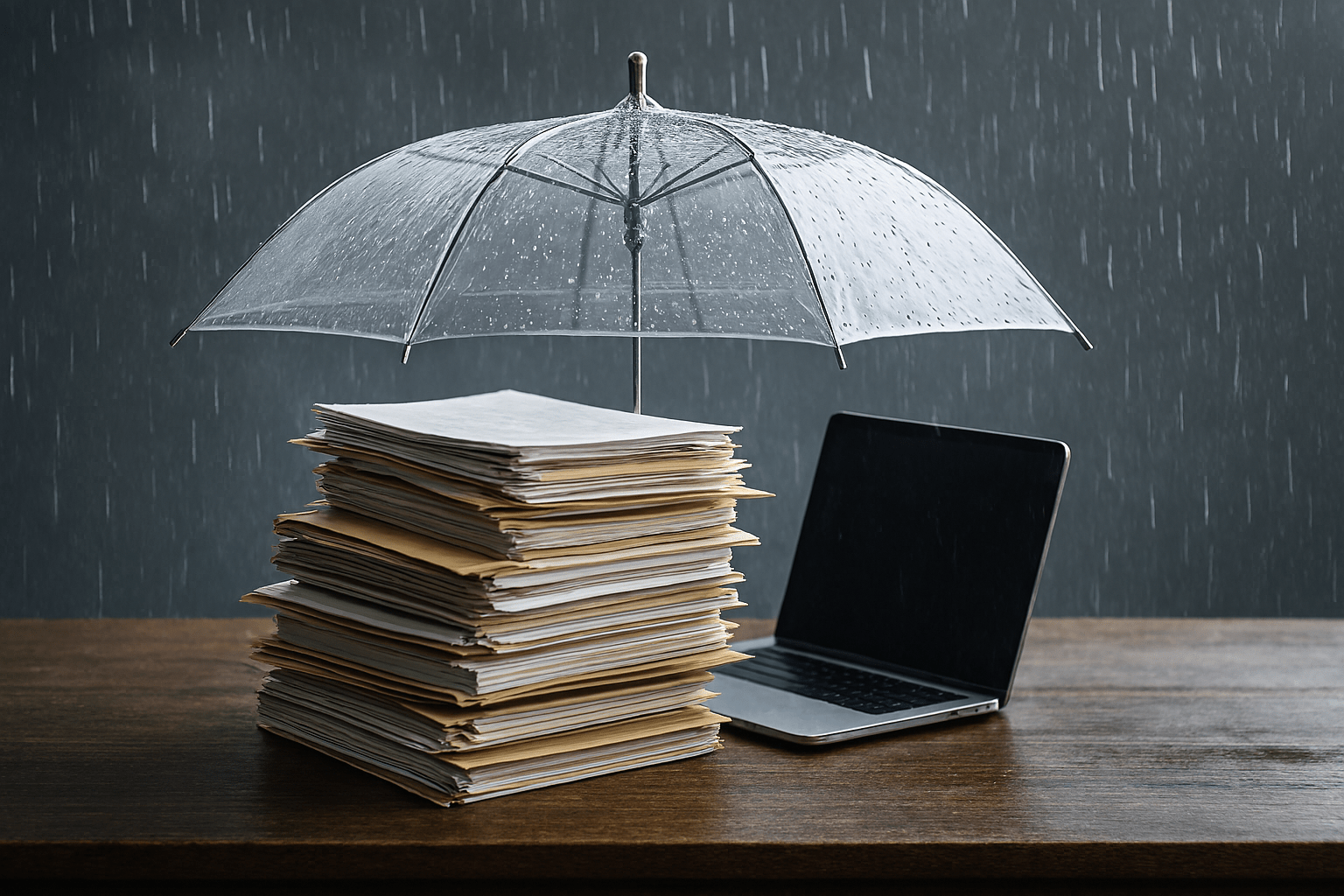

Insurance papers have a sneaky way of vanishing. One day they’re on the desk. The next, they’re wedged behind a stack of bills nobody has touched in months, or stuffed into a drawer labeled vaguely “Important Stuff.” Most people think, “I’ll deal with it later.” And then life happens. A fender-bender in the rain, a surprise hospital visit, or a leaky pipe turning the living room into a swamp. Suddenly finding the right document is like searching for buried treasure. Who remembers which folder holds the car insurance from two years ago? Or the health policy hidden behind envelopes untouched since last spring? That’s exactly why InsureYouKnow.org exists. It keeps everything safe, organized, and ready exactly when it’s needed.

Quick Access When Stress Hits

Emergencies never arrive at convenient times. Picture this: rainy night, minor car accident, and the insurance card is nowhere. People start digging through drawers, piles of mail, or folders labeled vaguely, hoping to locate it. Classic mistake. With a secure online vault, all documents are accessible in seconds. No panicking. No frantic calls. Just calm access. That little sense of relief feels huge when stress is already sky-high.

Filing Claims Without Losing Your Mind

Claims are tricky. Forms, receipts, proof of loss. Lose even one, and hours of frustration appear out of nowhere. Even a tiny missing receipt can ruin the whole process. Digital organization keeps everything in one spot. Users can grab exactly what they need without running around like headless chickens. It’s like laying out all the puzzle pieces before trying to finish the picture. No guessing, no stress, no muttering under your breath.

Keeping Policies Up-to-Date

Insurance policies aren’t static. A new car, updated health coverage, or moving across town can change everything. Digital storage allows instant updates. Platforms like InsureYouKnow.org even send reminders for renewals or payments. It’s like having a tiny assistant who never forgets anything. Honestly, who wouldn’t want that?

Sharing Documents Safely

Sometimes family members, partners, or legal representatives need access to documents. But full access isn’t always safe. A secure vault allows selective sharing. Only authorized people see what they need. Sensitive information stays private. Confusion is avoided. One less thing to stress over when life is hectic. Trust me, that matters more than it seems.

Protecting Against Loss or Damage

Paper is fragile. Documents can be lost, stolen, or damaged by floods, fires, or even small accidents like spilling coffee on a stack of papers. Digital storage prevents all that. Even if life throws a mess your way, records remain safe. A few minutes of setup now can prevent hours of headache later. Classic mistake avoided.

How InsureYouKnow.org Helps

Binders, filing cabinets, or random computer folders are full of human errors. InsureYouKnow.org provides a secure online vault for insurance policies, banking info, retirement accounts, legal papers, and more. Everything is encrypted, password-protected, and easy to locate.

Getting started is simple:

- Sign up for an account.

- Upload all important documents.

- Set reminders for updates or renewals.

- Share selected documents only with trusted people.

Final Thoughts

Insurance isn’t just about paying premiums. It’s about being prepared. Disorganized documents increase stress and slow claims when time is critical. Organizing digitally saves time, reduces frustration, and ensures accessibility. Spending just a few minutes today uploading documents to InsureYouKnow.org can prevent hours of stress tomorrow. Small step, big peace of mind.

Digital Pet Records: Organize and Store Pet Documents Securely

September 3, 2025

Pet emergencies rarely arrive at the right time. A dog limps after a jump. A cat suddenly won’t breathe easily. Owners grab at folders, glove compartments, even the folded vaccination slip that’s been stuck under a fridge magnet for months, only to realize the insurance info or medical history is still missing.

The vet keeps asking questions. What shots were given? What allergies are known? Too much time slips away.

That’s why keeping pet records, health notes, policy papers, and vet numbers saved in one secure digital spot makes such a difference. Instead of chaos, the details are ready in seconds. And that can mean faster decisions and better care when pets need it most.

Why Digital Pet Records Matter

In a real emergency, minutes feel heavy. A vet may ask about past shots or allergies, but the papers are often buried, tucked in a kitchen drawer under receipts or lost in an old email. With digital pet records, the answers are ready in seconds, and treatment doesn’t have to wait.

The same holds true when care is handed off. A sitter, a family member, even a boarding kennel can check pet medical files online instead of relying on rushed notes over the phone.

The truth is, organized records bring peace of mind. Storing pet papers safely in one place removes clutter and helps ensure steady care, whether at home, traveling, or in an emergency room late at night.

What to Include in Your Digital Pet Emergency Kit

When something goes wrong, the last thing anyone wants is to dig through drawers for missing papers. A simple digital kit avoids that headache.

The basics come first: vaccination records and health notes. Vets usually ask for them before doing anything else.

If the pet has coverage, add the insurance policy number and provider. It saves phone calls later. Keep proof of ownership too, like microchip info, adoption papers, or even a vet’s ID slip.

An emergency contact list matters just as much. The family vet, a backup clinic, a sitter, and one relative who can step in should all be easy to reach.

Then there are the little things. Care notes about food, medicine, or allergies may sound small, but they help anyone give consistent care. Storing these pet papers online in one safe place means less panic and faster help when every minute counts.

How to Securely Store Pet Documents Using InsureYouKnow

InsureYouKnow makes it simple to keep pet papers in order. Snap a photo of a vaccine slip or scan an insurance form, then upload it with a clear label like “Bella – Shots” or “Max – Insurance.” No more shuffling through drawers when the vet is waiting.

The files stay safe with encryption, so medical notes and policy numbers are private but easy to reach. Reminders can be set for shots or policy renewals, which means nothing gets overlooked.

Sharing is easy too. A sitter, boarding place, or vet can be given access to just the records they need, making care smoother and less stressful.

With everything in one place, digital pet records stay organized, secure, and ready when pets need it most.

Organizing and Managing Pet Info

Saving files is just the start. How they’re organized matters. Clear labels like “Vaccination,” “Insurance,” or “Ownership” make documents easy to find.

Adding details like the pet’s name, birthdate, or microchip number helps avoid mix-ups, especially with multiple pets.

Updates are important too. After checkups, insurance renewals, or when a new pet joins, taking a few minutes to update records keeps digital pet documents accurate and ready when needed.

Emergency Scenarios Where This Helps

Imagine the dog collapses during an evening walk. Heart racing, the family grabs the leash and heads to the vet. They don’t have to dig through drawers or emails. Digital pet records are ready on a phone. Shots, allergies, medications, all visible in seconds. The vet can start treatment right away, and stress levels drop for everyone.

Not all emergencies are medical. Moving suddenly, last-minute boarding, or traveling with a pet can turn chaotic fast. Having pet papers stored securely online means sitters, boarding staff, or vets can see what’s needed without endless calls or searching.

A few organized files can turn panic into calm. Pet documents online make sure pets get the care they need, wherever and whenever an emergency strikes.

Conclusion

Just like people, pets have important papers that need care. The vet, insurance info, and vaccination slips all matter. If you’re running around during an emergency, it’s easy to lose track. That crumpled slip under the couch or buried email suddenly matters more than ever.

The truth is, digital pet records make life simpler. Snap a photo, upload it, and label it clearly. Share it with your vet, a sitter, or a boarding facility when needed. It’s quick, secure, and saves time when every second counts.

Take a few minutes today to set up your pet’s digital profile with InsureYouKnow. It’s simple, it’s safe, and it gives peace of mind knowing your furry friend’s records are ready when they’re needed most.

Pre-Accident Planning: Stay Ready for Emergencies and Save Time

August 27, 2025

Nobody wakes up thinking, “Today I’ll have an accident.” But they happen. Sometimes when you’re driving, sometimes when you’re just making dinner. Suddenly, paramedics are asking questions: Any allergies? Medications? Who do we call?

If that info isn’t handy, things slow down. And in a crisis, slow is the last thing you want. I’ve personally seen families scramble through wallets and phones looking for details. It’s stressful and avoidable.

That’s why it makes sense to set up your health and insurance info now, not later. It doesn’t take long, and it could make all the difference in a critical moment.

What is Pre-Accident Planning?

Most people don’t really think about pre-accident planning until something goes wrong. Honestly, you probably haven’t either. It’s basically just having your key health and insurance info ready before an emergency ever happens. Nothing fancy. Just the stuff that can actually save time.

So what should you have? Here’s the quick list:

- A short record of your medical history.

- The medicines you take and how often.

- Any allergies doctors should know about.

- Names and numbers of people you’d want called first.

- Your insurance info, so care isn’t delayed.

Imagine this: you’re in a minor car accident and can’t talk. Paramedics show up and need to know if you’re allergic to a medication. If that info isn’t ready, they’re guessing. But if you’ve planned ahead, it’s right there. Seconds matter. And really, that’s the whole point, making sure first responders and doctors can help you as fast as possible.

Using Digital Tools for Emergency Preparedness

You probably keep most of your important info scattered—papers, cards, maybe even a few notes on your phone. But when an emergency hits, digging through that stuff wastes precious time. That’s where digital tools come in. Secure online vaults let you store all your health and insurance details in one place.

The best part? Only authorized people, like family, doctors, or first responders, can access it when it’s needed. Even if you can’t talk or move, the right people can get the info fast.

Why use a digital vault? Well, there are a few big advantages:

- Quick access – no more shuffling through papers or cards.

- Less paperwork – everything is in one organized spot.

- Safe backup – your info is secure, and you won’t lose it.

Honestly, setting this up doesn’t take long, but it can save a lot of stress and make sure you or your loved ones get the right care right away.

Real-Life Examples

Emergencies can happen when you least expect them. I once read about someone in a car mishap who couldn’t speak. Luckily, their family had a digital vault with all the key info, medical history, allergies, and medications. Paramedics got it fast. No guessing, no delays.

Another story: a senior fell at home. Their family had health and insurance info ready. EMTs didn’t waste time searching. Care started right away, and things went much smoother.

Studies show having info ready can cut treatment delays by up to 30%. That means fewer mistakes, faster care, and less stress for everyone. Honestly, most of us forget to do this until it happens. Spending a few minutes now could save a lot of trouble later.

Steps to Get Started

Okay, honestly, starting with pre-accident planning isn’t rocket science. Most of us just forget about it until something happens. But if you take a few minutes now, it can save a lot of panic later.

First things first, grab all your important stuff. Your medical history, medications, allergies, emergency contacts, insurance info, just toss it in one place. Trust me, you don’t want to be hunting for papers or digging through apps in a rush.

Next, find a safe spot to store it. Could be a digital vault, an app, whatever works for you. Just make sure only people you actually trust can get to it.

Then, make it easy to read. Like, sections for meds, allergies, contacts, insurance, whatever makes sense to you. Don’t overthink it.

And hey, don’t forget to update it. New meds, changed contacts, insurance stuff, small tweaks make a big difference when time is ticking.

Honestly? It might feel like a tiny thing. But having this ready can make everything smoother if something goes wrong. A few minutes now could seriously save you a lot of stress later.

Conclusion

Okay, so pre-accident planning might sound small, but honestly, it can really matter when stuff hits the fan. Like, having your meds, medical history, allergies, emergency contacts, and insurance info all ready and easy to grab can save you a ton of stress. Maybe even a life, who knows.

And here’s the thing, you don’t need to wait. Just start. Grab your info, toss it somewhere safe, and make sure you can actually get to it. Peek at it every now and then, update stuff if things change.

And, well, emergencies don’t give warnings. Every second counts. Being ready can really make a difference. A few minutes now could save hours later, or worse. Seriously.

Digital Inheritance: Secure Your Online Legacy with InsureYouKnow

August 13, 2025

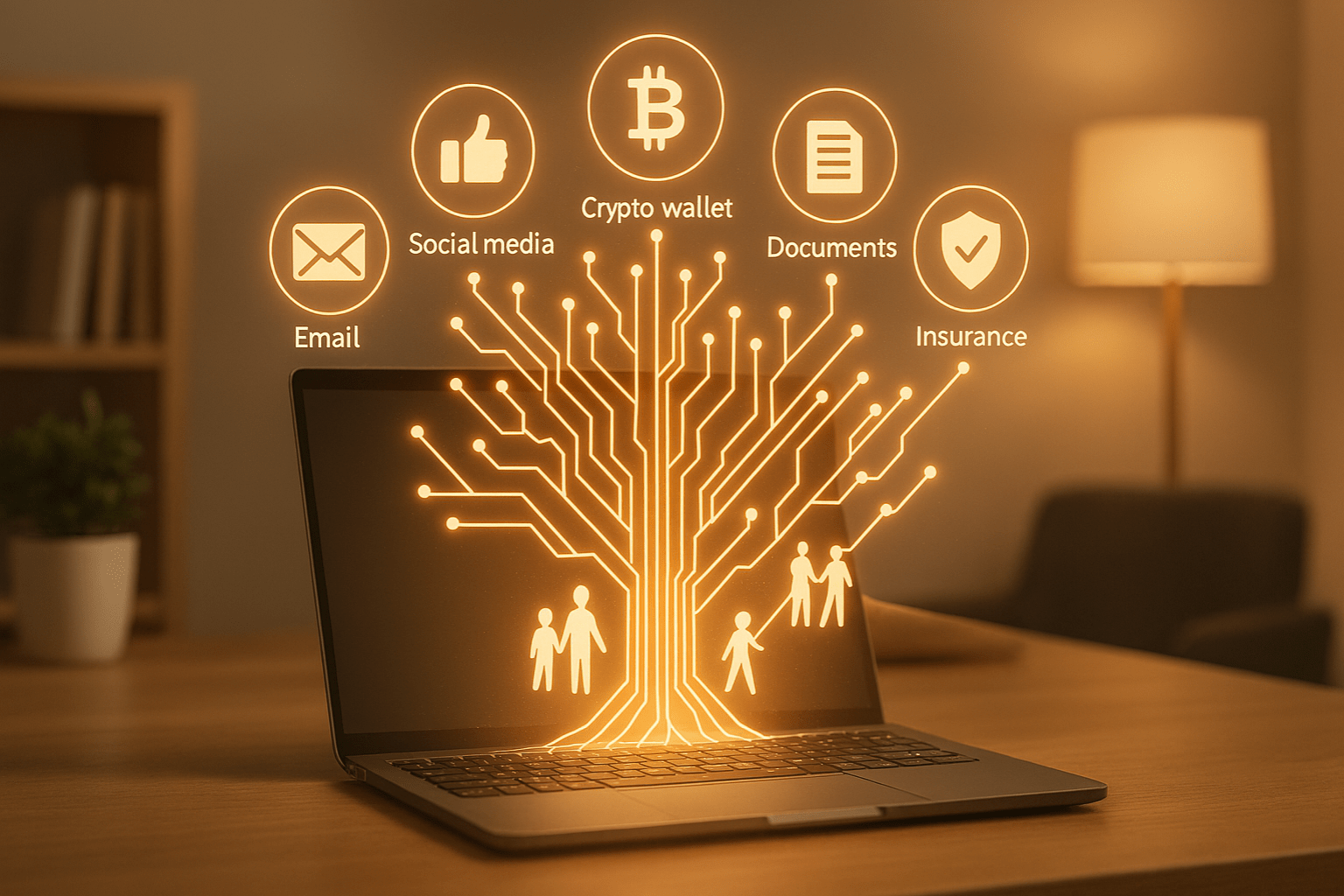

Think about how much of your life now lives online. Photos you never printed. Banking and insurance details you don’t keep in a filing cabinet. Emails, social media posts, maybe even a bit of cryptocurrency sitting in a digital wallet. It is all part of your story, and it does not just disappear when you do.

That is why digital inheritance matters. It is about making sure the people you trust can find and use what you leave behind, without having to play password detective or deal with frustrating account lockouts.

In the next few minutes, we will explore how to put a plan in place for your online life, and how a secure tool like InsureYouKnow.org can help you create a well-organized digital legacy your loved ones can actually access when it counts.

What Constitutes Digital Assets

When you think about what you own online, it is probably more than you realize. There are the obvious things like your insurance papers, bank records, medical files, and maybe a scan of your driver’s license sitting in a folder somewhere.

Then you have your accounts. Email, social media, streaming logins, and online banking all hold bits of your life, whether that is photos from years ago or details about your finances.

And do not forget the paid stuff. Cloud storage plans, memberships, crypto wallets, or payment apps like PayPal. Some of it has sentimental value, and some of it is worth real money.

Figuring out exactly what you have is step one in digital estate planning, and it makes life much easier for the people who will need to handle things later.

Risks of Digital Legacy Without Proper Planning

Not thinking about your digital stuff after you’re gone can really cause headaches. Sometimes you can’t get into accounts at all, and all those photos or important files? They might just disappear.

Hackers or scammers could also sneak in. They might use your info, drain money from digital wallets, or mess with accounts in ways that are hard to fix.

And honestly, it’s a lot for your family. They could spend hours digging for passwords, calling different companies, or trying to figure out what belongs where — all while they’re already dealing with grief.

Just taking a little time now to plan your digital estate can save a ton of trouble later and make sure the people you care about aren’t stuck sorting through a mess.

How InsureYouKnow.org Helps

Keeping track of all your digital stuff can be a pain, you know? InsureYouKnow.org makes it kind of simple. You just toss all your important docs, passwords, whatever, into one safe spot. You get to decide who sees what.

And if something happens, a family member can just log in and grab what they need. No digging through emails. No guessing passwords. Way less stress.

Honestly, it just makes your digital life easier and ready for your loved ones when it counts.

Best Practices in Preparing Your Digital Legacy

You know, getting your digital stuff in order now can save a lot of headaches later. Start by listing all your accounts and assets — emails, social media, bank stuff, subscriptions, crypto, everything.

Use password managers or secure lockers to keep logins safe. Also, jot down who should access what and how, and store it somewhere safe.

Finally, think about adding instructions in your will or estate plan. That way, your family can handle your digital life smoothly and without stress.

Step-by-Step Action Plan

Getting your digital stuff in order doesn’t have to be complicated. Here’s a simple way to do it.

- Make a list – Write down all your accounts, subscriptions, documents, crypto wallets… basically everything. Group them so it’s easy to see.

- Keep it safe – Store passwords and important docs in InsureYouKnow’s secure vault. That way, it’s all in one place and protected.

- Pick someone you trust – Decide who can access what. Set clear permissions so they know what’s theirs to handle.

- Check and update often – Things change, you know? Make a habit of reviewing your list regularly.

Doing this makes your digital life organized, safe, and way easier for your family when they need it.

Real-Life Scenario

Imagine this: Sarah had been using InsureYouKnow.org to organize her digital life. She had all her accounts, documents, and login info stored securely, and she’d assigned her brother as her digital heir with clear permissions.

When Sarah unexpectedly passed away, her brother didn’t have to hunt for passwords or guess what to do. He simply accessed the secure vault, grabbed the important files, and managed her online accounts without stress.

Thanks to pre-planning her digital estate, Sarah made things much easier for her loved ones. This shows how a little preparation can save a lot of headaches and ensure your digital legacy is handled smoothly.

Conclusion

Thinking about your digital stuff might feel a bit overwhelming, but honestly, getting it in order gives you peace of mind. Your loved ones won’t have to scramble or guess what to do.

Just start small. Make a list of your accounts and important files. Then use InsureYouKnow.org to keep everything safe and organized. A little planning now can make a huge difference later, and it keeps your digital life easy for your family.