Category: Family support

Intergenerational Care Benefits Everyone Involved

September 29, 2024

September is Intergeneration Month, launched by The Intergenerational Foundation, to connect generations and urge people from varying age groups to socialize. The idea behind recognizing Intergeneration Month each September is to promote learning from each other, such as gaining a better understanding of history and the challenges that separate generations. By connecting with different age groups across generations, unlikely friendships form between those who would otherwise never have communicated with each other.

People balancing raising young children and caring for aging parents may consider looking into what intergenerational daycare can offer. Facilities that provide both child care and senior care are on the rise, and that’s probably because, in addition to being a convenient solution for caretakers, the benefits to each age group are numerous.

If you’re considering Intergenerational Care for your loved ones, here’s everything you need to know.

What is Intergenerational Care?

Intergenerational care centers provide care for both young children and older adults. “It’s also referred to as a ‘shared site,’” says Merle Griff, the director of McKinley Center Intergenerational Project. “In many cases, there’s a senior area on one side of the building, a child care area on the other, and a hallway connecting the two. At various points during the day, they come together,” she says. The care provided can take on several forms, but at the core, it’s a service offered to multiple generations to provide care in one place across age groups.

The benefits of multi-generational care include forming connections between people who have a lot to teach one another and who would have otherwise never been allowed to meet. “It brings younger and older people together to increase social connectedness, enhance well-being for the benefit of all ages, and strengthen the web of support that is so integral to families and communities,” says Sheri Steinig, the director of Generations United. “People of different ages come together to learn, play, grow, and interact in planned intergenerational activities as well as through informal encounters,” she says.

The Different Kinds of Intergenerational Care

While intergenerational care means care across generations, the services provided vary. “There are many settings for intergenerational care,” says Steinig. “There can be programs at community centers and schools or care in daycare centers, retirement communities, nursing homes or assisted living and affordable housing,” she says. You may even provide intergenerational care in the form of a multigenerational household where more than two generations live. One in four American households are already multigenerational.

Intergenerational care centers look more like daycare facilities with adult daycare services or nursing home locations. “Each center is run their own way,” says Griff. “There are typically planned, structured interactions during the day,” she says. Both age groups are usually not combined for the entire day. Daily intergenerational activities may look like a combined sport, arts and crafts activity, comparison presentations between then and now, or even cradling opportunities, where seniors are paired with infants to rock and soothe to sleep. To date, there are fewer care centers than intergenerational programs. While there are only 150 sites across the country, care centers are expected to grow in popularity. For instance, The Mount Intergenerational Learning Center, a Seattle preschool within a nursing home, reports having over 400 children on their waiting list.

Intergenerational care programs are structured pairings between children of various ages and older adults. Programs such as these are designed to foster relationships between youth and seniors. It could be a pen pal program between elementary school kids and seniors, college students visiting nursing homes, multi-age choirs, or veterans going to schools to talk to students about their experiences.

To find a program such as this or a care center in your area, Generations United offers a search tool.

The Benefits of Intergenerational Bonds

Many grandparents live thousands of miles away from their grandchildren while aging adults live several states away from their children. According to a study from the University of California San Francisco, 43% of older adults report experiencing loneliness, and those who feel lonely are at a 59% increased risk of declining health.

That’s when intergenerational care can help. Older adults experience a sense of purpose and renewal after spending time with and helping young people. It helps seniors feel like they are not just receiving care but offering care. “Despite the dementia diagnosis, the maternal and paternal instincts can still kick in, and the seniors feel a sense of purpose,” says Jenna Hauss, the president of ONEgeneration. “They can care for others. They don’t always need to be cared for,” she says.

It isn’t just older generations that benefit from the connection. Children who spend time around older adults have fewer biases around such things as walkers and wheelchairs and become more comfortable with these differences. Multigenerational care promotes sensitivity among both age groups. Parents notice that their children are more empathetic, while older adults experience less loneliness, reduced agitation, and improved overall health.

Intergenerational care addresses two important needs: early childcare and the increasing demand for senior services, but the benefits of this combined service reap rewards far beyond caretaking. Research is proving that both age groups experience different perks from intergenerational connections. If this sounds like it might be the right fit for you and your loved ones, Insureyouknow.org can help you search for care by storing all of your research, financial information, and medical records in one easy-to-review place.

Five Things Happy Retirees Have in Common

June 15, 2024

The transition into retirement can be difficult, when work no longer provides a sense of identity and accomplishment. The change can be startling, especially when most people don’t switch to part-time schedules on the way out of their full-time careers. “We don’t really shift our focus to, how do we live well in this extra time,” says M.T. Connolly, author of The Measure of Our Age. “A lot of people get happier as they age because they start to focus more on the meaningful parts of existence and emotional meaning and positive experience as finitude gets more real.”

While most people account for how much money they’ll need when it’s time to retire, there are many other factors to consider when planning for a fulfilling retirement. Here are five things that happy retirees have in common.

Feeling a Sense of Purpose

There are several approaches to staying active and finding purpose after leaving a career. “Your retirement schedule should be less stressful and demanding than your previous one, but we don’t need to avoid all forms of work or service,” says Kevin Coleman, a family therapist. “Find some work that you take pride in and find intrinsically meaningful.”

Many retirees, for example, choose encore careers, where instead of working for the money, they are working for the enjoyment of the job. Besides finding a new job, there are other simple ways to feel purposeful during retirement. Purpose can be found by making oneself useful, such as by volunteering in the community, joining a community board, or participating in an enjoyable activity with a group, like a gardening club. Many retirees enjoy volunteering to take care of their grandchildren or helping their older friends with caregiving duties. Finding purpose doesn’t need to be complicated and can be achieved through simple acts of showing up for others and being open to new connections.

Finding Ways to Connect

As nearly 25% of those who are 65 and older feel socially isolated, finding ways to connect are important for mental and physical well-being during retirement. One way to connect is through storytelling. Sharing our stories with the people we care about strengthens our social bonds and helps us feel less lonely. Storytelling also helps people pass down their family memories, especially when we share stories with younger relatives, such as with grandchildren. It’s a nice feeling to think that your memories will live on through your loved ones. “The models we have for aging are largely either isolation or age segregation,” says Connolly. “There’s a loss when we don’t have intergenerational contact. It impoverishes our social environment.” Perhaps the best thing to do as you age is to cherish and foster these relationships with younger relatives.

Making Plans for the Retirement Years

Budgeting for your retirement is crucial to happiness during the retirement years. Successful retirement planning includes paying off debts prior to retiring and saving for unexpected expenses or emergency funds in addition to a standard monthly budget. According to a survey conducted by Wes Moss, author of You Can Retire Sooner Than You Think, the happiest retirees are those who have between $700,000 and $1.25 million in liquid retirement savings, such as stocks, bonds, mutual funds, and cash. His research also found that retirees within five years or less of paying off their mortgages are four times more likely to be happy in retirement. This is because the mortgage payment is typically the most significant expense, so those retirees who own their homes feel safer and more at peace once they no longer have that bill. Plus, not having a mortgage payment due every month dramatically lowers their monthly expenses and can help retirement savings last longer.

Many retirees overlook retirement planning beyond their finances. New research from the Stanford Center on Longevity shows that where someone lives in retirement can affect their longevity. Researchers found that people over the age of 60 who lived in upper-income areas lived longer due to having more access to health and social services. They also credited strong social networks and a sense of community to living longer. So perhaps there’s a city or area that you’ve always dreamed of living in or you’d like to live closer to family. Think about where you want to live when you’re done working and then plan for it before you retire.

Beyond saving up and thinking about where you want to spend your retirement years, setting goals for once you’re in retirement is equally as important. “Research suggests that those who think about and plan for what they will do in retirement in advance are far happier and fulfilled once they actually retire and begin living this phase of life,” says financial planner Chris Urban. “Sometimes it is helpful for people to write down what they plan to do every day of the week, what goals they have, who they want to spend time with and what they want to do with them.”

While your goals before retirement were likely centered around career and finances, it will be important to set different kinds of goals once you’re retired. Having goals doesn’t become less important just because you’re no longer working. “If you really want something, maybe a new romance, then take a concrete step in that direction,” says psychiatry professor Ahron Friedberg. “Don’t ever tell yourself that it’s too late.”

Prioritizing Both Physical and Mental Health

With a full-time career no longer on the schedule, cooking healthy meals at home, getting enough sleep, and finding ways to be more physically active everyday will be easier. It will also be important to keep up on medical appointments and preventive therapies. A study conducted by Harvard shows that even people who become more physically active and adopt better diets later in their lives still lower their risks of cardiovascular illnesses and mortality more than their peers who do not. “Not all core pursuits include physical activity or exercise, but many of the top ones do. I refer to them as the ‘ings’—walking, running, biking, hiking, jogging, swimming, dancing, etc.,” says Moss. “These all involve some sort of motion and exercise.” The most sustainable form of physical activity will be doing more of those activities that you enjoy and that move your body.

In addition to caring for your physical health, focusing on your mental health is just as important, especially as you age. According to Harvard’s Medical newsletter, challenging your brain with mental exercise activates processes that help maintain individual brain cells and stimulate communication between them. So choose something new or that you’ve always wanted to learn. Take a course at a community college or learn how to play an instrument or speak a language. If you enjoy reading, visit the library every week for a new book. If you enjoy helping others learn, then looking into a part-time tutoring job or volunteering to tutor is a way to challenge yourself mentally, connect socially, and feel a sense of purpose.

Prioritizing your overall health includes asking for help when you need it. If you reach a point where you need assistance with daily tasks and activities, then you shouldn’t hesitate to ask for help early. Whether it’s family members or caregiving services, finding help with the things that are becoming difficult for you is the best way to maintain your independence for as long as you can so that you may continue to thrive during your retirement years.

It’s important to think about how you want to spend your retirement before it’s here. While many people only consider their finances when they begin to plan for the future, there are other factors, including how you’ll spend your time, where you’ll live, and your overall health that will impact the quality of your retirement years. With Insureyouknow.org, storing all of your financial information, medical records, and planning documents in one easy-to-review place will help you plan for what can be the best years of your life.

Life After a Stroke: What You Should Know

May 21, 2024

A stroke affects the brain’s arteries and occurs when a blood vessel that brings blood to the brain gets blocked or ruptures. The area of the brain that is supplied with blood by the blocked or ruptured blood vessel doesn’t get the oxygen and nutrients it needs, and without oxygen, nerve cells are unable to function. Since the brain controls one’s ability to move, feel, and think, a stroke can cause injury to the brain that could affect any or all of these functions.

Everyone should know the signs of a stroke and seek immediate medical attention if you think you or someone around you is having a stroke. If you or someone you love has recently had a stroke, then it’s important to understand what happens next.

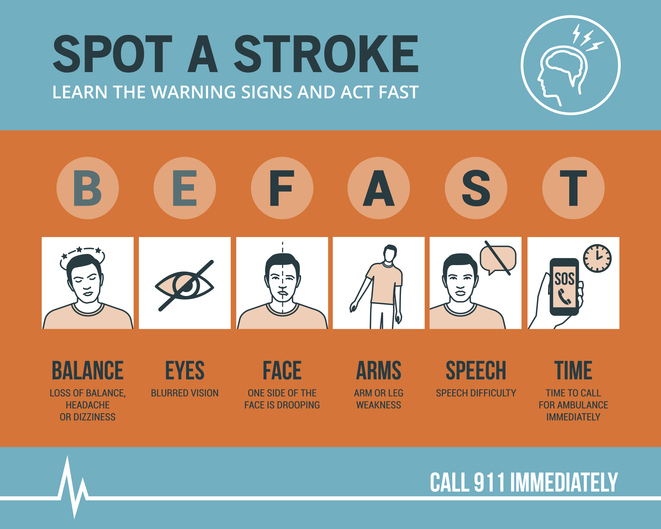

Know the Symptoms of a Stroke and act FAST

The longer the brain is left untreated during a stroke, the more likely it is that someone will have irreversible brain damage. The acronym FAST can help everyone recognize the four main signs that someone may be having a stroke and remember to act fast in seeking medical treatment. That means calling 9-1-1 immediately, as emergency response workers can treat someone on arrival if they think that person is having a stroke.

FAST stands for Facial drooping, Arm weakness, Speech difficulties, and most importantly, Time. If one side of a person’s face is drooping, if the person cannot lift both arms or one arm is drifting downward, and if the person’s speech is slurred or they cannot repeat a simple sentence, then they may be having a stroke. Not all of these signs need to be present to signal a stroke. Just one or two of these symptoms is enough to call 9-1-1, because time is of the essence in the event of a stroke.

Stroke Treatment Begins With Emergency Response Workers

Calling for an ambulance means that the emergency response workers can start life-saving treatment on the way to the hospital. Stroke patients who are taken to the hospital in an ambulance may get diagnosed and treated more quickly than people who wait to drive themselves. The emergency workers may also know best where to take someone, such as to a specialized stroke center to ensure that they receive the quickest possible treatment. The emergency workers can also collect valuable information for the hospital medical staff before the patient even gets to the emergency room, alerting staff of your arrival and allowing time to prepare. All of what the ambulance team can provide saves time in the treatment of stroke, and in the event of a stroke, time is of the essence.

Ischemic Stroke or Hemorrhagic Stroke?

There are two different kinds of stroke, ischemic or hemorrhagic. A medical team will need to determine which kind of stroke the patient is having in order to direct treatment. An ischemic stroke accounts for 87% of all strokes and happens when a blood clot blocks a vessel supplying blood to the brain. Hemorrhagic stroke happens when a blood vessel ruptures and bleeds within or around the brain.

“Fifty percent of strokes present with a clot in a large vessel in the brain, and these don’t respond very well to the old treatment, the IV clot busting medicine,” says M.D. and director of the Sparrow Comprehensive Stroke Center Anmar Razak. “And so nowadays, we do surgery, and what we do is we rush them into the hospital, into the cath lab. We quickly get access through the blood vessels and get up to where the clot is and pull it out.”

With ischemic stroke, the treatment goal is to dissolve or remove the clot. A medication called alteplase or tPA is often administered and works to dissolve the clot and enable blood flow. Alteplase saves lives and reduces the long-term effects of a stroke but must be given to the patient within three hours of the start of a stroke. Then, a procedure called mechanical thrombectomy removes the clot and must happen within six to 24 hours of stroke symptom onset.

For hemorrhagic stroke, the treatment goal is to stop the bleeding. There is a less-invasive endovascular procedure involving a catheter being threaded through a major artery in an arm or leg toward the area of the bleeding in the brain where a mechanism is inserted to prevent further rupture. In some cases, surgery is required to secure the blood vessel that has ruptured at the base of the bleeding.

Rehabilitation After a Stroke

Perhaps the most important part of stroke treatment is determining why it happened or the underlying causes of the stroke. Stroke risk factors include high blood pressure, which weakens arteries over time, smoking, diabetes, high cholesterol, physical inactivity, being overweight, heart disease including atrial fibrillation or aFib, excessive alcohol intake or illegal drug use, and sleep apnea. By making the right lifestyle choices and having a good medical management plan moving forward, the risk of another stroke can be greatly reduced.

That’s because if you have had a stroke, you are at high risk for having another one. One in four stroke survivors have another within five years, while the risk of stroke within 90 days of transient ischemic attack or TIA is as high as 17% with the greatest risk during the first week. This is why it becomes so important to determine the underlying causes of the initial stroke. Your doctor may give you medications to manage a condition, such as high blood pressure, and then recommend lifestyle changes, including a different diet and regular exercise.

Rehabilitation after a stroke begins in the hospital, often within only a day or 2 after the stroke. “There are so many things that patients need to fall into place to be functional and independent again after a stroke,” said Razak. “And they always come down to speed and time.” Rehabilitation can help with the transition from the hospital to home and can help prevent another stroke. Recovery time after a stroke is different for everyone and can take weeks, months, or even years. Some people may recover fully, while others may have long-term or lifelong disabilities. Stroke rehabilitation should be thought of as a balance between full recovery and learning how to live most effectively with some deficits that may not be recovered.

Difficulties from a stroke range from paralysis or weakness on one or both sides of the body, fatigue, trouble with cognitive functioning such as thinking and memory, seizures, and mental health issues like depression or anxiety from the fear of having another stroke. Everyone’s rehabilitation will look different based on their difficulties after a stroke but may include speech, physical, and occupational therapy. Speech therapy helps when someone is having problems producing or understanding speech, physical therapy uses exercises that help someone relearn movement and coordination skills, and occupational therapy focuses on improving daily activities, such as eating, dressing, and bathing. Joining a patient support group may help people adjust to life after a stroke, while support from family and friends can also help relieve the depression and anxiety following a stroke. It’s important for stroke patients to let their medical team and loved ones know how they’re feeling throughout their recovery and what they may need help with.

Stroke rehabilitation can be hard work, but just as in the initial treatment of a stroke, time matters in the possibility of a full recovery. Many survivors will tell you that rehabilitation is worth it and recommend using motivators to achieve recovery goals, such as wanting to see a child’s graduation or returning to working in the garden. With Insureyouknow.org, caretakers may keep track of medical treatments and rehabilitation plans in one easy-to-review place so that they may focus on caring for their loved one during the period of recovery from stroke.

May is American Stroke Month which aims to raise awareness of the second leading cause of death.

Looking after Elderly Parents Remotely

March 1, 2024

Taking care of loved ones without being close by is a challenge. Whether you live a long drive away from aging parents or in another state, long-distance caregiving can become emotionally exhausting. If that sounds like you, know that you are not alone. Nearly 15 percent of caregivers live an average of 450 miles away. If you have recently found yourself looking after your parents from a distance, then here are some simple strategies to help you along the way.

Evaluate Your Strengths and Outsource the Rest

Be honest with yourself about your strengths. Maybe you’re comfortable handling finances but not as comfortable determining medical needs. Pinpointing the areas of need that you’ll be most suitable for is the first step in delegating the rest. You may have siblings who live closer to your parents and are willing to accompany them to their doctor’s visits. Other helpful skills include organization and communication, which could be utilized to organize schedules and communicate with medical professionals and caregivers. Once you determine what you’ll be best at handling, then you can begin to make plans to fill in the gaps.

Create a Team for Support

Speak with the rest of your family and close friends about who can help with your parents’ care. Coordinating with everyone to determine what each person is willing to do will help everyone be on the same page and turn creating a care plan into a team effort. Even if you don’t have any other siblings or family members who are able to help, then you should still meet with your parents and include them in their own care planning. For instance, ask them what you can do that will be most helpful. It’s important to remember that you don’t have to handle everything alone and to try and outsource anything you need help with as much as possible.

Establish Access to Information

Once you determine who the primary caregivers will be and who needs to be in charge of what, then it’s time to make sure those people have access to the appropriate information. Make sure that the person designated to handle bill-paying and account management on behalf of your parents has the ability to do so. Establishing the rights to have medical information released to caregivers as well as decision-making rights is another imperative. This can also be a legal issue down the road, so making sure that you or another trusted party is the power of attorney, who is appointed to make financial and medical decisions, will need to be determined.

Revisit Living Arrangements

Sometimes a loved one’s health requires them to be closer to you. If it’s possible to relocate to where they live or have them move in with you, then that may be something worth exploring. If it’s not possible to live together, then senior living communities have the upside of being able to provide 24/7 care. Many older people don’t require full-time care though, so if relocation isn’t feasible, then hiring a home care aide or personal care assistant is another option.

Schedule Regular In-Person Visits

If you cannot live close to your parents, then making plans to see them will accomplish several things. First, you’ll instantly alleviate some of the caregiver guilt you may be experiencing just by knowing when you’ll be able to visit them next. Second, you’ll be able to check on them in-person, as you may not have an accurate assessment of their condition and needs from a distance. “It’s hard keeping a handle on their health, how they’re doing, physically, mentally, psychologically and emotionally, when you’re not there,” says Amy Goyer, AARP’s family and caregiving expert. “Isolation is a big thing and they can tell you, oh, I’m doing fine and everything on the phone, but is that really what’s happening?”

Lastly, but most importantly, you’ll be able to spend some much-needed quality time with your parents when visiting. If you are not the primary caregiver, then coordinate with them on when the best time to visit is and offer them a break. Plan in advance what you can do when you’re there to help out. Then speak with your parents about what they would like to do with you during your visit. Since visits can go by quickly, especially when there is so much to do, set priorities ahead of time about what’s most important once you’re there.

Remain Connected When You’re Apart

Schedule regular phone calls with your parents and ask for updates from their caregivers. With their permission, you may even choose to attend their telehealth visits and doctor’s appointments virtually. “The frequency of contact is dependent on the type and level of care needed,” says Iris Waichler, author of Role Reversal, How to Take Care of Yourself and Your Aging Parents. “It should be a collaborative decision, if possible, rather than a unilateral mandate from the caregiver.”

Regular communication can keep your bond with your parents strong, as long as it remains an enjoyable experience for all of you.

Take Care of Yourself as Well

Caregiving can come with a heavy emotional load. It will become just as important to check in with yourself in your new role as caregiver. “Caregivers may often feel like they can do more and this can cause ruminating thoughts,” says Brittany Ferri, geriatric care occupational therapist. “In this instance, they may benefit from practicing positive self-care and self-talk along with their loved one to keep the lines of communication open while relieving stress.”

It’s hard to be a good caregiver, when you’re running on empty, so taking care of yourself as well is just as important as taking care of those depending on you. Show yourself compassion, make sure you’re recharging, and be kind to yourself.

Insureyouknow.org

While it can be a challenge to care for your parents from a distance, that doesn’t mean it’s not manageable. By planning ahead and creating a care team, you can make sure your parents are cared for even when you can’t be close at all times. Insureyouknow.org can help you compile care plans, schedules, financial information, and medical records all in one place. Then you can rest easy that you have a plan set in motion, ensuring that your parents will be well-taken care of.

Dealing with Mental Stress During the Holidays

November 22, 2023

For most people, the best parts of the holidays, extravagant decor, rich foods, gift-giving, and additional time with friends and family, can also be the most stress inducing. While the holidays are thought of as the most wonderful time of the year, it is in fact viewed by many as the most stressful time of the year.

Neverending to-do lists, added expenses, and the desire to achieve a perfect holiday are just a few of the ways that the season brings on an overwhelming amount of stress. Plus, if you have an existing mental health condition, the holidays may accentuate it. “There are a lot of stressors in life without the holiday season,” says event planner Courtney Lutkus. “The holidays can be triggering and make it worse.”

In order to have a more relaxing holiday season, it’s important to choose some strategies ahead of time that will help you combat seasonal stress.

Exercise is Often the Best Medicine

During the holidays, prioritizing regular exercise can mitigate stress before it happens. Whichever exercise you choose, taking the time to move your body will guarantee a healthy dose of holiday cheer.

If you tend to feel restricted during the holidays from being spread too thin both physically and mentally, dance therapist Erica Hornthal recommends what she calls joy workouts. Take a break from the festivities, find an open space, and spend eight minutes moving through six expanding moves, including reaching, swaying, and jumping, that are designed to boost happiness. “Shake your hands, shake your head — kind of like an animal after it gets wet,” she says. “You can make a game out of it if you have kids.”

Alternatively, if you feel the need to slow things down, then yoga might work best for you. Even a fifteen minute session can lower levels of stress and anxiety. With a focus on breathwork and mindfulness, yoga can be especially effective for alleviating the feelings of nonstop commotion that often come with the holidays.

If you find yourself wanting to get away, a walk or run around the neighborhood may be just what you need to reset. You could even plan a “microadventure,” which could be as simple as a bike ride in the dark or a daytime hike at a nearby nature reserve. Viewing things in a new light and admiring your surroundings can create a sense of awe, which has been proven to lower stress levels. Plus, spending time outside, even if it’s just a walk around the block, can lower cortisol levels, blood pressure, and muscle tension.

Schedule Breaks

If you’re having difficulty finding time for yourself during busy days, then reclaiming your mornings might be the best way to fit in a break. “I encourage everyone to develop a daily habit of starting their day with their own voice as the primary driver for how they want to engage the day,” says therapist Chanel Dokun. “This is an easy way to pre-schedule ‘me-time’ amid a busy holiday season where you can check in with your own needs, set your own priorities, and move into your day feeling centered and in control.” Plus, research shows that waking up just one hour earlier lowers an individual’s risk for depression by 23 percent.

In addition to making time for yourself in the mornings, simply saying no to yet another social obligation could help you avoid the burnout that comes from overdoing it. The sheer volume of things to do during the holidays can make it difficult to prioritize what’s most important. Sometimes, taking care of your mental health can be more important than attending yet another event, so give yourself permission to choose your festivities wisely. Not only will saying no to some things ease your stress, but it can also reinforce healthy relationship boundaries, which will leave you feeling empowered rather than burnt out.

Honor Your Routine

With all of the added hustle and bustle, it will be easy to fall out of your usual routine, but sticking to your routine might be the simplest solution to seasonal stress. Dr. David Spiegel, director of the Center on Stress and Health at Stanford University, says that our stress responses are far more flexible when we are resting and nourishing our bodies. “Mitigate stress by taking care of your body first,” says Spiegel. Give your body something to depend on during the holiday rush by getting enough sleep, eating well, and exercising regularly.

It would be impossible for every part of the holiday to be perfect, so why place that standard upon yourself? Think about what traditions matter most to you, such as cooking a specific meal for your children or visiting family. When you take the time to think about what matters most, you can either ditch the items that fall down on your to-do list, or you can ask other family members to take some tasks off of your plate.

“You have a lot going on,” reminds psychologist David Rakofsky. “You can’t possibly do it all. Instead of lamenting your ‘losses,’ congratulate yourself on the everyday victories, like leaving the bed, smiling, and putting on pants.”

Whether you’re counting on your travels to go just as planned, finding the perfect gifts, or hosting the event of the season, having an idealized approach can set you up for disappointment. When you let go of your vision for the perfect holiday, you may find that you have far more joy this season, as well as far less stress.

Stick to a Holiday Budget

The best way to manage financial stress is to set a realistic budget. Since nearly 1 in 4 people feel financially burdened by the holidays, there may be no better time to employ a budget than this time of year. “Be realistic when creating a budget by using real prices, not ballpark figures,” says Family and Community Health specialist Joyce Cavanagh. “Don’t forget to include travel, food and entertaining costs in your holiday budget. And remember to jot down what you’ve bought so you don’t lose track of how much you’ve spent.”

Due to inflation, lower-income households may experience more financial stress this year. 29 percent of consumers say they’re stressed about the cost of holiday shopping, and 14 percent feel pressured to spend more than they’re comfortable with. Talking with your loved ones about minimizing holiday spending and gift-giving could take the pressure off of everyone and put the focus back on celebrating with loved ones. “Try managing your anxiety through transparency and planning,” says psychiatrist Dr. Georgia Gaveras. “You may end up being a hero this holiday season if you propose limiting the number of gifts everyone buys.”

While you concentrate on the most wonderful time of the year, Insureyouknow.org can help you keep track of everything from financial records to travel itineraries and schedules. This season, stay organized when things get chaotic, and give yourself space to be present for all of what the holidays offer.

Legal and Financial Planning for Those with Alzheimer’s and Their Caregivers

November 1, 2023

If you or a loved one is diagnosed with Alzheimer’s or dementia, then there are certain things that you will need to plan for legally and financially. An estimated 6 million Americans have Alzheimer’s, and it is currently the seventh leading cause of death in the United States. Alzheimer’s is a brain disorder that slowly decreases memory and thinking skills, while dementia involves a loss of cognitive functioning; both cause more and more difficulty for an individual to perform the most simple tasks. Though a diagnosis can be scary, the right planning can help individuals and their families feel more at ease.

Putting Legal Documentation in Place

Christopher Berry, Founder and Planner at The Elder Care Firm, recommends three main disability documents that should be in place.

First, there needs to be a financial power of attorney, a document that designates someone to make all financial decisions once an individual is unable to do so for themselves. If an individual lacks a trusted loved one to make financial decisions, then designating a financial attorney or bank is an option.

The next document that needs to be in place is the medical power of attorney that designates someone to make medical decisions for an individual. In many cases, it may be appropriate to appoint the same person to be the financial and medical power of attorney, as long as that person is well-trusted by the individual. In the event that something happens to the original power of attorney(s), successor (or back-up) agents for power of attorney(s) should also be designated.

The last document is the personal care plan, which instructs the financial and medical power of attorney(s) on how best to care for the individual in need. For instance, those entrusted to the care of an individual will need to make sure they sign medical records release forms at all doctor’s offices; copies of the power of attorney or living will should also be given to healthcare providers.

These three documents provide a foundation to make decisions for the individual diagnosed with Alzheimer’s or dementia when they no longer can themselves. It’s ideal to include the individual in these conversations in the early stages of their diagnosis, so that they may be a part of the decision-making process and appoint people that they will feel most comfortable with during their care.

How to Pay for Long-Term Care

Since Alzheimer’s is a progressive disease, the level of care an individual needs will increase over time. Care costs may include medical treatment, medical equipment, modifications to living areas, and full-time residential care services.

The first thing a family can do is to use their own personal funds for care expenses. It’s important for families to remember that they will also pay in their time, as many children of loved ones with Alzheimer’s or dementia will become the main caregivers. It may be wise to meet with a financial planner or sit down with other family members, such as your spouse and siblings, to determine how long some of you may be able to forgo work in order to provide full time care.

When personal funds get low or forgoing work for a period of time becomes difficult, long-term care insurance can be a lifesaver. The key to relying on long-term care insurance though is that it needs to be set up ahead of the Alzheimer’s or dementia diagnoses, so considering these plans as one ages may be smart.

Veterans can make use of the veterans benefit, or non-service-connected pension, which is sometimes called the aid and attendance benefit. This benefit can help pay for long-term care of both veterans and their spouses.

Finally, an individual aged 65 or older can receive Medicare, while those that qualify for Medicaid can receive assistance for the cost of a nursing home. If someone’s income is too high to receive Medicaid, then the spenddown is one strategy to know; under spenddown, an individual may subtract their non-covered medical expenses and cost sharing (including Medicare premiums and deductibles) from their available income. With the spenddown, a person’s income may be lowered enough for them to qualify for Medicaid.

Minimizing Risk Factors During Care

Research published recently in the journal Alzheimer’s & Dementia found that nearly half of patients with Alzheimer’s and dementia will experience a serious fall in their own home. Author Safiyyah Okoye, who was at John Hopkins University when the study was conducted, recommends minimizing risks such as these by safeguarding homes early on in diagnoses. “Examining the multiple factors, including environmental ones like a person’s home or neighborhood, is necessary to inform fall-risk screening, caregiver education and support, and prevention strategies for this high-risk population of older adults,” she states.

The good news is that since the progression of Alzheimer’s is often slow, families have plenty of time to modify the home for increased safety.

In addition to fall prevention modifications, other safety measures may include installing warning bells on doors to signal when they’re opened, putting down pressure-sensitive mats to alert when someone has moved, and using night lights throughout the home. Coats, wallets, and keys should also be kept out of sight, because at some point, leaving the home alone and driving will no longer be safe. Conversations about these safety measures, such as when an individual will have to stop driving, are ones that caregivers should have early on with their loved ones. Including individuals in their future planning while they are still cognitively sound will help both them and their caregivers feel more comfortable with the journey ahead.

It’s important to remember that even though receiving an Alzheimer’s or dementia diagnosis can be devastating, it is not the end. People with Alzheimer’s can thrive for many years before independent functioning becomes difficult. Both patients and caregivers will feel more calm through planning ahead. Insureyouknow.org can help caregivers stay organized by storing all of their important documents in one place, such as financial records, estate planning documentation, insurance policies, and detailed care plans. Above all, there is hope for those with Alzheimer’s; research is happening every day for potential therapies and future treatments.

Paying for Early Childhood Intervention Services

October 1, 2023

Over three million children in the United States had a reported disability according to the 2019 U.S. Census, and that number has risen 0.4% since 2008. Children experiencing developmental delays, not reaching developmental milestones, or those at risk may be eligible for early intervention services and supports.

When to Screen for Developmental Delays

If a child is born prematurely or with a genetic condition, then that child may qualify for early intervention as soon as birth. Early screening is part of the services that should be offered while parents are in the hospital for their child’s birth. However, if a parent becomes concerned about their child’s development after birth or notices any changes, they should refer their child for an early intervention evaluation. Eligibility for services is based on an evaluation of a child’s skills and abilities. A doctor’s referral is not necessary for an evaluation. It’s important for parents to educate themselves on which milestones their children should be reaching and not rely completely on their doctor’s recommendations; it is parents who spend the most time with their children, so they may notice something that a pediatrician won’t catch during a routine check-up. Emma Fitzsimmons, a New York mom who claims early intervention saved her son’s life, tells other parents, “If you’re worried that your child has delays, I would encourage you to seek out Early Intervention services and to ask for recommendations to find the best therapists in your area and a good service coordinator, the person who oversees your case.”

Know What Your State Offers

If eligible for early intervention, children may receive services to help with physical skills (crawling and walking), cognitive functions (thinking and learning), communication (talking and listening), adaptive skills (eating and dressing), and social-emotional development (play). Services are wide-ranging and can include speech therapy, physical or occupational therapy, psychological services, home visits, nutritional services, audiology (for hearing issues), vision therapy, social work, assistive technology, and even transportation.

The Individuals With Disabilities Education Act, or IDEA, covers early intervention and school-aged services. Under Part C of IDEA, funding is made available to each state and requires services to be made available to eligible children with disabilities. While all states offer early intervention, the screening processes and services offered vary state by state. The first step in finding out what your child may qualify for is learning about what your state offers. The CDC offers links for each state in order to learn about the benefits your state offers. Each state has its own guidelines around how families qualify, but generally, a child must exhibit a developmental delay or have been diagnosed with a specific health condition that is known to lead to delays, such as a genetic disorder. The Early Childhood Technical Assistance Center (or ECTA) also outlines the services each state offers. In some states, children may be eligible for services if they are at risk and not yet exhibiting any delays, such as having been born at a low weight. If a child is found eligible for services, a care team will develop an Individualized Family Service Plan (IFSP), which will outline the services a child will receive and the desired outcomes for those services. For instance, physical therapist Tonya McCool explains, “If a child presents with a delay that limits their abilities to complete age-appropriate milestones, a provider will assist by guiding the child into appropriate positions, providing them opportunities to experience new opportunities or helping them try new things so that their families can continue to work with them throughout the week to meet their goals.”

Who Pays for Early Intervention Services?

Under IDEA Part C, Child Find services, which include the initial referral, evaluations, the development of the IFSP, and service coordination must be made free to families, but depending on your state’s policies, some services may be provided at a cost or on a sliding scale. In addition to the federal education funds provided through IDEA, Medicaid and private insurance can also help cover the costs of interventions, such as speech therapy and hearing services. Finding a provider that is familiar with Early Intervention funding will know best how to help families cover the costs of these services. Although early intervention is mandated by IDEA and designed to meet the needs of children, it often requires a combination of resources to cover the costs of services. The ECTA’s website offers contact information for each state’s lead agency, who will be able to provide parents with the resources they’ll need to secure services and funding. If your child qualifies for interventional services, it will be important to become educated in what services must be provided at no cost to you through IDEA Part C.

What Happens When Services End?

Once a child is three, if they are still experiencing delays or require supports, then services will continue and transition into special education services. These are often provided through a child’s school at no additional cost to you. The age at which a child begins schooling also varies state-by-state, which is why it’s important for families to work with their initial early intervention team in order to ensure children continue receiving the supports they need. When an IFSP is developed, it should include any support for the transition to preschool when a child turns three. Plans should be reviewed every six months, as children change quickly from birth to age three.

Early intervention services can have an enormous impact on a child’s ability to meet developmental milestones. These services are provided not only for a child, but also so that their caregivers have the tools they need to create a healthy environment for their entire family. Insureyouknow.org can help you keep track of medical records, interventional resources, and your child’s IFSP, as well as their progress. When it comes time for your child to start school, having this paperwork organized in one place will help you provide their school with everything they require in order to ensure the necessary continued supports.

Health and Economic Costs of Dealing with Chronic Illness

September 1, 2023

While the diagnosis of a chronic illness is upsetting enough, the financial ramifications of needing ongoing care often hit the hardest. Medical issues account for two-thirds of all US bankruptcies, making them the number one reason people file; forty percent of people who are diagnosed with cancer are bankrupt within four years of their diagnosis. For those who are chronically ill, healthcare is the number three line item for budgeting, while it’s number 10 for healthy individuals.

The costs of living with a chronic illness is not limited to financial burdens though; a chronic illness can also lead to even more health and interpersonal issues.

A Decline in Mental Well-Being

Health impairments can exacerbate existing mental health conditions, like depression, or cause new issues to arise, such as anxiety. Being diagnosed with an illness that’s incurable or being unsure about whether or not the symptoms will improve is going to cause an immense amount of stress in patients. People who feel ill often may also end up feeling guilty for not being able to fulfill their personal responsibilities and show up fully for their loved ones.These mental and physical chronic conditions can lead to harmful degrees of social isolation and perpetuate a cycle of declining overall health.

When considering the connection between physical and mental health, it has been shown that those who report feeling lonely suffer from higher rates of morbidity, infection, depression, and cognitive decline. Living with a chronic illness doesn’t have to equate to a lonely life though, and may even lead to more meaningful relationships, according to Caroyn Hax, an advice columnist for the Washington Post. In her response to a reader with multiple sclerosis, she stated “Although your illness will deter some potential companions, your ability to plan it into a full, rewarding and well-managed life will attract others — specifically those people who appreciate that circumstances change but character does not.”

An Inability to Work and Losing Health Benefits

Many people suffering from chronic health issues may begin to find it difficult if not impossible to go to work consistently. Many people who deal with chronic health issues––such as Charlene Marshall who is a Pulmonary Fibrosis patient–– find it difficult if not impossible to go to work consistently. “Whether the fatigue I feel is from managing the disease or the disease progression, daily activities become exhausting and hard to manage,” she shares. Unfortunately, many people suffering from a chronic condition may begin to be viewed as unreliable by their supervisors, leading to termination, while others may need to resign as they find it impossible to keep working.

For many, losing their job also means losing their health benefits. Those who can no longer work may become reliant on spousal coverage or public assistance, which is likely why 99 percent of Medicare and 80 percent of Medicaid spending goes toward the treatment of chronic disease. Not only does the inability to work affect individuals and their families, but lower labor force participation rates affect society as a whole and are linked to slower economic growth, a higher dependency ratio, and higher tax rates.

Straining Personal Relationships

The inability to work due to chronic illness can lead to financial strain on an individual’s entire family. Not only may family members need to help pay for care, but they may also need to take time from work to care for their loved ones who are undergoing treatment that makes them ill, need help with daily activities, or have just had a major surgery. Between new bills and extended care, the financial struggles of the chronically ill can spread easily to those who care for them most.

People who have a loved one that is suffering from a chronic health condition may also experience stress, concern, and an overwhelming sense of helplessness. Battling a chronic illness doesn’t always have to come with negative interpersonal effects though. Many people actually find that their relationships are strengthened through their health struggles. Marshall, for instance, shares that she is grateful for a strengthened social circle. “I’m blessed to have a network of great friends who support me despite IPF and who are always willing to listen.”

How We Can All Fight Chronic Disease

By working together, we can help build up the next generation for a healthier life through education about the prevention of many chronic diseases. Eating well, regular exercise, and avoiding substance abuse are all behaviors that may reduce the risk of becoming chronically ill. On a societal level, we can address the underlying determinants of health, including one’s environment, education, and access to healthcare. For instance, since many chronic diseases, including cardiovascular disease, diabetes, and arthritis, are associated with poor diet and obesity, the FDA is currently working to make sure US eating patterns are meeting federal dietary guidelines.

If you or a loved one are struggling through a chronic illness, know that you are not alone. The CDC estimates that 6 in 10 adults living in the US have at least one chronic disease, while 4 in 10 suffer from at least two or more. Insureyouknow.org can help you keep track of medical records, doctor’s appointments, financial planning, and other important documentation regarding your health and finances. Getting organized and keeping a plan are easy ways to get more peace of mind on your life’s journey through a chronic illness.