Author: Gerry Acuna

Not Quite Yet… Back to School Frenzy

August 3, 2019

The children are watching… your every move, your every snack and your every minute carved out for yourself. They are hungry for attention, for something fun to do, for YOU. You could be their parent, uncle, grandparent, neighbor or even the passerby in the grocery store aisle, but the child has a fascination and need to soak up all stimuli. How can we fathom what is going on in their minds with neurons firing and brain cells absorbing YOU?

There are many similarities between the preparation for the school year, and learning more about what makes you, YOU.

School Supplies – We get a list of school supplies provided by the school perhaps 3-4 months before the new school year starts. Some people will purchase the full school supply package from the school, have the supplies delivered to the school and not worry about anything further – their job is done, without even reading the list. There is the group in the middle that have studied the list, reviewed the communal supplies like tissues and wipes, and child-specific – pencils, folders, and composition books and are working at their own pace to find the best deals and coupons at the best stores. And others will see the list, but not act upon it until the last days before the school year starts – nearly 100 days later – and will rush to the nearest store to gather everything and more.

Which is better, which is YOU? It really depends on your values. Group 1 saves mental stress but spends more. Group 2 saves money but takes on the mental stress throughout the summer. Group 3 spends more and has intense mental stress. Our personality type dictates how we handle the school supply task – and other to-do items.

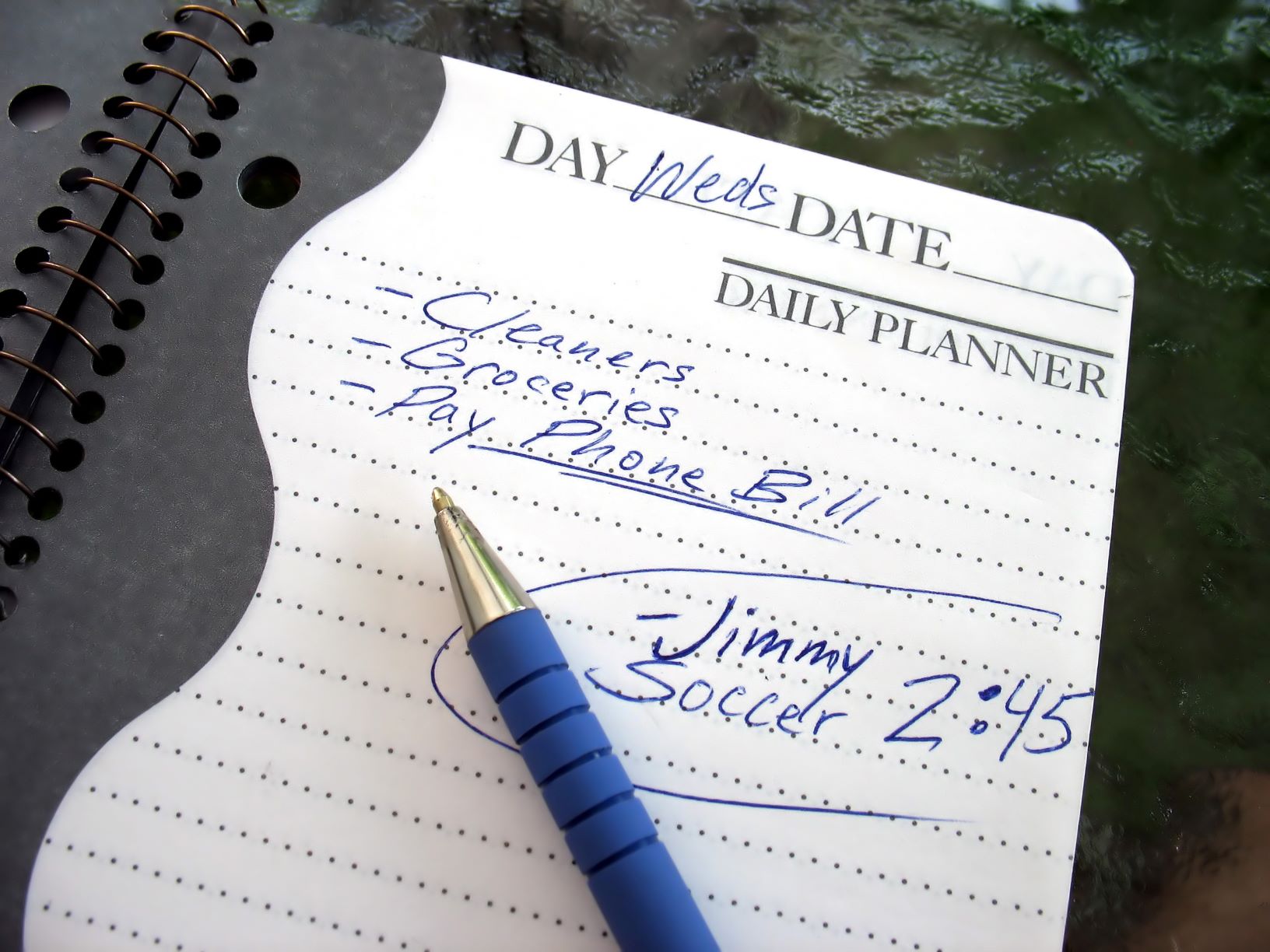

Organizing the Calendar – The Summer months give many families a chance to escape from reality. The calendar belongs to you instead of the school system. Some people will fill the calendar with vacations and camps; there is something “to-do” everyday – essentially keeping the constant flow. Others will take each day as it comes, they may not know what day it is, what time it is and what is the next meal – the Summer is the Summer. The last group tries to have it all – keeping a foot in reality but having some fun along the months.

Which have you followed, which is YOU? It really depends on your circumstance. Group 1 may have more financial resources. Group 2 may have more time. Group 3 may need more control. Our life dictates how we handle the calendar – and other activities in our lives.

As you watch the frantic caregivers purchase school supplies, organize their calendars, and keep the youth entertained for just a few more days – remember there’s InsureYouKnow.org product offerings to reference those important records. It’s a safe place to store all the information in case you need to access it remotely – or from the comforts of your own home. Take stock of the summer memories and your current resources with an annual plan.

What do I really need?

July 23, 2019

Jumping down the rabbit hole of getting our affairs in order can seem like another chore on top of our full days. And where to start? The idea seems overwhelming – paperwork, copies, notarizing, legal counsel and fees. Questions add to our procrastination: What if I can’t find it? What if I don’t really know what my account numbers are? What if I can’t finish – does this just create more clutter?

There are many lists and suggestions of “in case of emergency” documents that everyone should have together, but when there are multiple people in your household, or multiple dependents – the task can seem confusing and overwhelming. I’ve thought of some suggestions of how to start the task, and then how to add to the folder or portfolio as time allows.

Stage 1: Locating documents.

Some of these are easier than others. Creating a physical file AND an electronic copy of these documents is vital in our new era of technology. Requests for “soft copies” or the need to provide 3 or 4 documents at a time makes it easier to utilize the electronic versions.

Suggestions for these documents can be found on our website – InsureYouKnow – but some of the easier ones are – Driver’s License, Social Security Card, Medical Insurance Card and Passport. Some of the trickier ones are Birth Certificate, Wedding License, Mortgage/Lease Paperwork and Vehicle Titles and may require you to reach out to the county office to apply for a copy.

Stage 2: Creating Lists.

If you are like me – making lists is easy. The hard part is filling in the information and remembering to update them. There are three types of lists that are important for ongoing upkeep.

Assets/Liabilities: Meaning – what do I have and what do I owe. Do you own property, land, business? Where do you put your money – bank, credit union, bonds, 401K? The liabilities are the companies you pay bills to – electric, cell phone, mortgage, pest control, car insurance. Essentially it’s the things that are in your head, but not documented in one place and certainly not available for all.

Contacts: Meaning – who are your most important people. Start with the top 10 list of people that you would like to know that a life change has happened. This doesn’t have to be in catastrophic instances – the lottery win would be a fantastic opportunity to utilize this list. Many times, there would be overlap in the lists for household members. Examples are children, siblings, parents, partners.

Medications: Most of us have this handy but is a good practice to have a medication list to share with a household member during an emergency or if we are unable to make it to the pharmacy for refills. There are several apps and templates available online to keep the lists uniform. A short narrative of the medical history can also be put with this list.

Stage 3: Fill in the gaps

As you get deeper in the rabbit hole, it will be clear that there’s items that you need to research further, and involve other parties. Examples include healthcare directives and living wills. These often need to be notarized to be valid and sometimes require a witness or legal professional. There are many options online but having conversations with those that you trust may uncover a resource that you can utilize that saves money, time and headache.

As you start putting all your documents together, consider using InsureYouKnow.org – an online information-safe, as a place to store them. This product gives you the ability to access documents, and files remotely – or from the comforts of your own home. There are various levels of access to allow your family members, caregivers or business associates insight into your documents – as needed. There is even a trusty reminder feature to help you remember that it’s time to update.

Happy Birthday America!

June 30, 2019

Happy Independence Day America. As the red, white and blue combinations emerge in our clothing and décor, marketing and sales galore treat our senses – It is a time for enjoyment in America. Fireworks, BBQ, Baseball, time with the family and friends – and for most of us – time off from work and the normal routine. Who doesn’t enjoy a birthday and time to celebrate, a time to kick-back and accept that the summer season is here – heat and all.

The 4th of July celebrations have been diversifying since the first official celebrations in 1777, when “Philadelphians remembered the 4th of July. Bells were rung, guns fired, candles lighted, and firecrackers set off.” Though we have introduced the summertime aspects of sports and outdoor foods to our traditions the fireworks remain!

Here are some facts about America that we can introduce into our own traditions:

- There are 126x more people in the United States than in 1776. There is a reason that the American population continues to grow. With the 2020 Census coming up – we’ll be able to have a more accurate count of who and where everyone lives. “In July 1776 there were an estimated 2.5 million people living in the Colonial United States. Currently there are approximately 316 million Americans.” Do you have such colossal growth or debt during your lifetime that you haven’t accounted for? Looking at all our accounts, the 401k accounts from our first place of employment, and checking with family members to see if there are any assets lurking out there. There may be more than you know.

- We started celebrating the 4th of July holiday 100 years after the Declaration was signed. If we waited that long to formalize the important things in our lives we would be in trouble. Power of Attorney, Wills, Healthcare directives, your birthday wish list, the Bucket List, – the family and friends may know what your wishes are – but have they changed over the years. Document and act upon the things that are important to you – before 100 years pass. Americans were so busy creating their young nation that they forgot to enjoy and recognize national holidays until 1870.

- We have a Declaration of Independence How many of us have read the declaration of Independence since we left school? There are lot of words, and a lot of fine print – and it’s the fine print that defines the why – why our military continues to fight for America. The British rules and regulations were stifling the growth of America, and the 13 states came together to put together a document to publicly declare freedom The full Declaration of Independence can be found in many books and the original lies in National Archives in Washington DC. Where is the history of your life, your family and the why?

As a proud American, with access to life, liberty and justice, the access we have to continue to keep our belongings safe is easy. With InsureYouKnow.org – an American based-company –our online information is safe. The ability to access documents, and files remotely – or from the comforts of your own home can be taken for granted, just like so many other things. An annual plan is also available for cost-savings.

Go figure – it’s Fathers’ Day

June 14, 2019

Happy Father’s Day to all the dads, fathers, papas, grandfathers and father-figures in our lives. The world would not be the same without them. Since 1910, the USA has honored the third Sunday in June to remember the “contribution that fathers and father figures make to the lives of their children.” As other countries have adopted this custom, some in August, September or December, the celebrations usually involve gifts and food.

Although the role of the father as being the breadwinner in the family, the one with the full-time job, or the one that leaves to go to work every day is not always the norm – there is still popular public opinion that this is the case. According to the Pew Research Center, in the United States only a quarter of families with children under the age of 18 have a father that is the breadwinner. That means that men are connecting with children in a different way to the 1970s, when almost half of these couples (47%) were in families where only the dad worked.

Do we have more money now than in our father’s generation? Where do my resources go? Father’s Day, like so many events, can often be a time of reflection. Does our habitual nature with finances stem from our father-figures’ habits?

- Spending. Work hard, play hard. For so many of us, the money is a means to an end. After the bills are paid – what makes us and our families happy? Is it the latest gadget or home improvement, the presents for the children, or the holidays and excursions? If your father-figure showed love and excitement spending on summer vacations with ice-creams and beach time, it is likely you will be doing a similar thing.

- Saving. Keep the money for a rainy-day – or for large events. The price of college, weddings, first-homes are skyrocketing. It’s not just a phrase about the good ol’ days – the dollar used to go much further. According to the CPI Calculator in 1910 $100 would buy the same as $2500 would buy today. With unemployment rates high and pay for jobs low, it is pretty difficult to cross the threshold from poverty to middle class, from middle class to rich, and rich to wealthy. Foregoing the restaurants and the international travel for 529 plans and down-payments on homes are options we can provide our children.

- Scaling Back. As we are encouraged to look ahead and plan for retirement and downsize – do we need the large home, the extra vehicles, the tax-rate for the school districts that we are currently in? Some current trends involve the KonMari method in finding joy in our possessions and discarding or rehousing others. Are our loved ones living in different states or countries that we don’t get to connect with because of distance. Perhaps owning a smaller property or finding a space in a favorite location is the best use of the resources now.

As you place yourself in the category that best fits you – and there is no-one that stays stagnant in their mindset – each requires monitoring of your assets to fit the lifestyle that you desire. This takes time and work, but there are tools out there that are designed to simplify your life, and give your family the visibility into your world.

As you reach to contact the father-figures in your world, or are considering a Father’s Day gift to remember – InsureYouKnow.org product offerings may be your answer. It’s a safe place to store all the information in case you need to access it remotely – or from the comforts of your own home. Taking stock of your memories and your current resources with an annual plan.

Summer Speculations

June 1, 2019

Can you believe it’s already June. Where did the first 5 months of the year go? And have you already planned out your summer, or has that been on the to-do list for the umpteenth week? Whether you have every weekend from Memorial Day to Labor Day booked, or you are planning to enjoy the lazy, lengthy days of summer – your money is usually a factor.

Summer vacations can be crowded and expensive. Nearly 100 million Americans are planning to take a family vacation in 2019, per AAA data, and 38 million traveled during Memorial Weekend alone. The tourism industry is ramping up pricing on accommodation, transportation, food, gas and admission fees to attractions. In 2016, 58 percent of Americans spent over $1,300 on travel. This statistic is increasing 30% year over year

How to reduce Summer spending – and increase your Personal savings.

- Travel. Where do you want to go? Do you have a destination in mind? There are peak destinations that four out of 10 U.S. adults are hoping to travel to in the summer. However there are hundreds of articles with off-peak options. Try to book your flights 45 days in advance, and avoid the US National Holidays and early-August if possible. Schools in the US and Europe are off for summer break and families are taking advantage of the last few weeks off.

- Accommodations You probably already have experience with hotel chains or bed and breakfast establishments, but now there are many other options. The explosion of home rentals priding themselves as vacation experiences, are catering to all types of travelers. There are 1 night rentals to multiple week possibilities. Resorts are also affordable with lodging-only options instead of all-inclusive.

- Attractions and Activities. From amusement parks to museums to waterparks – every location has activities to enjoy. Coupons and online discounts are available for most of the top attractions and there may even be reduced rates for visiting on weekdays vs. weekends. Some banks and credit cards also have affiliations – Museums on Us is an example.

- Time. Can you mentally and physically afford to take the break out of your routine? Your workplace may have vacation policies around when you can use your time-off. Consider if you would like to save some time for DIY at the home or local excursions.

At the end of the day – take the vacation that works for your budget and time circumstances. If you only have a weekend – a staycation may be much more enjoyable than spending multiple hours on planes trains and automobiles to reach your destination for just a few hours. If you have a limited budget – create a list of the must-haves and ignore the advertising, social media and recommendations that you may encounter.

Bon Voyage! or Enjoy your couch! Before you enjoy your summer break, don’t forget to upload all your documents onto InsureYouKnow.org. It’s a safe place to store all the information in case you need to access it remotely – or from the comforts of your own home.

Is Pet Insurance Worth It?

May 23, 2019

Anyone with pets knows that taking care of them isn’t cheap. According to the American Pet Products Association, Americans spent more than $72 billion on their pets in 2018. From food to boarding, there are a lot of expenses associated with owning a pet.

Anyone with pets knows that taking care of them isn’t cheap. According to the American Pet Products Association, Americans spent more than $72 billion on their pets in 2018. From food to boarding, there are a lot of expenses associated with owning a pet.

One of the biggest expenses is veterinary care. A trip to the veterinarian isn’t cheap, nor should it be. Veterinarians have spent years in school learning how to care for and treat animals. They’re doctors for animals, and when Rover swallows something he shouldn’t or Tigger suddenly stops eating, their expertise is worth every penny.

But when money is tight, an unexpected trip to the vet can break your budget for the month. And that’s if you can afford to pay for care at all; some pet owners feel they have to put their beloved family member down because they can’t afford expensive medical treatments.

There is a potential solution: pet insurance. Just like your health insurance helps cover the cost of your medical care, pet insurance can defray some of the expenses associated with veterinary care. And just like you need to understand how your health insurance policy works in order to avoid an unexpected bill, you need to read the fine print on any pet insurance policy before signing on the dotted line.

If you’re trying to decide if pet insurance is the right decision for you, here are a few questions to ask yourself:

- Does your pet have any preexisting conditions? If so, stop right there. If your vet has diagnosed your pet with an ailment or disease already, pet insurance won’t cover any care for it. That may include illnesses or accidents related to the condition.

- How old is your pet? Generally speaking, the older the pet, the higher the premiums. You’ll get the best rates when your pet is still young. Keep in mind that the rate most likely will rise as your pet ages, and it’s not uncommon for people to drop pet insurance after their pet reaches a certain age.

- Is your pet prone to hereditary conditions? Many large dog breeds are known for hereditary conditions, such as hip dysplasia and torn ACLs. Insurers often won’t cover treatment for these conditions even if your pet wasn’t showing any symptoms when you initially bought coverage.

- Can you afford to save up instead? If you can afford it, it might be smarter to have a separate savings account for pet care. If you never need it, great—you can put that money toward paying down debt or a down payment on a house. Just keep in mind that should the worst occur, medical expenses can add up quickly.

Pet insurance is growing in popularity; according to the North American Pet Health Insurance Association, about 1.4 million pets in the U.S. and Canada were covered by a plan in 2014, up from 680,000 pets in 2008. If you’re considering purchasing pet insurance, be sure to explore all your options, including whether you can get it through your employer. Eleven percent of U.S. employers offer pet insurance benefits, according to the Society for Human Resource Management.

If you decide to purchase pet insurance, be sure to upload the policy and any related documents to InsureYouKnow.org. When you need to access them quickly, you’ll be glad they’re in a safe, secure, easy-to-find location.

Buying vs. Leasing a Car

May 7, 2019

When it’s time to get a new car, one of the first decisions you’ll have to make is whether to buy it or lease it. If you aren’t paying cash and have to take out a loan, you’ll have a monthly payment either way. So which option is better?

When it’s time to get a new car, one of the first decisions you’ll have to make is whether to buy it or lease it. If you aren’t paying cash and have to take out a loan, you’ll have a monthly payment either way. So which option is better?

While many financial experts recommend never leasing a car, there are a few times it does make sense. Here are some reasons you may want to lease a car:

- Lower monthly payments. Generally speaking, the monthly payment on a car lease is much lower than that of a car payment because it is based on a car’s depreciation instead of its purchase price. In addition, you may only have to put a little down, if anything at all.

- Fewer repair costs. Most likely, major repairs will be covered by your warranty. You’ll be responsible for general upkeep, but you won’t have to worry about a huge repair bill destroying your monthly budget.

- Less hassle when it’s time for a change. When you’re ready for a new car, you don’t have to worry about selling your old one. You can simply return the car when your lease expires and pick out a new one.

So why do people buy a car if it costs more and can be more of a hassle? Here are a few reasons:

- True ownership. Your car is yours. You can customize it as much as you like, and no one is going to expect you to keep it in pristine condition—or charge you if it isn’t.

- No mileage limits. When you lease a car, you must stay within your mileage limits or pay a pretty penny for exceeding them. When you buy a car, you can drive it as much and as far as you’d like.

- No monthly payment (eventually). If you have to take out a car loan, at some point you’ll pay it off and your monthly payment will drop to $0. When you lease, you will always have a monthly payment.

Looking at the big picture, leasing a car is actually more expensive in the long run. Not only will you always have a monthly payment, but also you won’t be building up any equity in your car that you can cash in later when you sell it.

But it’s not always about the money. If it’s important to you that you have a new car every few years with the latest technology and safety features, or if you use your car for business purposes and can write off related costs, leasing might be your best bet. Just make sure you run the numbers and take all factors into consideration.

Whether you decide to lease or buy, be sure to store the related documents on InsureYouKnow.org. This includes any loan documentation and/or a copy of your car’s title. It’s vital that you keep all your important financial documents in one place so you and your loved ones don’t have to dig through a mountain of paper whenever they need to be accessed.

Should You Choose a Bank or a Credit Union?

April 19, 2019

You work hard for your money. When it comes to storing it, you want to know it’s in a safe place. So which is better for your financial needs: a bank or a credit union?

You work hard for your money. When it comes to storing it, you want to know it’s in a safe place. So which is better for your financial needs: a bank or a credit union?

Ultimately, both banks and credit unions offer a number of benefits. Both offer checking accounts, savings accounts, and other financial products, like loans and credit cards. The main difference between them is that banks are for-profit entities while credit unions are nonprofit organizations. This means that banks answer to their shareholders while credit unions answer to their members.

What does that mean for you as a potential customer/member? Here are a few things to consider as you decide between a bank and a credit union:

- Membership requirements. Many credit unions have membership requirements. You may need to live in a certain area, be part of a certain profession, or work for a certain employer. Banks, on the other hand, are open to anyone.

- Interest rates. Credit unions generally offer higher interest rates. This is because they aim to please their members. Banks tend to offer lower interest rates in order to generate more profit.

- Fees. Similarly, credit unions often offer lower fees than banks. According to Bankrate’s 2018 Credit Union Checking Survey, 82% of the nation’s 50 largest credit unions offer free checking, compared to only 38% of banks.

- Convenience. The larger banks seem to have a location in every town; some seem to have a location on every corner. Many credit unions, on the other hand, only have a few locations in a specific region. As more people turn to online and mobile banking, this is less of a consideration than it used to be, but it may still be a factor.

- Customer service. At credit unions, customer service is a top priority. They are known for their personalized attention and fast service. While many banks also offer excellent customer service, especially smaller banks, some customers feel like they are treated as little more than an account number.

- Product availability. Large banks are able to offer a wider variety of financial products and services than credit unions. These include more credit card options (and better rewards programs) and investment services.

- Technology. Thanks to their larger budgets, banks tend to have better online and mobile services. Their services also often integrate more easily with personal finance and budgeting software such as Mint.com or Quicken.

Still can’t decide? Here’s some good news: Whether you choose to deposit your money in a bank or a credit union, your deposits will be insured up to $250,000. Just make sure your bank is a member of the Federal Deposit Insurance Corp. (FDIC) or your credit union belongs to the National Credit Union Administration (NCUA). This will protect you in the unlikely event that your bank or credit union fails.

After you open your new checking or savings account, you’ll want to upload the related documents to InsureYouKnow.org for safekeeping. Don’t forget to let your loved ones know they’re there!

Do Children Need Life Insurance?

April 5, 2019

Getting ready to welcome a baby into the world is an exciting time. You can’t help but think of all the adventures to come and dream of the future that awaits your new son or daughter. You start by planning for your child’s immediate needs, stocking up on diapers, decorating the nursery, and lining up day care if needed, before considering longer-term issues, like setting up a 529 plan to help fund your child’s education.

Getting ready to welcome a baby into the world is an exciting time. You can’t help but think of all the adventures to come and dream of the future that awaits your new son or daughter. You start by planning for your child’s immediate needs, stocking up on diapers, decorating the nursery, and lining up day care if needed, before considering longer-term issues, like setting up a 529 plan to help fund your child’s education.

The last thing you want to think about during this joyous time is purchasing life insurance for your unborn child. You’re eagerly awaiting your baby’s birth, not anticipating his or her death. Nonetheless, it’s worth looking into before you make up your mind.

Here are a few reasons you may want to get life insurance for your child:

- It can serve as a savings vehicle. When you buy a whole life insurance policy (you can’t buy term life insurance for minors), the cash value grows slowly over the years. Your child can surrender the policy later and use the money as he or she wishes.

- It guarantees your child’s insurability. If your child develops a medical condition, you won’t have to worry about whether he or she will have life insurance. In fact, your child will be able to buy additional insurance as an adult if needed regardless of his or her health (check with your individual insurance provider to see if you’ll need to include an additional rider for this benefit).

- It provides peace of mind. Planning a funeral is difficult, and planning one for your own child is especially hard. Life insurance would cover funeral expenses, which can cost thousands of dollars, and perhaps allow you to take some time off work as you grieve.

On the other hand, here are some reasons why life insurance may not be the best idea:

- There are better ways to save. According to Consumer Reports, the average annual rate of return is 1.5 percent for the whole life guaranteed cash value. That doesn’t take into consideration associated fees that eat into the returns. You can easily beat that rate by investing your money elsewhere.

- It probably isn’t needed. Statistically, it’s unlikely your child will die. In addition, the main purpose of life insurance is to replace income or cover debts, and those situations generally don’t apply to your child. You most likely aren’t relying on your child’s income to pay your monthly bills.

- Your child probably can get term life insurance later. Again, statistically speaking, your child should be able to purchase a term life insurance policy as an adult. Term life insurance is more affordable and practical for most people.

Ultimately, purchasing life insurance for your child is a personal decision. If you do decide to get a policy, be sure to store the related documents on InsureYouKnow.org. Should the worst occur, you will want to be able to access the documents quickly and easily so you can focus on healing.

Finding a Great Job in Retirement

March 29, 2019

You’ve made it! After a long, fulfilling career, you’ve closed the office door for the last time and retired. Now you’re ready to relax and enjoy your golden years.

You’ve made it! After a long, fulfilling career, you’ve closed the office door for the last time and retired. Now you’re ready to relax and enjoy your golden years.

But as they say, the best-laid plans of mice and men often go awry.

Many retirees quickly discover that despite years of faithfully contributing to their retirement plans, they haven’t put away quite as much as they’d hoped. In fact, they may not have enough money coming in each month to meet their financial obligations. Those dreams of traveling the world are replaced with nightmares of dusting off the resume and finding another 9-to-5 job.

If you’re finding yourself in this situation, it’s important to remember that you’re not alone. According to Northwestern Mutual’s 2018 Planning & Progress Study, one in five Americans (21%) have nothing saved for retirement at all, and one in three baby boomers (33%) have between $0 and $25,000 in retirement savings. Four in 10 Americans (40%) expect to work until 70 years old or older.

Nonetheless, the idea of finding another job can be daunting. Instead of looking at it as a disappointment, however, you can look at it as an opportunity. Here are a few ways you can make sure your new job is an amazing job:

- Find a job in a new field. Have you always dreamed of working in a bookstore? Do you think it’d be fun to take tickets at a movie theater? This may be the chance for you to do something that excites you.

- Limit your hours. If you only need to supplement your retirement income, try working part-time. You’ll keep your brain busy and your wallet full but still have the freedom to spend a few hours each day pursuing other interests.

- Turn your hobby into a business. From selling hand-knit baby booties in your own Etsy store to hawking the vegetables you’ve lovingly grown in your garden at the neighborhood farmer’s market, there are a number of ways you can make money off your hobbies. Just be sure to check local regulations first.

- Stay active. It’s important to stay physically active as you age, and your new job could keep you moving. Consider becoming a tour guide or yoga instructor to ensure you stay fit both financially and physically.

- Share your knowledge. Many retirees want to get more involved with their communities, and teaching is a great way to do that. You can inspire today’s youth by becoming a teacher in the local school district or an instructor at a community college.

-

Help raise tomorrow’s children. Maybe you have fond memories of watching your children take their first steps. Maybe you never had a child but always enjoyed hearing their joyful laughter. Becoming a child care worker might be the right step for you.

Having a shortfall in your retirement savings isn’t the end of the world. In fact, it can open up a whole new world to you. Be sure to keep track of your retirement accounts and store the related paperwork on InsureYouKnow.org. The peace of mind you’ll have from knowing your information is safe and sound will help you enjoy your retirement—or semi-retirement—more fully.