Digital Inheritance: Secure Your Online Legacy with InsureYouKnow

August 13, 2025

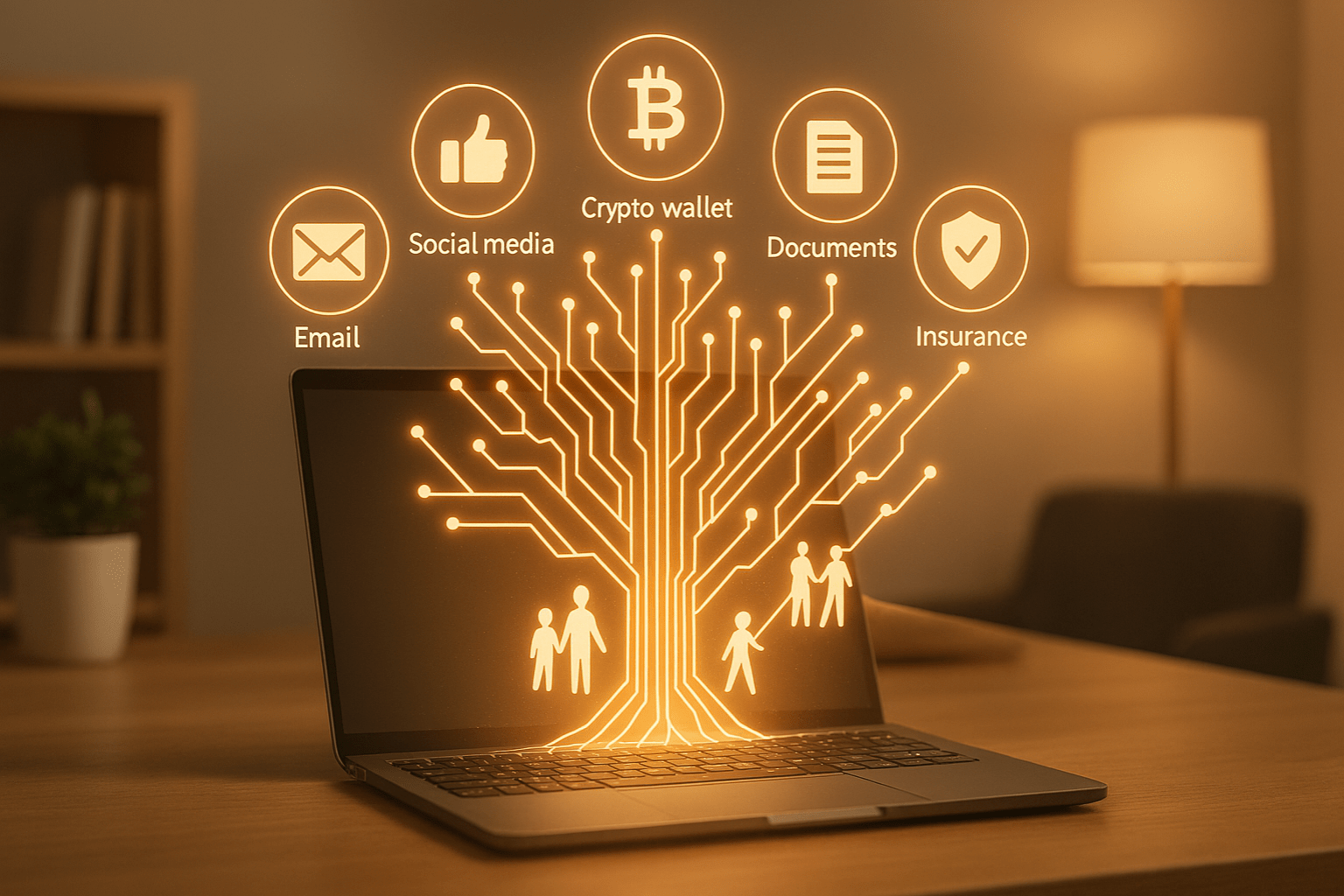

Think about how much of your life now lives online. Photos you never printed. Banking and insurance details you don’t keep in a filing cabinet. Emails, social media posts, maybe even a bit of cryptocurrency sitting in a digital wallet. It is all part of your story, and it does not just disappear when you do.

That is why digital inheritance matters. It is about making sure the people you trust can find and use what you leave behind, without having to play password detective or deal with frustrating account lockouts.

In the next few minutes, we will explore how to put a plan in place for your online life, and how a secure tool like InsureYouKnow.org can help you create a well-organized digital legacy your loved ones can actually access when it counts.

What Constitutes Digital Assets

When you think about what you own online, it is probably more than you realize. There are the obvious things like your insurance papers, bank records, medical files, and maybe a scan of your driver’s license sitting in a folder somewhere.

Then you have your accounts. Email, social media, streaming logins, and online banking all hold bits of your life, whether that is photos from years ago or details about your finances.

And do not forget the paid stuff. Cloud storage plans, memberships, crypto wallets, or payment apps like PayPal. Some of it has sentimental value, and some of it is worth real money.

Figuring out exactly what you have is step one in digital estate planning, and it makes life much easier for the people who will need to handle things later.

Risks of Digital Legacy Without Proper Planning

Not thinking about your digital stuff after you’re gone can really cause headaches. Sometimes you can’t get into accounts at all, and all those photos or important files? They might just disappear.

Hackers or scammers could also sneak in. They might use your info, drain money from digital wallets, or mess with accounts in ways that are hard to fix.

And honestly, it’s a lot for your family. They could spend hours digging for passwords, calling different companies, or trying to figure out what belongs where — all while they’re already dealing with grief.

Just taking a little time now to plan your digital estate can save a ton of trouble later and make sure the people you care about aren’t stuck sorting through a mess.

How InsureYouKnow.org Helps

Keeping track of all your digital stuff can be a pain, you know? InsureYouKnow.org makes it kind of simple. You just toss all your important docs, passwords, whatever, into one safe spot. You get to decide who sees what.

And if something happens, a family member can just log in and grab what they need. No digging through emails. No guessing passwords. Way less stress.

Honestly, it just makes your digital life easier and ready for your loved ones when it counts.

Best Practices in Preparing Your Digital Legacy

You know, getting your digital stuff in order now can save a lot of headaches later. Start by listing all your accounts and assets — emails, social media, bank stuff, subscriptions, crypto, everything.

Use password managers or secure lockers to keep logins safe. Also, jot down who should access what and how, and store it somewhere safe.

Finally, think about adding instructions in your will or estate plan. That way, your family can handle your digital life smoothly and without stress.

Step-by-Step Action Plan

Getting your digital stuff in order doesn’t have to be complicated. Here’s a simple way to do it.

- Make a list – Write down all your accounts, subscriptions, documents, crypto wallets… basically everything. Group them so it’s easy to see.

- Keep it safe – Store passwords and important docs in InsureYouKnow’s secure vault. That way, it’s all in one place and protected.

- Pick someone you trust – Decide who can access what. Set clear permissions so they know what’s theirs to handle.

- Check and update often – Things change, you know? Make a habit of reviewing your list regularly.

Doing this makes your digital life organized, safe, and way easier for your family when they need it.

Real-Life Scenario

Imagine this: Sarah had been using InsureYouKnow.org to organize her digital life. She had all her accounts, documents, and login info stored securely, and she’d assigned her brother as her digital heir with clear permissions.

When Sarah unexpectedly passed away, her brother didn’t have to hunt for passwords or guess what to do. He simply accessed the secure vault, grabbed the important files, and managed her online accounts without stress.

Thanks to pre-planning her digital estate, Sarah made things much easier for her loved ones. This shows how a little preparation can save a lot of headaches and ensure your digital legacy is handled smoothly.

Conclusion

Thinking about your digital stuff might feel a bit overwhelming, but honestly, getting it in order gives you peace of mind. Your loved ones won’t have to scramble or guess what to do.

Just start small. Make a list of your accounts and important files. Then use InsureYouKnow.org to keep everything safe and organized. A little planning now can make a huge difference later, and it keeps your digital life easy for your family.