Crypto Estate Planning: How to Protect Your Digital Assets

January 21, 2026

Introduction: The Hidden Tragedy of Lost Cryptocurrency

Billions in cryptocurrency are currently lost in digital limbo. It wasn’t hackers or scams. Owners simply passed away without sharing the password.

Crypto is unforgiving compared to a bank. There is no “Forgot Password” button or help desk to call. If the login details vanish, the money vanishes with them.

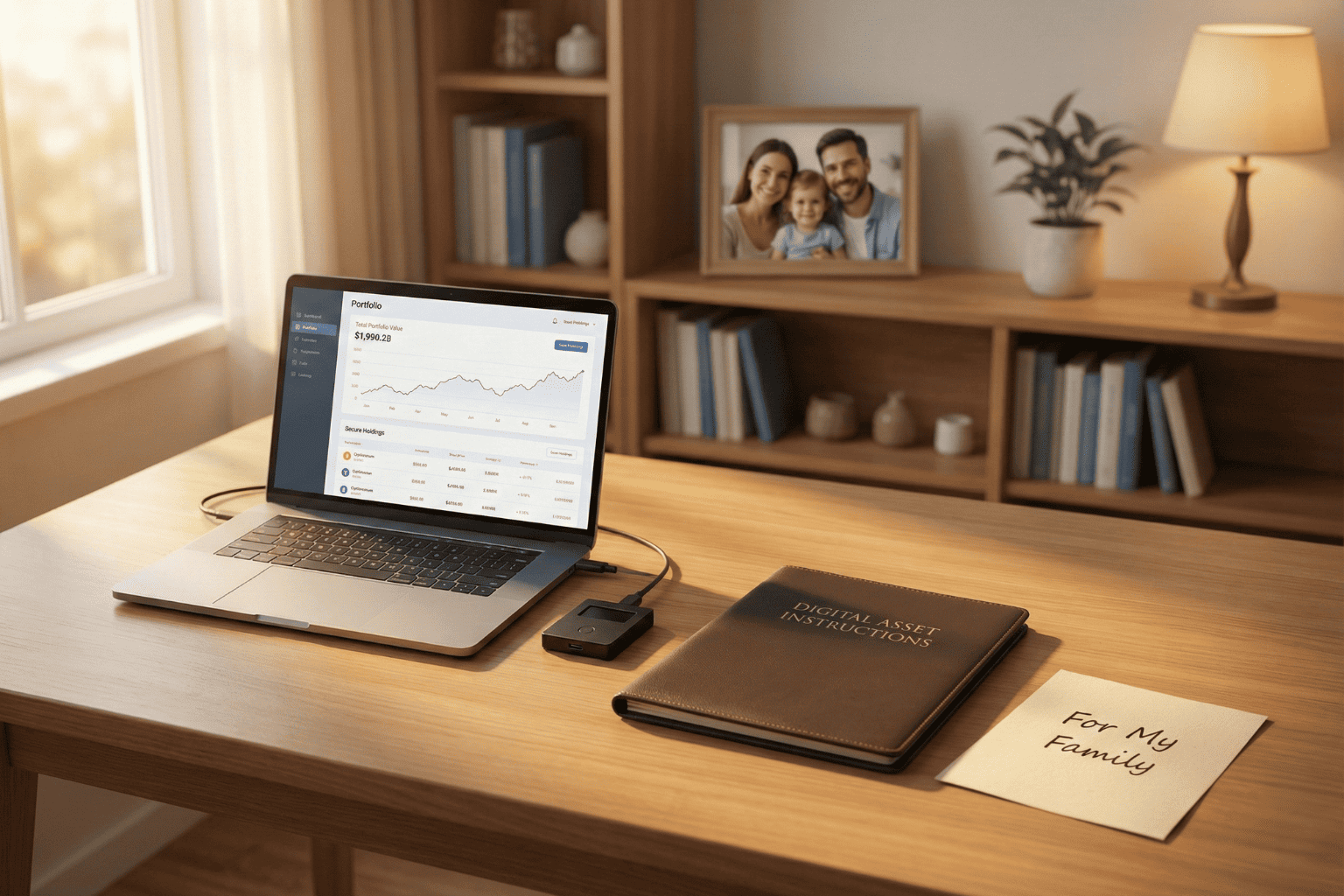

This puts families in a bind. Most executors aren’t tech-savvy, so handing them a hardware wallet without instructions is like leaving a locked safe without the key.

The fix is simple. You don’t need to be a tech expert. You just need a secure, central place to leave a clear “treasure map” that guides your family to the assets.

Why a Will Alone Isn’t Enough for Cryptocurrency

A lot of people assume that as long as their cryptocurrency is mentioned in their will, everything is taken care of. In practice, that rarely works out.

1. Privacy vs. Access

When someone dies, their will typically becomes a public document. If wallet details or crypto account information are written into it, that sensitive data can be seen by anyone who pulls the record. That’s an obvious security risk.

But putting detailed login instructions into a will isn’t safe either. Anyone who gets a copy of the will intentionally or not could try to use that information to get into the accounts.

2. The Custody Problem: Exchange vs. Private Wallet

How and where cryptocurrency is stored changes the situation completely:

On an exchange (like Coinbase or Binance):

The executor would usually need:

- The username and password

- Access to the linked email account

- Access to the phone used for two-factor authentication (2FA)

In a private wallet (like Ledger or Trezor):

The executor would usually need:

- The physical device

- The PIN code

- The 12- or 24-word seed phrase

If even one of these is missing, there’s a real chance the assets will never be recovered.

The “Treasure Map” Strategy (Safety First)

Before anything else, one rule must be clear:

Never upload a 12- or 24-word seed phrase to the internet. Not even to a secure portal.

Those words are the master key to the wallet. If someone gets them, they can steal everything.

So what should be stored instead?

Breadcrumbs, not the key.

The goal is to leave a clear, simple map that tells loved ones:

- What assets exist

- Where they are located

- How to access them safely

Examples of What to Store in a Secure Digital Vault

- A document stating:

“My Ledger wallet is taped under the bottom drawer of my desk.”

“The seed phrase is stored in a sealed envelope in the bank safety deposit box.”

- A list of exchanges used:

“Accounts exist on Coinbase and Kraken.”

This step is critical. Family members cannot claim assets if they don’t even know which website or platform to look at.

Device Access Instructions

Most crypto accounts use two-factor authentication. That code is usually sent to a phone or email.

A simple note explaining:

- How to unlock the phone or laptop

- Where the phone is kept

- Which email account receives security codes

can make the difference between recovery and total loss.

How InsureYouKnow.org Solves the Executor Gap

This is where InsureYouKnow.org becomes essential.

A Centralized Digital Vault

InsureYouKnow.org acts as the bridge between a complex digital life and non-technical family members. It allows users to securely store:

- Letters of instruction

- Lists of crypto exchanges

- Locations of hardware wallets

- Guidance for accessing phones, emails, and computers

All in one place.

Secure Document Uploads and Shared Access

Users can upload documents such as a “Crypto How-To Guide” or “Letter of Instruction” and grant access to a trusted partner or executor.

This ensures the right person has the right information at the right time.

Strong Encryption for Peace of Mind

InsureYouKnow.org uses Amazon cloud encryption, making it a safe place to store sensitive account lists and location maps for physical crypto keys.

While private seed phrases should always remain offline, everything else needed for recovery can be organized securely inside the platform.

A Step-by-Step Checklist for Every Crypto Owner

This simple checklist helps ensure cryptocurrency doesn’t vanish after death.

Step 1: Inventory All Crypto Assets

List every place where crypto is stored:

- Exchanges

- Hardware wallets

- Software wallets

Note whether each is online or offline.

Step 2: Write a “Letter of Instruction”

This letter should explain everything in plain language.

Write it as if explaining to a fifth grader.

Include:

- What cryptocurrency is

- Which platforms are used

- Where devices are located

- Where passwords and seed phrases are stored physically

- How two-factor authentication works

Step 3: Secure Seed Phrases Offline

Write seed phrases on paper or metal plates.

Store them in:

- A safe

- A bank safety deposit box

- A sealed envelope with a trusted attorney

Never store them digitally.

Step 4: Upload Instructions to InsureYouKnow.org

Upload:

- The Letter of Instruction

- Lists of exchanges

- Device locations

- Access instructions for email and phone

This becomes the digital “treasure map.”

Step 5: Share Access With a Trusted Partner

Grant access to a spouse, adult child, executor, or attorney.

They don’t need crypto knowledge.

They only need clear instructions and a secure place to find them.

Conclusion: Don’t Let Digital Wealth Disappear

Cryptocurrency represents the future of finance. But protecting it still requires old-school organization.

Without a plan, digital assets can vanish forever.

With a simple treasure map and a secure vault, families can inherit what was meant for them.

No one should leave behind money that loved ones can never reach.