Category: Uncategorized

Why Freelancers Need Vault for Business, Insurance and Personal Docs

December 3, 2025

Running a small business or working independently as a freelancer can be incredibly rewarding, but it also comes with a unique kind of pressure. There is no support team to handle accounts, filing, legal paperwork or insurance policies. Everything falls on one person. And when documents get scattered across laptops, email inboxes, envelopes, and drawers, that pressure doubles.

Many professionals don’t realise the value of having one organised vault for business, insurance, and even personal documents until something goes wrong like a tax review, a lost invoice, a sudden medical emergency or an unexpected client dispute. Situations like these can turn a normal week into chaos if the necessary files aren’t available when they’re needed.

The Hidden Risk Behind Scattered Paperwork

Almost every freelancer or business owner ends up collecting a long list of important documents over time:

- Contracts and NDAs

- Tax records and GST filings

- Business registration and licenses

- Insurance policies

- Personal documents like PAN / Aadhaar / passport copies

- Client invoices and payment proofs

When these are stored in different places some printed, some emailed, some saved on a mobile phone, some forgotten on a hard drive it becomes hard to track what exists and what is missing. Searching for one paper in the middle of work is stressful and wastes valuable time that could be spent earning money.

It is not just about convenience scattered documents increase the chances of financial loss, missed tax claims, denied insurance claims and even legal trouble.

Why a Single Vault Makes Life Easier

Keeping all important documents in one vault (preferably digital) can completely transform the way a business operates. A well-organised vault helps in:

Faster Access When Needed

Instead of digging through old emails or piles of files, documents are found in seconds. During tax season, project negotiations, audits or emergencies, this makes an unbelievable difference.

Confidence with Clients and Authorities

Being able to quickly retrieve contracts, invoices or payment receipts shows professionalism. It also protects the business during disputes or late payments.

No More Panic During Emergencies

If a device breaks, a document goes missing or an accident occurs, a vault ensures that everything is backed up and safely stored.

Clear Separation of Personal and Business Finances

Many freelancers mix personal and business papers by accident. Keeping them in labelled folders inside one vault keeps everything organised without confusion.

Which Documents Should Be Included?

A good vault should include every document that is hard to replace, legally important or financially relevant. For example:

Business-related documents

- Licenses and registrations

- Client contracts and project agreements

- Invoices sent and payment receipts

- Expense proofs bills, subscriptions, travel, utilities

- Bank statements and annual reports

Insurance-related documents

- Health insurance policies

- Life insurance details

- Business and asset insurance

- Renewal receipts and claim history

Personal documents

- Identity proofs such as Aadhaar, PAN, Passport

- Important legal documents

- Nominee details

Keeping everything in one vault does not mix the documents it simply allows them to be stored together but categorised, making access extremely efficient.

Digital Vault vs Physical Storage Which Is Better?

Some business owners still rely on physical files, and while that is familiar, it has limitations. Paper can be misplaced, damaged by water or fire and is hard to access when travelling or working remotely.

A digital vault has several advantages:

- Documents can be accessed anytime, even while travelling or from another device

- Multiple categories and labels reduce confusion

- Search options make it easy to locate files quickly

- Backup storage ensures documents are not lost

- Sensitive information can be password protected

For professionals who work across locations or serve international clients, digital access becomes even more valuable.

Real-World Scenarios Where a Vault Saves the Day

A secure, organised vault may feel like an optional system until the moment it becomes essential:

- A client wants to verify payment for an old invoice

- A large company payroll team requests old tax receipts for onboarding

- A medical emergency requires quick access to insurance details

- A visa form needs a scanned copy of passport and financial proof

- A GST or income tax review asks for expense records from previous years

Having everything stored neatly in one place turns stressful events into simple tasks.

A Small Habit That Leads to Big Stability

Building a vault doesn’t require complicated software or a huge investment. It only needs a habit: every time an important document arrives, store it in the vault immediately. Small, consistent organisation protects both personal and professional life in the long run.

For freelancers and small business owners, a vault is not just storage. It is preparation. It is peace of mind. It is a safety net during the uncertain moments that every business eventually faces.

Final Thought

Success in business isn’t only about skills or marketing. It is also about stability and preparedness. Keeping business, insurance and personal documents in one secure vault gives a professional the confidence to grow without fear of losing control over paperwork. With organised records, business becomes smoother, income becomes predictable and stressful situations become manageable.

ACA Marketplace: Understanding the Upcoming Insurance Hikes

October 28, 2025

Imagine logging in to renew your health-insurance plan this November and discovering your monthly premium has nearly doubled — all because Congress couldn’t agree to fund the tax credits that have quietly kept your coverage affordable. That’s the stark reality for millions of Americans enrolled in the health insurance marketplaces under the Affordable Care Act (ACA).

Under the ACA, individuals and families who do not get health insurance from an employer or through a public program can shop at a federal or state-based “Marketplace.” Insurers offer plans in metal tiers (Bronze, Silver, Gold)—with varying premiums, deductibles, and out-of-pocket costs. What keeps many of these plans affordable is the federal premium tax credit. If you qualify (mainly based on income as a share of the federal poverty level), you receive a subsidy that reduces the monthly premium you pay.

Because of this subsidy, many enrollees pay only a modest portion of what might otherwise cost thousands of dollars. The Kaiser Family Foundation (KFF) found that thanks to the enhanced tax credits, an individual making $28,000 “will pay no more than around 1 % ($325) of their annual income towards a benchmark plan.” The system ties a person’s share of premium costs to their income, and the subsidy covers the rest. This critical safeguard has kept coverage within reach for millions of lower-income Americans.

Why Subsidies Are in Danger of Expiring

The wrinkle: the enhanced subsidies many people now rely on are temporary unless Congress renews them. These enhancements were introduced by the American Rescue Plan Act in 2021 and extended under the Inflation Reduction Act of 2022. They expanded eligibility (including households earning more than 400% of the poverty level) and reduced out-of-pocket costs for individuals. But unless renewed by year’s end, they sunset at the end of 2025.

Even more urgent: insurers are already filing their proposed 2026 premiums, assuming no renewal of the enhanced tax credits. KFF reported that enrollee net premium payments could increase by 114 % on average—from about $888 in 2025 to about $1,904 in 2026—if the enhanced credits expire.

What People with Low Income Will Face

For low- and moderate-income Americans who depend on the marketplaces, the expiration of enhanced subsidies is more than theoretical—it’s a budget-breaker.

If subsidies are eliminated, many enrollees will see their monthly premium contributions skyrocket. KFF’s analysis shows that without the enhanced tax credits, average annual premium payments for subsidized enrollees would more than double. Some households will lose eligibility altogether. For people earning above 400 % of the poverty level, that subsidy cliff means they go from some assistance to none. KFF explains that “people with incomes over four times the poverty level will no longer be eligible for any financial assistance” if the enhanced credits expire.

The rate increases compound the effect: insurers are proposing median premium hikes of around 18 % for 2026. Those who are already barely making ends meet may find the new premiums impossible. One enrollee in Florida told Health News Florida that she’s already struggling to cover other rising costs. “The rent is going up. The water bill is going up,” said the Florida resident. “I cannot afford a premium hike.”

A missing subsidy cushion means not just higher premiums but a greater risk of losing coverage altogether. As Jason Levitis, Senior Fellow at the Urban Institute, explained, “If you have fewer subsidies, you’re going to have less health coverage and less health care.”

Why Enrollment Has Grown Recently

Enrollment in the marketplaces has surged in recent years, and the subsidy enhancements are a significant reason. Before the enhancement period, around 11 million people used the marketplace; now more than 24 million are enrolled.

Several factors have driven the growth. The enhanced tax credits increased eligibility and lowered what many paid, making coverage far more accessible. Improved outreach and usability—especially as state-based marketplaces matured—helped consumers find and keep plans more easily. At the same time, rising costs in employer-based coverage pushed more people to shop for plans individually. According to KFF, the enhancements cut annual premium payments by an estimated 44 % (about $705) for many subsidized enrollees. “The enhancements made it easier for millions of people to afford health coverage,” said Larry Levitt, Executive Vice President for Health Policy at KFF. “If they expire, we could see those gains wiped out almost overnight.”

In short, more help meant more people using the marketplace. The flip side is that less help could mean fewer people—and higher premiums for those who stay.

What’s at Stake

At the core of the current federal budget impasse (which led to the shutdown beginning October 1, 2025) is a fight over whether to extend the enhanced subsidies. Democrats insist that any funding deal must include the subsidy extension, arguing that letting them expire would cause a major affordability crisis. Republicans are pushing for reopening the government without tying the subsidy question directly to the budget deal, saying the issue should be negotiated separately.

From a consumer standpoint, the stakes are enormous. Without subsidy extensions, millions may lose assistance, face steep premium increases, or drop coverage altogether. KFF’s district-level data show that premiums would at least double in many parts of the country if the enhancements are not renewed. Rising premiums could also cause healthier enrollees to opt out, worsening the insurance risk pool and pushing rates even higher in subsequent years.

For families already squeezed by inflation and rising living costs, this would trigger an affordability crisis. “The cost of health insurance is never going to be low enough for a person who makes just above poverty to be able to afford it,” said Cynthia Cox, Director of KFF’s Program on the Affordable Care Act. “If you want that person to have health insurance, then there needs to be financial assistance.”

If Congress doesn’t act, many Americans will pay far more—or lose coverage altogether. As open enrollment begins, millions will face difficult choices about whether they can keep the coverage that has protected them for years, and whether Washington will act before the bills come due.

Insure You Know

Before you finalize your renewal or new plan selection, it may help to check out Insure You Know — a secure, central place where you can store and manage the critical information your family will need (insurance details, plan documents, contact numbers, and more). Taking a few minutes now to upload your coverage information ensures you’re ready for whatever changes lie ahead, and helps keep everything organized so you’re not scrambling when the numbers on your bill jump or the policy rules shift.

Having Surgery—Is Your Home Ready?

August 1, 2025

According to the National Library of Medicine, one in nine Americans has at least one surgery each year. The hospital discharge is just the beginning. Imagine returning home from surgery, groggy and sore, only to discover you can’t climb the stairs, reach the pain meds, or safely take a shower. That’s why preparing your home before the surgery is just as important as the procedure itself. Known as prehabilitation, this proactive approach helps reduce stress, lowers the risk of complications, and prepares you for a safer and smoother recovery.

Here’s everything you need to think about preparing before surgery.

Stay on Top of Recovery

Your doctor is the best resource for preparing for surgery. Ask them what to expect after surgery so that you know how to prepare best. Even when patients are discharged on the day of their surgery, it can take several months to return to normal activities. Following your surgeon’s care instructions can ensure a smooth recovery.

For older patients undergoing joint replacement procedures, physical therapy after surgery is crucial in regaining strength and mobility. “A knee or hip replacement is fundamentally a major surgery,” says Matthew Abdel, an orthopedic surgeon at the Mayo Clinic. “Everything related to that remains essential– preparing the patient, educating the patient, managing expectations, and having a multidisciplinary team in place – all must work together to allow that patient to go home that day safely.”

Things to consider:

- Learn the best way to contact your doctor if you need assistance after the surgery. If your doctor uses a patient portal to communicate with patients, make sure that you are registered and have access before your procedure.

- Know what your pain management plan will be. “Pain after surgery is something that a lot of patients fear,” says Sterling Elliott, a clinical pharmacist and a professor at Northwestern University. “Knowing how to make good decisions about your options, especially nonopioid ones, will help you feel better and make the best progress.”

- Research outpatient rehabilitation facilities that accept your insurance and would be willing to work seamlessly with your doctor.

- Stay on top of your follow-up appointments to ensure timely and effective communication.

Arranging for Help

You’ll likely need support with a variety of tasks after surgery, from getting a ride home from the hospital to potentially requiring round-the-clock care for several weeks. To ensure your safety, most surgeons recommend having someone stay with you the first night after surgery and arranging for a caregiver to be nearby or living with you for the first three to five days of recovery.

Think about the tasks around the home that you’ll be unable to do on your own. Determine who will be helping you after the surgery and make those arrangements in advance.

Things to consider:

- Arrange for someone to collect the mail, tend to the lawn, or dispose of the trash.

- Don’t forget to check the calendar. Reschedule any other appointments as needed and pay all your upcoming bills in advance.

- If you have pets, consider asking a friend or family member to care for them or board them before the procedure. This will allow you to focus on your recovery and avoid an accident with an active pet.

Preparing the Home

Take time to thoroughly clean and organize your home before surgery. Simple touches—like freshly washed sheets on the bed—can provide comfort and make your recovery more restful. Think about the parts of the home that you’ll need access to the most after surgery.

Things to consider:

- Set up your bed on the first floor if possible.

- Ensure you have convenient access to a safe and easy-to-use bathroom during your recovery.

- Fill the closet with clothes that are easy to put on and take off.

- Move everything you’ll need to where you can reach without having to bend down or stretch.

- Shortly before the surgery, buy the groceries you’ll need while recovering at home.

- Meal prep in advance or make full meals to keep you fed for a week or more.

- Place food in a cabinet between your waist and shoulder height and put the dishes you’ll use most on the kitchen counter.

- Use paper products if doing dishes would not be ideal while recovering.

- Keep your phone and charger handy.

To prevent falls, inspect every room for tripping hazards. This includes tucking away electrical cords, installing nightlights, getting clutter off the floor, and securing rugs. Rearrange furniture to create clear pathways for walking, especially if you’ll be using assistive equipment such as crutches or a wheelchair. For more extensive recovery periods, a home healthcare professional can visit your home to provide installation recommendations, such as grab bars in the bathroom or a stairlift in two-story homes.

While preparing the home for an upcoming surgery can be a lot of work upfront, the opportunity to recover in one’s home environment is beneficial. “It satisfies patients,” says Abdel. “You recuperate with your family. You recuperate in your home environment. You don’t feel like you’re institutionalized.”

Many people feel apprehensive before surgery, but poor mental health can negatively affect recovery. Anxiety and depression are shown to increase pain and stress, as well as slow wound healing. Getting outside, making time for enjoyable activities, and eating a healthy diet are all ways people can care for their mental health before undergoing surgery. With Insureyouknow.org, you may store all of your medical and financial records in one accessible place, giving you one less thing to worry about while you recover.

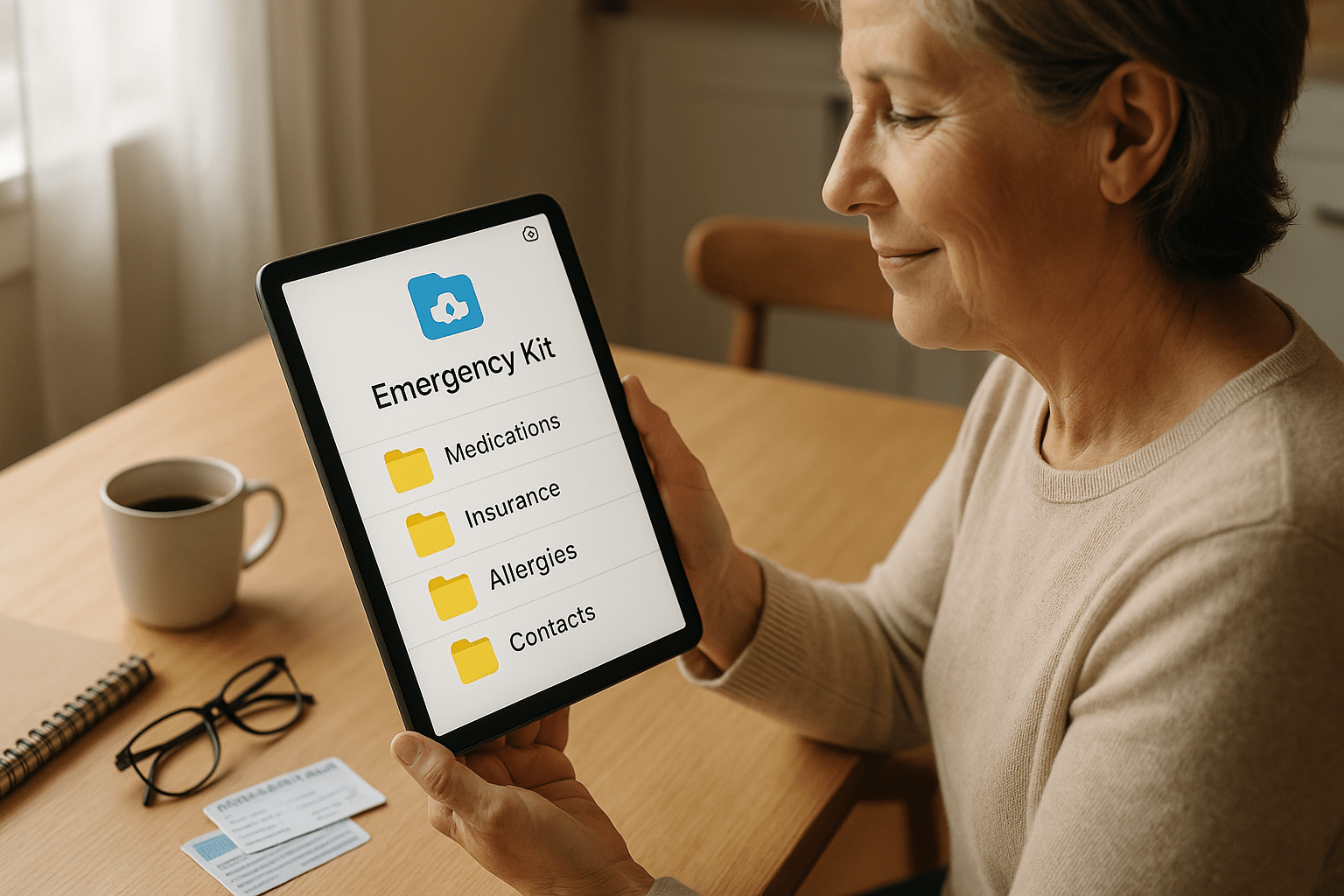

Digital Emergency Kit: How to Prepare for Unexpected Health Crises

July 25, 2025

A few years ago, someone in the family had to go to the ER. No one knew what meds they were on, or even who their doctor was. We were flipping through drawers, guessing, hoping we didn’t miss something important.

Since then, we’ve started keeping a digital folder with everything: meds, allergies, insurance cards, even just phone numbers for doctors. It’s not high-tech or anything. Just one place where all the important stuff lives — our emergency health documents included.

Paper copies kept getting lost or out of date. The digital one is easy to update, and we can open it from a phone if we ever need it. Honestly, it’s one of those things you hope you never use, but you’re glad it’s there.

Why You Need a Digital Emergency Kit

Something happens. A fall, a weird chest pain, a sudden trip to the ER. It’s always fast, and it never feels like the right time. People start asking questions: what meds are they on? Any allergies? Who should we call?

Usually, no one’s totally sure.

Some stuff is written down somewhere. Some is on a phone. Maybe a few things are in a drawer nobody has checked in years. That mess can slow everything down, and in emergencies, every minute counts.

That’s why it helps to have a digital folder with emergency medical information. Nothing complicated. Just one place with names, numbers, medical info, and anything that could help in a rush. When people know it’s there, it takes a bit of pressure off. It’s one less thing to figure out in the middle of everything else.

What to Include in a Digital Emergency Kit

Having a digital emergency kit means everything important is in one place. It doesn’t have to be fancy — just clear, updated, and easy to open when it matters. Here’s what to keep in it.

Medical History

A simple list of conditions, allergies, and vaccines. Just the basics, so doctors aren’t left guessing. Keeping medical records online and maintaining online health records ensures this information is accessible in seconds.

Medications

Write down what you take, how much, and who prescribed it. That’s often the first thing emergency staff ask.

Legal Forms

Upload anything like a living will or DNR form. If decisions need to be made fast, these are essential emergency health documents to have on hand

Insurance Details

Health, dental, life — if you’ve got it, include it. Add policy numbers and contacts too.

IDs and Cards

Take photos of your ID and both sides of your insurance cards. Hospitals usually ask for them right away.

Who to Call

List a few key contacts — family, your doctor, maybe a legal or financial rep. Make sure info is current.

Doctors and Clinics

Add names and numbers of your regular doctors. It helps if new providers need to follow up or check records.

How to Organize and Store Your Digital Emergency Kit

A digital emergency kit only helps if it’s easy to find and use. Here’s a simple way to set it up and keep it useful.

1. Create Clear Folders

Start with one main folder. Inside, add smaller folders like:

- Medical Records

- Medications

- Legal Papers

- Insurance

- IDs and Cards

- Emergency Contacts

- Doctor Info

This helps you or a loved one find things fast in a stressful moment.

2. Name Files Simply

Use clear names that explain what each file is. For example:

- Jane_Doe_Meds_List.pdf

- Dental_Insurance_Card.jpg

- Living_Will_2024.pdf

Skip confusing names like “scan3” or “doc_final.”

3. Keep It Current

Check your kit every few months. Remove old files and update anything that’s changed. Use a trusted cloud service so you can access it anywhere, and share access with one or two people you trust. Storing medical records online and online health records this way also reduces the risk of losing important paperwork.

Why InsureYouKnow.org Works for Your Emergency Kit

Choosing where to store your digital emergency kit matters — it needs to be safe, easy to use, and reliable. That’s where InsureYouKnow.org comes in.

Keeps Your Info Safe and Private

All files you upload are stored in a secure, encrypted system. Medical records, legal papers, or insurance details stay protected and private — just as they should be.

Always Within Reach

Since everything is stored in the cloud, you can log in from any phone, tablet, or computer. Whether you’re at the doctor’s office or traveling out of town, your files go with you. You’ll always have your emergency medical information and medical records online, ready when needed.

Share Access with People You Trust

If someone needs to help in an emergency, they won’t be left guessing. You can allow access for family members, doctors, or legal contacts — and change those settings anytime.

Helpful Tools Keep You on Track

Set reminders so you don’t forget to update documents or renew policies. The platform helps you stay organized without extra effort.

A Great Match for Emergency Planning

InsureYouKnow.org makes it simple to keep your digital emergency kit and emergency medical information in one place. No messy folders or lost papers — just everything you need, right where it belongs.

Best Practices for Maintaining Your Digital Emergency Kit

- Update Every 6–12 Months: Set a calendar reminder to review your kit twice a year. Make sure all medical, insurance, and contact info is still correct.

- Give Access to Someone You Trust: Share your kit with a reliable family member or caregiver. This ensures help is available even if you can’t access it yourself.

- Test Access Before It’s Urgent: Log in from another device or location to confirm everything works. Also, make sure anyone with shared access knows how to reach the kit.

Conclusion

A digital emergency kit makes it easier to handle unexpected health events by keeping your emergency medical information and vital records in one safe, accessible place. It helps avoid stress, saves time, and ensures the right information is available when it matters most.

Take the first step today. Start building your Digital Emergency Kit with InsureYouKnow.org — a secure, cloud-based tool made for peace of mind and keeping your medical records online—right where you need them.

The Great Resignation Continues in 2022

January 29, 2022

“The Great Resignation” is a term coined in May 2021 by Anthony Klotz, Ph.D., an associate professor of management at Mays Business School at Texas A&M University who predicted the mass exodus of employees abandoning jobs during the pandemic.

In April, a month before Dr. Klotz made this prediction, a record 4 million people quit their jobs, many of them in low-paying, inflexible industries such as retail trade sectors and food services. He explained that during the pandemic, employees have been able to reflect about family time, remote work, commuting, passion projects, life and death, and what it all means which led workers to consider alternatives to their current positions.

Because the latest data suggests this trend, also called the “Big Quit,” will continue through 2022, employees, as well as employers, must prepare for changes in the workforce.

Employees

Before you submit your resignation, consider the following suggestions to guide your decision:

- Reassess your duties: Expanding your responsibilities within the company may offer the growth that you’re looking for without leaving your workplace. Promotion within your company may lead to a higher salary and additional benefits. On the other hand, you may feel overworked or are experiencing burnout, resulting in work-related stress, and seeking a less demanding opportunity may be a solution during this difficult time.

- Meet with your employer: If you prefer to work remotely, meet with your employer and plead your case to work all or part of your workweek away from the corporate office, especially if you have health and safety concerns, childcare issues, or COVID-related care responsibilities. Explain how important work/life flexibility is to you and ask if your employer is willing to consider your needs for your home life situation. Take this opportunity to ask if your salary, benefits, and health insurance could be improved to entice you to stay.

- Be flexible with your transition: If possible, notify your supervisor in person when you decide to resign and be flexible about the ending date in your position. Be professional in your exit interview, request a letter of recommendation for your files, find out when you’ll receive your last paycheck, and ask about the continuation of your benefits.

- Assess your financial situation: If you determine that you need to continue receiving a steady paycheck and insurance benefits, secure another position or outline a solid self-employment opportunity before you resign. If you are close to retirement age, figure out if you can delay collecting Social Security and retirement benefits so you can collect higher monthly payments in the future.

Employers

Employers who want to reduce staff turnover and retain experienced employers may benefit from the following tips adapted from the article, “How Employers Can Overcome The Great Resignation” from the Worth Media website.

- Be creative in putting together benefits packages that can support a diverse workforce with broad, varying needs.

- Remain flexible when employees choose their work locations.

- Keep an open line of communication with your employees.

- Emphasize the importance of employees’ mental and physical well-being.

- Prioritize pay equity and adopt a spirit of transparency.

- Remind your employees about your company’s mission, values, and vision.

- Treat employees who do leave with respect, a sense of professionalism, and kindness.

Employers’ main goal during this tumultuous time should be to remain calm, listen to employee feedback, and use it to make any necessary changes to their business model, benefits package, and salaries.

InsureYouKnow.org

Are you planning to join “The Great Resignation” in 2022? If so, consider not only how you can improve your present work situation but also what the future may hold for your career choices, continuing education, home life, insurance coverage, and financial goals. As you put each of these options in place, keep records regarding your decisions at insureyouknow.org.

The Most Wonderful/Stressful Time of the Year

December 1, 2021

Welcome to what is referred to as both the “most wonderful” and the “most stressful time of the year.” During the second year of the COVID-19 pandemic, you may be experiencing stress and depression—unwanted emotions that can ruin your holidays and impact your physical and mental health.

Although you can’t control inflation, high gas prices, food and toy shortages, and shipping delays, you can be realistic, plan ahead, and seek support to overcome holiday stress and depression. You may even end up embracing the “most wonderful time of the year.”

Tips to Deal with Seasonal Pressures

Be realistic. COVID-19 cases are on the rise in some areas and even if you’ve been vaccinated, you may decide not to gather with friends and relatives in person. You can opt for a virtual celebration or increase efforts to share photos, texts, emails, phone calls, or videos with loved ones.

Avoid overspending, especially if you’re already feeling financial stress. Consider alternatives to expensive gifts by donating to charities in giftees’ names or by making and giving homemade presents.

Strive to decorate your home, create meals and desserts, and select gifts that will be appreciated not because they are “perfect” but because they are heartfelt and sincere.

Plan ahead. Compile lists of recipients and specific gift ideas; don’t go to browse in busy stores, hoping for inspiration. Save time and frustration caused by traffic and parking congestion by shopping online for items on your gift list. Schedule specific times to shop, bake, and attend social events. Plan menus and then create a detailed grocery list to prevent forgetting needed ingredients.

Acknowledge your feelings. Stress about gatherings with family and friends, or feeling grief about missing loved ones, may result in sadness and grief. Take time to acknowledge and express your feelings. You can’t force yourself to be happy just because it’s the holiday season. If you celebrate in person or in other ways as described above, set aside differences and controversial topics and concentrate on positive conversations.

Practice mindfulness by bringing your attention to the present moment and avoid getting stressed about past or future events.

Reach out. If you feel lonely or isolated, seek out community, religious or other social events, or communities. Many helpful organizations have websites, online support groups, social media sites, or virtual events that can offer support and companionship.

Volunteering your time and doing something to help others also are good ways to lift your spirits and broaden your friendships. Consider dropping off a meal and dessert at a friend’s home or to a community center that serves less fortunate individuals during the holidays.

Learn to say no. Set priorities based on preserving your well-being and don’t overextend yourself or you may wind up feeling resentful and overwhelmed. Learn to feel guilt-free when you decline invitations and recognize that you sometimes need to allow yourself to say no to demands on your time.

Maintain healthy habits. Get ample sleep, eat well—even at holiday events—and stay physically active in your daily routine. Maintaining healthy habits during the holiday season will be one of your best defenses against stress. When you feel a bout of stress coming on, have a healthy snack before a holiday party to curb your desire for high-calorie food and drink. Try deep-breathing exercises, meditation, or yoga. Avoid excessive tobacco, alcohol, and drug use.

Take a breather. Make time for yourself. Find an activity you enjoy like taking a walk, listening to calming music, or reading (or listening to) a book. Disconnect temporarily from social media and electronic devices.

Seek professional help if you need it. Even after following all the tips listed above, you may find yourself feeling continuously sad or anxious, beset by physical complaints and lack of sleep, and unable to face daily chores. If these feelings last for a while, talk to your doctor or a mental health professional. If you rely on medications to maintain your physical and mental health, make sure your prescriptions are up-to-date and that you have an adequate supply when your doctor’s office or pharmacy may be closed or have reduced hours during the holidays.

InsureYouKnow.org

At InsureYouKnow.org, you can keep a handy record of your prescriptions, refill expiration dates, and contact information for healthcare providers who prescribe and pharmacies that fill your medications.

In an Emergency, Be Ready to Go or to Stay

September 13, 2021

Emergencies often are unpredictable. But you can still plan for them. If you’ve experienced a catastrophic event—a hurricane, a flash flood, a fire in your home or on your property, or a winter storm that left you without electricity, food, and water—you may live in constant fear that you will relive a dangerous and stressful experience. Or, you can create a “go bag” and a “stay bag” that can help ease your mind in case of an emergency.

Emergency Go Bag

Prepare a portable kit that contains items that you’ll need to survive if you suddenly have to leave your home. Your emergency go bag should contain the following items:

- Personal identification

- Recent family photos for identification, including pictures of your pets

- Copies of important information, including contact numbers, passports, bank and credit card account numbers, medical records, and insurance information sealed in a waterproof container

- Bottled water and food, including high-energy snacks, in easy-to open containers, utensils, and bowls

- Prescription medications and a list of your prescriptions

- Small first-aid kit, including ice packs, bandages, hand sanitizer, gloves, ointment, pain relievers, stomach remedies, cough and cold medicines, and fluids with electrolytes

- Blanket/throw

- Sturdy shoes or boots and socks

- Warm clothes, rain gear, and hats

- Extra pair of glasses, contact lenses and supplies, dentures, and hearing aids/batteries

- Personal hygiene items, including face masks, soap, wipes, toilet paper, feminine hygiene products, toothbrush, toothpaste, paper towels, and household chlorine bleach

- Items such as canes, walkers, diapers, and formula for family members–children, seniors, and people with disabilities—with special needs

- Essential items for pet care: water, bowls, food, updated medical records, leashes, collar ID tags, crates, plastic bags, and carriers

- Flashlight and LED headlamp

- Candles

- Waterproof matches and lighter

- Battery operated/manual radio

- Extra batteries (sizes AA, AAA, C, and D)

- Pocketknife

- Whistle and pepper spray

- Extra house and car keys

- Solar and electric chargers for phones and other electronics

- Plastic garbage bags and toolkit

- Paper, pens, and tape for leaving messages

- Family communication plan that includes emergency phone numbers

- Regional road map if you need to travel

- Small amounts of cash–such as coins, one, and five dollar bills in case you can’t use your credit/debit cards

- Toys and games for kids

You also should consider to:

- Prepare an emergency go bag for each member of your household

- Store your emergency go bag in a place that is easy to get to, such as under a bed, in a closet, next to a door, in the garage, or in the trunk of your car

- Prepare emergency go bags for year-round use: spring, summer, fall, and winter

- Update your emergency go bag every six months

- Replace items that will expire in the upcoming months such as food and medical supplies

- Equip a vehicle bag with the following items:

- Jumper cables, flashlight, and extra batteries

- First aid kit

- Red bandana or help signal

- Packaged food, water, and a refillable water bottle for each person

- Sand or cat litter and a small shovel

- Gloves, hat, boots, jacket, blankets or sleeping bags, and rain gear

Although your emergency go bag will include a number of items, make sure your bag is sturdy and easy to carry.

Emergency Stay Bag

An emergency stay bag should contain a two-week supply of essentials in the event you have to hunker down at home without power, water, or heat. If you’ve prepared your emergency go bag, you can use many of its contents if you need to stay at home and wait for inclement weather or other adverse conditions to improve.

You’ll need greater quantities of supplies for your emergency stay bag and may want to add:

- Firewood if you’ll be relying on your fireplace for heat

- Extra blankets

- Duct tape

- Multipurpose tool

- Trash bags for sanitation

- Fire extinguisher

After you’ve collected extra items for your emergency stay bag, put them in one place—like a large plastic bin or two—so they don’t get used and will be at the ready if an emergency situation strikes.

InsureYouKnow.org

With the right gear in your emergency go and stay bags, you can be prepared to face unpredictable circumstances that force you to deal with whatever comes your way. In addition to keeping copies of important records safely in waterproof containers as recommended, you also should file important information, including contact numbers, passports, bank and credit card account numbers, medical records, insurance information, and a list of your prescriptions electronically at insureyouknow.org.

Safely Enjoy Summer Fun in the Sun

May 29, 2021

With students out of school and parents ready for a vacation, your summer planning may lead to seasonal activities and events outside during the warmest time of the year. While making a list of your fun in the sun options, keep in mind your family’s health and safety while avoiding the dangers of heat-related illnesses, water-related injuries, grilling hazards and food poisoning, allergy attacks, and the stress of traveling.

The Federal Occupational Health agency offers the following tips for balancing fun activities and sun safety.

Prepare for Heat and Sun

A big part of staying safe in the heat and sun is being prepared. Have an idea of how long you will be out in the sun and the heat, and then plan accordingly by:

- Limiting your outdoor activity, especially midday when the sun is hottest.

- Wearing and reapplying sunscreen as indicated on the package.

- Pacing your activity; starting activities slowly and picking up the pace gradually.

- Drinking more water than usual and not waiting until you’re thirsty to drink more.

- Wearing loose, lightweight, light-colored clothing that protects your skin.

- Wearing sunglasses and a hat.

- If possible, taking breaks from the heat and sun in a shady or air-conditioned location.

For more information, visit the Centers for Disease Control and Prevention’s (CDC) Keep Your Cool in Hot Weather! and Sun Safety pages.

Stay Hydrated

Dehydration is a safety concern, especially during the summer months. Be sure to drink enough liquids throughout the day, as your body can lose a lot of water through perspiration when it gets hot outside. Drinking plenty of water can be part of good nutrition, too. Snacking on water-rich foods like raw fruits and vegetables also can help keep you hydrated.

Without enough fluids, you may experience dehydration. Look for these signs:

- Extreme thirst

- Dry mouth

- Headache

- Muscle cramping

- Feeling lightheaded

- Foggy thinking

Learn more on the MedlinePlus Dehydration page.

Heed Water Safety Precautions

Swimming is an enjoyable way to both cool off and get some exercise, but it also takes extra precautions and vigilance. To lower the risk for water-related injuries or accidents:

- Always have adult supervision for children who are in or around water.

- Do not swim alone, and swim near lifeguards whenever possible.

- Learn to swim.

- If you have difficulty swimming, wear a life jacket when participating in water-related activities.

- Wear a life jacket when boating.

- Know local weather conditions and forecasts before swimming or boating.

For more information, visit CDC’s Water-Related Injuries page.

Additional summer safety reminders include the following tips from National Insurance Services:

Eliminate Grilling Risks

Grilling is a great way to make a delicious meal, especially during summer get-togethers and events. However, grilling carries a number of risks—from fire to food poisoning—that you must be aware of to keep your outing safe and enjoyable. Experts say that food poisoning peaks in summer months for two main reasons: bacteria grow fastest in warm, humid weather, and people generally do not pay as much attention to cleanliness when eating outside.

General Safety Precautions

- Do not allow children and pets to play near the grill until it is completely cool, and you’ve had a chance to put it away.

- Place your grill at least 3 feet away from other objects, including your house, vehicle, trees, and outdoor seating.

- Before using a gas grill, check the connection between the propane tank and the fuel line to make sure it is not leaking and is working properly.

- Only use starter fluid for barbecue grills that use charcoal. Do not use starter fluid for gas grills.

- If you suspect that your gas grill is leaking, turn off the gas and get the unit repaired before lighting it again.

- Never use a match to check for leaks.

- Do not bring your grill into an unventilated or enclosed space, such as a garage or inside your home. This is not only a major fire hazard, but it’s also a carbon monoxide hazard.

- Never grill on wooden decks, porches, or balconies.

Carcinogen Hazard Preventions

- Cook leaner meats that drip less grease. Opt for a turkey burger or a lean cut of beef, and cut visible fat from poultry. When fat drips into the coals or flames, smoke travels up to the meat and releases carcinogens.

- Marinate meat to reduce carcinogens by 87 percent. Herbs contain polyphenolic antioxidants, which prevent the formation of carcinogens on the meat’s surface.

- Scrub your grill with a wire brush after every use. This will prevent bits of leftover food from dropping into the grate and creating carcinogen-filled smoke.

- Use a nonstick cooking spray on the grill rack to prevent meat buildup.

Follow Food Safety Tips

- Wash your hands. You should do this before all types of food prep, and grilling is no exception. If you’re outdoors and there is no bathroom, use a water jug, some soap, and paper towels. Consider carrying moist towelettes for cleaning your hands.

- Separate raw and cooked food. Don’t use a plate or utensil that previously touched raw food to touch cooked food unless the utensil has been washed with hot, soapy water.

- Marinate your food in the refrigerator, not on the counter.

- Make sure food is cooked thoroughly to kill any harmful bacteria that may be present. Hamburgers should be cooked to 160 degrees Fahrenheit, or until they are brown all the way through. Chicken should be cooked to 165 degrees Fahrenheit.

- Refrigerate leftovers within two hours of being cooked—the sooner, the better.

Manage Allergies

Warm weather and high humidity can put a strain on seasonal allergy and asthma sufferers. It’s a peak time for certain types of pollen, smog, and mold. Below are some survival tips to help you manage your allergies during the summer months.

- Protect yourself during prime allergy time—stay indoors between 5 a.m. and 10 a.m., when outdoor pollen counts are usually the highest.

- Avoid extremes—going between intense outdoor heat and indoor air conditioning can trigger an asthma attack and other allergy symptoms.

- Wear a mask when mowing the lawn or if you know you are going to be around freshly cut grass. Also, take a shower, wash your hair, and change your clothes to remove any pollen that may have collected on your body. You should also dry clothing inside, rather than on an outside line.

- Patrol your yard for weeds such as nettle or ragweed and oak, birch, cedar, and cottonwood trees—they all can trigger allergies.

- If you’re allergic to bees, protect yourself. Wear shoes, long pants, and sleeves. It’s also a good idea not to wear scented deodorants, hair products or perfumes, as all of these can attract bees.

Travel Safely this Summer

The following tips can help you plan for a safe and fun road trip:

- Buckle up for safety; you’ll avoid a ticket, and more importantly, should you get into an accident, you’ll increase the odds of surviving the crash and reducing injuries for both you and your family.

- Get a good night’s sleep; drowsy drivers can be as dangerous behind the wheel as drunk drivers. And don’t think coffee or opening windows will be enough to keep you awake— there is no substitute for a good night’s sleep.

- Take a break from driving if you feel yourself getting drowsy. Get out of the car for some exercise or switch drivers if you have that option.

- Do not drink alcohol and drive—you put yourself and anyone around you in danger.

- Conduct a pre-road trip inspection on your vehicle—taking just 10 minutes to ensure your car’s tires are properly inflated, that the fluids are topped off, and that everything under the hood is all right—to identify and mitigate problems that could lead to future breakdowns.

Review CDC’s travel tips on the following topics that are continuously updated as needed:

- Domestic Travel During COVID-19

- When NOT to Travel: Avoid Spreading COVID-19

- Safer Travel Tips for Families with Unvaccinated Children

- Requirement for Face Masks on Public Transportation Conveyances and at Transportation Hubs

- Travel Health Notices

- Cruise Ship Travel

- International Travel During COVID-19

- Travel Recommendations by Destination

- After International Travel

- Travel Planner

- Travelers Returning from Cruise Ship and River Cruise Voyages

- Travel: Frequently Asked Questions and Answers

- Travelers Prohibited from Entry to the United States

- Communication Resources for Travelers

InsureYouKnow.org

When planning your summer vacations, keep track at insureyouknow.org of your health, automobile, boat, and travel insurance policies, as well as passports and COVID-19 vaccination records, for you and your family members. In case you face an emergency or need to prove your coverage, you’ll be able to refer to your secure documents online.

Planning to Retire? Find Answers to Social Security Questions

January 27, 2021

Social Security provides benefits to about one-fifth of the American population and serves as a vital protection for working men and women, children, people with disabilities, and the elderly. The Social Security Administration (SSA) will pay approximately one trillion dollars in Social Security benefits to roughly 70 million people in 2021. Almost eight million people will receive Supplemental Security Income (SSI), on average, each month during 2021. Beyond those who receive Social Security benefits, about 178 million people will pay Social Security taxes in 2021 and will benefit from the program in the future. That means nearly every American has an interest in Social Security, and SSA is committed to protecting their investment in these vital programs.

Social Security payments are adjusted each year to keep pace with inflation as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers. The 1.3 percent Social Security cost-of-living adjustment for 2021 is down from 1.6 percent in 2020. The average monthly Social Security benefit in January 2021 was $1,543. The maximum possible monthly Social Security benefit in 2021 for someone who retires at full retirement age is $3,148.

The most convenient way to get information and use online services from SSA is to visit www.ssa.gov or to call SSA at 800-772-1213 or at 800-325-0778 (TTY) if you’re deaf or hard of hearing. SSA staff answers phone calls from 8 a.m. to 7 p.m., weekdays. You can use SSA’s automated services via telephone, 24 hours a day.

What is the best age to start your benefits?

There is no one “best age” for everyone. Ultimately, it’s your choice. You should make an informed decision about when to apply for benefits based on your personal situation.

Your monthly benefit amount can differ greatly based on the age when you start receiving benefits.

- If you start receiving your benefits as early as age 62, before your full retirement age, your benefits will be reduced based on the number of months you receive benefits before you reach your full retirement age.

- At your full retirement age or later, you will receive a larger monthly benefit for a shorter period. If you wait until age 70 to start your benefits, your benefit amount will be higher because you will receive delayed retirement credits for each month you delay filing for benefits. There is no additional benefit increase after you reach age 70, even if you continue to delay starting benefits.

- The amount you receive when you first get benefits sets the base for the amount you will receive for the rest of your life.

What should you consider before you start drawing benefits?

- Are you still working? If you plan to continue working while receiving benefits, there are limits on how much you can earn each year between age 62 and full retirement age and still get all of your benefits. Once you reach full retirement age, your earnings do not affect your benefits.

- What is your life expectancy? If you come from a long-lived family, you may need the extra money more in later years, particularly if you may outlive pensions or annuities with limits on how long they are paid. If you are not in good health, you may decide to start your benefits earlier.

- Will you still have health insurance? If you stop working, not only will you lose your paycheck, but you also may lose employer-provided health insurance. Although there are exceptions, most people will not be covered by Medicare until they reach age 65. Your employer should be able to tell you if you will have health insurance benefits after you retire or if you are eligible for temporary continuation of health coverage. If you have a spouse who is employed, you may be able to switch to their health insurance.

- Should you apply for Medicare? If you decide to delay starting your benefits past age 65, be sure to go online and file for Medicare. You will need to apply for Original Medicare (Part A and Part B) three months before you turn age 65. If you don’t sign up for Medicare Part B when you’re first eligible at age 65, you may have to pay a late enrollment penalty for as long as you have Medicare coverage. Even if you have health insurance through a current or former employer or as part of your severance package, you should find out if you need to sign up for Medicare. Some health insurance plans change automatically at age 65.

How can you get a personalized retirement benefit estimate?

Choosing when to retire is an important and personal decision. The best way to start planning for your future is by creating a my Social Security account. With your personal my Social Security account, you can verify your earnings and use SSA’s Retirement Calculator to get an estimate of your retirement benefits.

What happens to Social Security payments when a recipient dies?

- If a person who was receiving Social Security benefits dies, a payment is not due for the month of his death.

- In most cases, funeral homes notify SSA that a person has died by using a form available to report the death.

- The person serving as executor of the decedent’s estate or the surviving spouse also can report the death to SSA.

- Upon the death of a Social Security recipient, survivors are generally given a lump sum payment of $255.

- Survivor benefits may be available, depending on several factors, including the following:

- If the widow or widower has reached full retirement age, they can get the deceased spouse’s full benefit. The survivor can apply for reduced benefits as early as age 60, in contrast to the standard earliest claiming age of 62.

- If the survivor qualifies for Social Security on their own record, they can switch to their own benefit anytime between ages 62 and 70 if their own payment would be more.

- An ex-spouse of the decedent also might be able to claim benefits, as long as they meet some specific qualifications.

- For minor children of a person who died, benefits also may be available, as well as to surviving spouse who is caring for the children.

How can you start receiving Social Security benefits?

- To start your application, go to SSA’s Apply for Benefits page and submit your application online.

- After SSA makes a decision about your application, you’ll receive a confirmation letter in the mail. If you included information about other family members when you applied, SSA will let you know if they may be able to receive benefits from your application.

- You can check the status of your application online using your personal my Social Security account. If you are unable to check your status online, you can call SSA at 800-772-1213 (TTY 800-325-0778) from 8 a.m. to 7 p.m., weekdays.

- You can do most of your business with SSA online. If you cannot use these online services, your local Social Security office can help you apply. Although SSA offices are closed to the public during the COVID-19 pandemic, employees from those offices are assisting people by telephone. You can find the phone numbers for your local office by using the Field Office Locator and looking under Social Security Office Information.

What if you want to withdraw your application?

After you have submitted your application, you have up to 12 months to withdraw it. You will be required to repay any benefits you’ve already received. Learn more about Withdrawing Your Social Security Retirement Application.

InsureYouKnow.Org

At insureyouknow.org, you can keep track of applications you submit to SSA and responses you receive for Social Security benefits. You also can file statements and notices you get from SSA throughout the years ahead during your retirement.

April Fools…

March 31, 2020

If 40 days ago – you turned on the TV or read the news which told you the world was in quarantine and curfew status, you may have called a friend to check or thought it was an April Fools prank. The rapid spread of COVID-19 has changed the globe, causing governments to enact shelter-in-place, quarantines and curfews. Knowledge of the virus began in December 2019 and became a pandemic in March 2020. The lives of many have changed from carefree to careful, from rushed to restful in an attempt to save the population from contracting the disease.

April Fools’ Day originated in a time of change. It is unclear of the actual origins, or how it has become a tradition from Europe to the Americas, but there are two main theories. The transforming of the seasons – Winter to Spring – may have precipitated the start of the April Fool’s tradition of pranks, or the introduction of the new calendar from Julian to Gregorian. The 1700 was a world without the technologies, however the pranks ranged from announcing a never-seen-before performance to the poisson-d’avril – April fish – which still continues today.

Though some of you may be homebound, or spending time indoors, here are ten easy Ideas for April Fools which can be implemented in your home. Hopefully, these can bring some smiles and stress-relief to start the month.

1 – Change the clocks

Many options with this one – An hour, three hours, make it earlier or later. This one is sure to make a person take a second look.

2 – Switch salt and sugar

Morning-coffee, or afternoon-tea with a spoonful of salt? A sweetened dinner? Stand away from the person consuming the food and have the camera ready.

3 – Rearrange the drawers – socks in the t-shirt drawer

Reach in your drawer and pull out the swimsuit, or winter scarf. Move the sock drawer down and the t-shirt drawer up.

4 – Hide bugs/snakes around the house

Not for the faint of heart – find some fake bugs in the children’s toys, or draw some in dark colors and create shadows. Record and replay the shrieks.

5 – Change outfits every 30mins and act like nothing is different

Take a chance to go through your closet and put together a new outfit every few minutes. A good way for you to try on your clothes, and the people in your home to take a pause.

6 – Put eyes on everything in the refrigerator

Find googly eyes and stick them on everything in the refrigerator for an eerie view of the contents. Opening of the door of the fridge has never been so anticipatory.

7 – Switch toothbrushes/soaps/mugs

For those of you with multiple bathrooms, switch the toothbrushes or soaps around.

8 – Wear a wig to bed

Adorn the Halloween wig and wait for the surprise in the morning.

9 – Change the ring tone and volume of a phone in your home.

Whether a cell phone or the house phone, your phone or your partners – a new sound in the home is cause for a few minutes of searching.

10 – Act like you are having a huge fight with someone – GOTCHA.

Pick a topic of contention, or of historical reference and have an intense one-sided conversation. This can work in person or over the phone and be sure to break the intensity with a distinct – GOTCHA.

At the end of the day – take a break from the routine and the demands of the day for some light-hearted humor. If you don’t have people in your home to play a practical joke on – utilize social media to tag a random picture with your friend’s name, or call someone and use a distorted voice.

Don’t forget to take pictures or videos and upload it onto InsureYouKnow.org. It’s a safe place to store all the information in case you need to access it remotely – or from the comforts of your own home.