Category: Personal Finance

Passkeys vs. Passwords: Why It’s Time to Switch Now

February 26, 2026

We all do it. Every morning. You grab your coffee, sit down, and try to log into your bank. Or maybe your insurance portal. You type in a password. Maybe it’s a strong one. Maybe it’s… well, let’s be real. It’s probably the same one you use for Netflix. But here is the hard truth: relying on a secret code just doesn’t cut it anymore. Not when your entire financial life is sitting behind it. Fast forward to 2026, and there is finally a better option that people are actually using: the passkey.

If you are the one stuck managing the heavy stuff for your family – wills, health records, the “in case of emergency” file – knowing the difference between a passkey and a password isn’t just tech trivia. It is a survival skill. It’s about keeping the wolves at the door away from the things that actually matter.

This guide breaks down exactly what passkeys are, how they smash the old-school password system, and why making the switch is probably the smartest move you can make right now.

What Is a Password – And Why Is It No Longer Enough?

Think about it. A password is just a string of letters you made up. It’s a secret handshake between you and a computer. And for a long time? That was fine.

But here is the snag: humans are involved. And humans? We are messy. The stats are pretty rough – something like 70% of hacks start because of a weak or stolen login. We reuse passwords because we’re lazy. We pick easy ones because we’re forgetful. Or we get tricked by a fake email and hand them over on a silver platter.

Common password headaches include:

- Brute-force attacks: Hackers have computers that can guess billions of passwords a second. If yours is simple, it’s gone before you can blink.

- The Dark Web: If one random site you use gets breached, your password ends up for sale. Suddenly, the bad guys have the keys to your whole life.

- Phishing: It is terrifyingly easy to get fooled by a fake email or website that looks real. You type it in, and poof – they have it.

- Fatigue: You have dozens of accounts. Remembering unique codes for all of them? Impossible. So we reuse them. And that is dangerous.

- SMS flaws: Even those text message codes aren’t bulletproof. Hackers can swap SIM cards and steal those codes right out of the air.

There is a saying in the security world that haunts me: Hackers don’t break in – they log in. If they have your password, they are you.

What Is a Passkey – And How Does It Work?

Passkeys are a total rewrite of the rules. Forget typing. A passkey uses public-key cryptography. Imagine a digital key that is split in two. One half sits on the website. The other half stays locked inside your phone or laptop.

When you want to log in, your phone and the website have a quick, silent chat. You prove it’s you by just unlocking your screen – Face ID, fingerprint, whatever. You don’t type a single letter. Nothing gets sent over the internet for a hacker to steal.

Think of it like a puzzle. The website has a piece. Your phone has a piece. They only fit together when you – the real you – are holding the device.

Key facts about passkeys:

- They run on the FIDO2 standard. Basically, the big tech companies all agreed on a better way to do things.

- Everyone is jumping on board: Google, Apple, Amazon, Chase Bank. They all support it.

- Millions of people are already using them without even realizing it.

- You can’t phish them. You can’t guess them.

- If you have a smartphone from the last few years, you are already ready to go.

Passkeys vs. Passwords: A Side-by-Side Comparison

Why is everyone making such a big deal about this? You have to look at the differences side-by-side to really get it.

1. Security

- Passwords: Weak. They can be stolen, guessed, or fished out of you with a fake email.

- Passkeys: Rock solid. The private key never leaves your phone. Even if a hacker breaks into the bank’s server, they can’t steal your key because it isn’t there.

2. Ease of Use

- Passwords: A pain. You forget them. You reset them. You type them wrong.

- Passkeys: Easy. You look at your phone, or touch the sensor. Done. It works 98% of the time and it’s way faster.

3. Phishing Resistance

- Passwords: Terrible. If a fake site looks real, you’ll probably type your password in.

- Passkeys: Perfect. A passkey is tied to the real website. If you land on a fake site, your phone knows. It simply won’t let you log in.

4. Device Dependency and Flexibility

- Passwords: You can use them anywhere, but that’s also why they are risky.

- Passkeys: They live on your device. But don’t worry – Apple and Google sync them to the cloud. So your passkeys are on your phone, your tablet, and your laptop automatically.

5. Risk in a Data Breach

- Passwords: If a company gets hacked, your password is leaked.

- Passkeys: If a company gets hacked, the hackers get… nothing useful. They just get a public key that can’t unlock anything without your phone.

Why This Matters for Protecting Vital Life Records

We usually don’t think about this stuff until it’s too late. You get hacked, or a family member passes away and nobody can get into their accounts. That is a nightmare scenario.

The accounts that hold your life’s work – insurance, savings, wills – need better protection than “123456.” If these get breached, it’s not just annoying. It’s identity theft. It’s losing money.

The banks know this. That’s why Chase and Wells Fargo are pushing passkeys. They want you safe.

If you are using a digital vault to keep your family’s info organized, turning on passkeys is the single best thing you can do today.

How to Set Up a Passkey (It Is Simpler Than It Sounds)

You don’t need to be a tech wizard. It takes two minutes.

Step 1: Go to your account settings (Google, Amazon, whatever).

Step 2: Look for “Passkeys” or “Security.”

Step 3: Click “Create Passkey.” Your phone will ask for your face or fingerprint. Do it.

Step 4: You’re done. Next time, just click “Use Passkey.”

Step 5: If you want to be extra safe, use a password manager like 1Password to keep them all organized.

Expert Tip: Start with the big ones. Email. Bank. Insurance. Get those locked down first.

Should Passwords Be Abandoned Entirely?

Not yet. We’re in a transition phase. Lots of old websites still need passwords. So here is the game plan:

- Switch to passkeys for anything important.

- Use a password manager to generate crazy long passwords for the junk sites that don’t support passkeys yet.

- Stop using SMS codes if you can help it. Use an app instead.

- Get a hardware key (like a YubiKey) if you are really paranoid about your email security.

- Check back often. More sites are adding this every month.

Microsoft went passkey-first last year and it’s been huge. By the end of 2026, typing passwords will feel like using a flip phone.

What Happens If a Device Is Lost?

Everyone asks this. “If I lose my phone, am I locked out forever?”

No. You’re fine.

- Cloud Sync: If you use an iPhone, your keys are in iCloud. Get a new phone, sign in, and they are back. Same for Android.

- Backup: You can still use other ways to get into your account if you absolutely have to.

- Thieves can’t use them: Even if someone steals your phone, they don’t have your face or fingerprint. They can’t use your passkeys.

Passkeys and the Future of Secure Document Storage

For families storing wills and financial docs online, security is everything. A digital vault is pointless if the key is under the mat.

Passkeys fix the human error part. You can’t accidentally give away your passkey. It solves the biggest problem in security: us.

Experts at Gartner and big tech firms are calling this the biggest shift in security in decades. The password era is ending. Finally.

Key Takeaways

- Passwords are weak. They are too easy to steal or guess.

- Passkeys are strong. They use heavy-duty encryption and your own biometrics.

- It’s happening now. Major banks and tech giants are already using them.

- Mix it up. Use passkeys where you can, strong passwords where you must.

- Don’t worry about lost phones. Cloud sync has your back.

- Protect your legacy. If you store vital records, this is a must-have upgrade.

Conclusion: The Lock Is Getting an Upgrade

Switching to passkeys isn’t just about cool new tech. It’s about peace of mind. Passwords put all the pressure on you to be perfect. Passkeys let your device handle the security so you don’t have to.

If you are serious about keeping your family’s future safe, stop waiting. Passkeys are here. They work. And they are way better than what you’re using now.

The best time to switch was yesterday. The second best time is today.

Protect What Matters Most

InsureYouKnow.org provides a secure, encrypted electronic safe deposit box for life’s most important information – insurance policies, financial records, healthcare documents, and more. Storing vital records in one organized, protected location means families are never left searching when they need information most. Start protecting what matters today at InsureYouKnow.org.

Preparing for Tax Season

February 15, 2026

Taxes aren’t usually a task people look forward to. If anything, many procrastinate or put the chore off completely. In fact, about 5% of taxpayers fail to file their taxes each year, the top two reasons being that it’s overwhelming or they simply object to paying income taxes. But skipping your taxes is a bad idea.

“It does catch up to you, and the penalties and interest are huge,” says David Ragland, a certified financial planner and CEO of IRC Wealth. “If you don’t file your return, you’re going to have to pay interest on any unpaid taxes.”

The penalty for failing to file is 5% of unpaid taxes for each month a filing is late, capped at 25%. So a taxpayer who owes $10,000 would owe $500 each month, with a maximum owed of $2,500.

Filing your taxes can be intimidating and tedious, but by forming a plan and gathering the documents you need in advance, it can go quite smoothly. Here’s everything you can do to make filing your taxes easier this year.

Gather Paperwork First

Get together all of the information you’ll need for your taxes ahead of filing to save time and reduce stress.

The IRS recommends gathering personal information, including:

- Your Social Security number, as well as those of anyone else on your tax return, such as spouses and dependents

- Your bank account and routing numbers, if you wish to receive your refund by direct deposit

- Your adjusted gross income or AGI and the exact refund amount from last year‘s tax return, if you filed

Anyone who paid you during the year is required to report the payments to the IRS. They must file their information and return forms with the IRS and send a copy to you. You should receive these electronically or by mail in January or February.

These forms include:

- Forms W-2, which show your wages from employers

- Form W-2G for lottery and gambling winnings

- Any Form 1099, including from government payments, freelance and contract work, and retirement plan distributions

- Form SSA-1099 for Social Security benefits

- Form 1095-A, Health Insurance Marketplace Statement

If you are self-employed, have multiple jobs, or have a small business, then you’ll need:

- Bank statements and other payment collection records

- Receipts for potential deductions, such as from travel, car expenses, and business supplies

- Proof of training and further schooling

Anything that you spent on investing in your business is a potential deduction and should be collected as a reference for filing.

Deductions to Know

There’s always the chance that the IRS will file your taxes on your behalf if you fail to file on time yourself. “Just because you don’t file the return doesn’t mean you can escape the IRS long term,” says Ragland. If this happens, you’ll likely miss out on deductions that you yourself would have likely claimed.

Other documents for potential deductions include:

- Childcare and dependent expenses

- Mortgage and property tax records

- Any donations made to charity

- Healthcare expenses, including Health Savings Accounts or HSAs

- Retirement contributions

- Specific education and career expenses, such as those with students and teachers

- Student loan interest statements

The One Big Beautiful Bill Act (OBBB) was signed into law in July 2025 and makes significant changes to the tax code. It makes the 2017 tax cuts (like the seven income tax brackets from 10%–37%) effectively permanent while adjusting many bracket thresholds for inflation and substantially increasing the standard deduction (e.g., $15,750 for singles, $31,500 for joint filers). It also adds new deductions (like for tips, overtime, seniors, and certain auto loan interest), raises the SALT deduction cap, and modifies credits such as the Child Tax Credit. Study the more than 60 tax provisions that IRS has adjusted to keep deductions, tax brackets, and other items aligned with the cost of living. For those filing taxes in 2026 (for the 2025 tax year), these adjustments have increased by about 2.8%.

The Right Filing Status

Your filing status is used to determine your correct tax rate, standard deduction, and certain credits. Whether or not you are married, are the head of household, or have dependents are all factors in determining your filing status. The IRS offers a tool to help you choose the filing status that will result in the lowest amount of tax.

It pays to do a little research and know which status is best for your given situation. For instance, filing jointly as a married couple rather than separately comes with certain benefits, such as the most significant standard deduction, tax credits, and a higher income threshold. But if your spouse owes tax penalties, then that’s a situation where filing separately makes more sense.

How to File

When you can claim tax credits or otherwise have money owed to you, filing taxes can be a great thing. The IRS now offers Free File, a way to do your taxes online for free. People with potentially complex tax situations, such as multiple business ventures or multiple streams of income, may opt to work with a Certified Public Accountant (CPA). There are also many companies, like TurboTax that offer both free and fee-based services.

With Insureyouknow.org, you can get in the habit of storing this information throughout the year. That way, when it comes time to file, everything you need will be in one place.

Public WiFi vs. Your Data: Why You Need a Secure Vault

January 28, 2026

The Open Window

A traveler sits at a crowded airport gate. The flight is delayed. Boredom sets in. The phone comes out, and there it is: “Free Airport WiFi.”

Click. Connected.

It feels like a small victory. A chance to check a bank balance, pay a credit card bill, or look up a policy number.

But that click? It is the digital equivalent of leaving a house key under the doormat and hoping no one looks.

In 2026, we treat our phones like fortresses. We lock them with faces and fingerprints. Yet, the moment we connect to an open network, we lower the drawbridge. We invite the world in. And the world is watching.

The Invisible Eavesdropper

Here is the ugly truth about public internet: it is loud.

When data leaves a phone on a secure home network, it whispers. On public WiFi, it screams.

The danger isn’t usually some master criminal in a hoodie. It is often just software. Simple, cheap scripts running on a laptop three seats away. These programs are like digital vacuums. They suck up everything floating through the air.

- The Man-in-the-Middle: A hacker cuts in line. The user sends a password to the bank. The hacker catches it, copies it, and then passes it to the bank. The login works. The user has no idea they just handed over their keys.

- The Fake Twin: You see a network called “Coffee_Shop_Free.” It looks real. It isn’t. A scammer set it up five minutes ago. Connect to it, and the device effectively belongs to them until you disconnect.

The “Inbox” Mistake

Fear makes people do silly things. When travelers get nervous about logging in, they turn to an old, bad habit: The Email Search.

“I won’t log in,” they think. “I’ll just find that PDF I emailed myself.”

This is a disaster.

An email inbox is not a safe. It is a glass box. Email accounts are the most hacked targets on the planet. If a thief gets into an email account, they don’t just read letters. They find the tax returns from 2024. They find the scan of the child’s birth certificate. They find the list of “backup codes.”

Using an inbox to store life’s vital documents is like hiding jewelry in a clear plastic bag. It doesn’t work.

The Real Fix: A Digital Vault

So, what is the answer? Carry a filing cabinet? Never go online?

No. The answer is a Secure Digital Vault.

This is where platforms like InsureYouKnow.org step in. They aren’t storage bins. They are armored trucks.

1. It Shreds the Data A real vault uses encryption that mimics the banking world, like Amazon Cloud security. If a hacker snatches a file from the air, they don’t get a readable document. They get noise. A jumbled mess of code that means nothing. The thief gets the envelope, but they can never read the letter.

2. Nobody Knows the Code Privacy matters. The best systems run on “zero-knowledge” rules. That means the company holding the data doesn’t have the password. Even if they wanted to look, they couldn’t. The user holds the only key.

3. Get In, Get Out With a vault, the data lives in the cloud, not on the device. A user can log in on a hotel computer, check a passport number, and vanish. No files left in the “Downloads” folder. No trail for the next guest to find.

Peace of Mind

Security usually feels like a headache. Extra steps. More passwords.

But actually? It is freedom.

It is the ability to lose a wallet in Paris and not fall apart. Why? Because the backup copies of every card and ID are sitting behind an iron door in the cloud. Accessible. Safe. Ready.

Public WiFi is fine for reading gossip columns or checking the weather. But for the heavy stuff like the money, the legacy, and the identity, stay off the open road. Put the valuables in a vault. Lock it up. Then go enjoy the coffee.

Crypto Estate Planning: How to Protect Your Digital Assets

January 21, 2026

Introduction: The Hidden Tragedy of Lost Cryptocurrency

Billions in cryptocurrency are currently lost in digital limbo. It wasn’t hackers or scams. Owners simply passed away without sharing the password.

Crypto is unforgiving compared to a bank. There is no “Forgot Password” button or help desk to call. If the login details vanish, the money vanishes with them.

This puts families in a bind. Most executors aren’t tech-savvy, so handing them a hardware wallet without instructions is like leaving a locked safe without the key.

The fix is simple. You don’t need to be a tech expert. You just need a secure, central place to leave a clear “treasure map” that guides your family to the assets.

Why a Will Alone Isn’t Enough for Cryptocurrency

A lot of people assume that as long as their cryptocurrency is mentioned in their will, everything is taken care of. In practice, that rarely works out.

1. Privacy vs. Access

When someone dies, their will typically becomes a public document. If wallet details or crypto account information are written into it, that sensitive data can be seen by anyone who pulls the record. That’s an obvious security risk.

But putting detailed login instructions into a will isn’t safe either. Anyone who gets a copy of the will intentionally or not could try to use that information to get into the accounts.

2. The Custody Problem: Exchange vs. Private Wallet

How and where cryptocurrency is stored changes the situation completely:

On an exchange (like Coinbase or Binance):

The executor would usually need:

- The username and password

- Access to the linked email account

- Access to the phone used for two-factor authentication (2FA)

In a private wallet (like Ledger or Trezor):

The executor would usually need:

- The physical device

- The PIN code

- The 12- or 24-word seed phrase

If even one of these is missing, there’s a real chance the assets will never be recovered.

The “Treasure Map” Strategy (Safety First)

Before anything else, one rule must be clear:

Never upload a 12- or 24-word seed phrase to the internet. Not even to a secure portal.

Those words are the master key to the wallet. If someone gets them, they can steal everything.

So what should be stored instead?

Breadcrumbs, not the key.

The goal is to leave a clear, simple map that tells loved ones:

- What assets exist

- Where they are located

- How to access them safely

Examples of What to Store in a Secure Digital Vault

- A document stating:

“My Ledger wallet is taped under the bottom drawer of my desk.”

“The seed phrase is stored in a sealed envelope in the bank safety deposit box.”

- A list of exchanges used:

“Accounts exist on Coinbase and Kraken.”

This step is critical. Family members cannot claim assets if they don’t even know which website or platform to look at.

Device Access Instructions

Most crypto accounts use two-factor authentication. That code is usually sent to a phone or email.

A simple note explaining:

- How to unlock the phone or laptop

- Where the phone is kept

- Which email account receives security codes

can make the difference between recovery and total loss.

How InsureYouKnow.org Solves the Executor Gap

This is where InsureYouKnow.org becomes essential.

A Centralized Digital Vault

InsureYouKnow.org acts as the bridge between a complex digital life and non-technical family members. It allows users to securely store:

- Letters of instruction

- Lists of crypto exchanges

- Locations of hardware wallets

- Guidance for accessing phones, emails, and computers

All in one place.

Secure Document Uploads and Shared Access

Users can upload documents such as a “Crypto How-To Guide” or “Letter of Instruction” and grant access to a trusted partner or executor.

This ensures the right person has the right information at the right time.

Strong Encryption for Peace of Mind

InsureYouKnow.org uses Amazon cloud encryption, making it a safe place to store sensitive account lists and location maps for physical crypto keys.

While private seed phrases should always remain offline, everything else needed for recovery can be organized securely inside the platform.

A Step-by-Step Checklist for Every Crypto Owner

This simple checklist helps ensure cryptocurrency doesn’t vanish after death.

Step 1: Inventory All Crypto Assets

List every place where crypto is stored:

- Exchanges

- Hardware wallets

- Software wallets

Note whether each is online or offline.

Step 2: Write a “Letter of Instruction”

This letter should explain everything in plain language.

Write it as if explaining to a fifth grader.

Include:

- What cryptocurrency is

- Which platforms are used

- Where devices are located

- Where passwords and seed phrases are stored physically

- How two-factor authentication works

Step 3: Secure Seed Phrases Offline

Write seed phrases on paper or metal plates.

Store them in:

- A safe

- A bank safety deposit box

- A sealed envelope with a trusted attorney

Never store them digitally.

Step 4: Upload Instructions to InsureYouKnow.org

Upload:

- The Letter of Instruction

- Lists of exchanges

- Device locations

- Access instructions for email and phone

This becomes the digital “treasure map.”

Step 5: Share Access With a Trusted Partner

Grant access to a spouse, adult child, executor, or attorney.

They don’t need crypto knowledge.

They only need clear instructions and a secure place to find them.

Conclusion: Don’t Let Digital Wealth Disappear

Cryptocurrency represents the future of finance. But protecting it still requires old-school organization.

Without a plan, digital assets can vanish forever.

With a simple treasure map and a secure vault, families can inherit what was meant for them.

No one should leave behind money that loved ones can never reach.

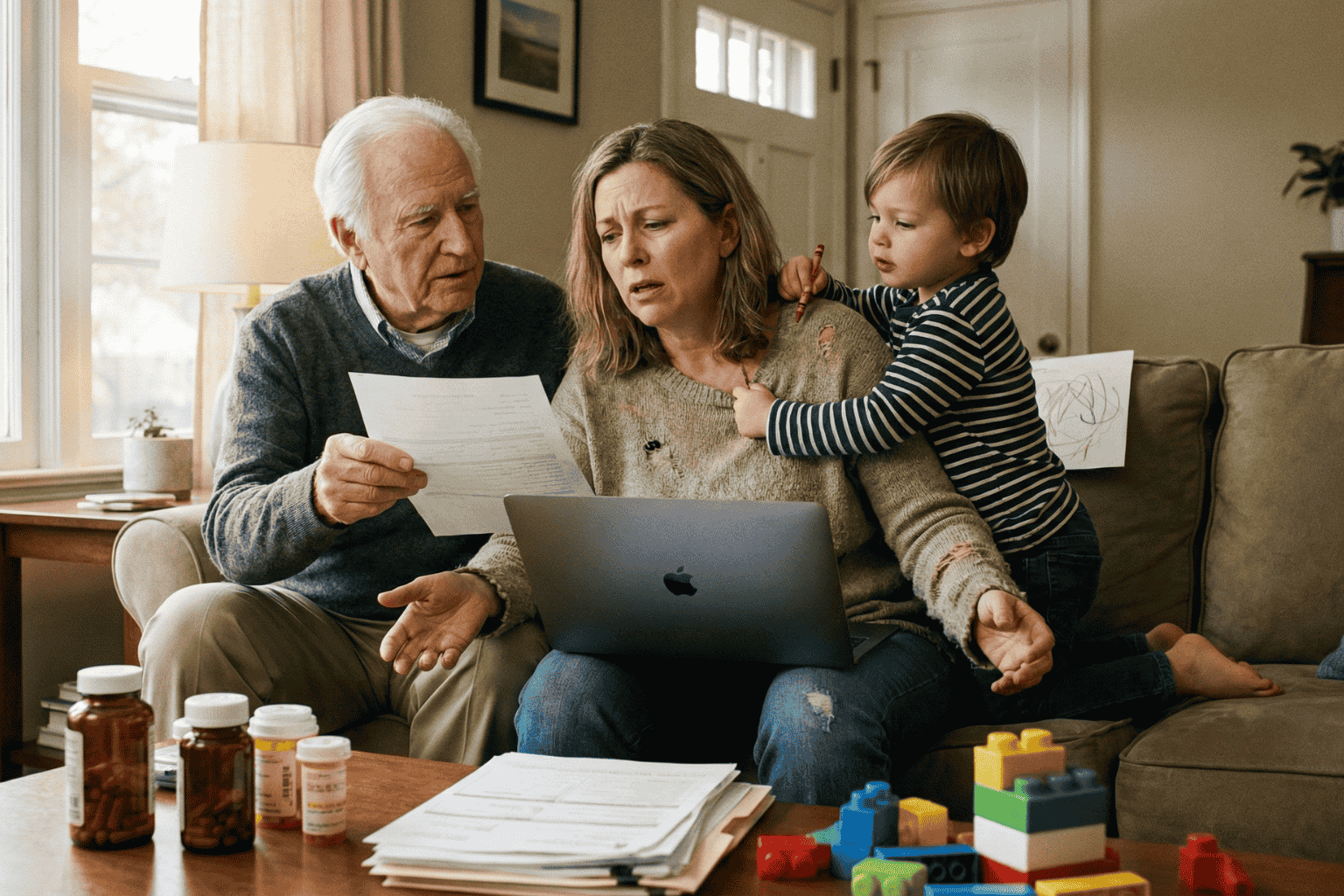

Sandwich Generation Guide: Organize Parents’ & Kids’ Records

January 8, 2026

The Squeeze is Real

The term “Sandwich Generation” sounds polite, almost clinical. But for the millions of adults living it, the reality feels a lot more like a pressure cooker. They are squeezed tight. On one side, there are children needing help with homework, permission slips, and growing pains. On the other, aging parents need support with doctors, medications, and a lifetime of accumulated paperwork.

It is exhausting.

The hardest part usually isn’t the physical caregiving. It is the administration. It is being the unpaid, overworked secretary for two different households. One minute, a parent is hunting for a vaccination card for summer camp; the next, they are frantically searching for Mom’s Medicare supplement number because a receptionist is waiting on the line.

When these worlds collide, chaos wins. Unless, of course, there is a system in place.

Two Households, One Overloaded Brain

The main problem isn’t a lack of effort. It is a lack of centralization. The “Sandwich” caregiver is trying to run two different operating systems at once.

Consider the children. Their documentation is constant and urgent:

- Social Security cards (usually lost in a drawer somewhere).

- Immunization records that schools demand every September.

- Birth certificates for sports or travel.

Then look at the parents. Their paper trail is decades long and much heavier:

- Wills, Trusts, and Deeds (often hidden in “safe” places that no one can find).

- Complex lists of daily medications.

- Insurance policies that need to be renewed.

- The dreaded “In Case of Emergency” contacts.

Keeping the kids’ files in a backpack and the parents’ files in a dusty filing cabinet across town simply doesn’t work. Not in 2026. When an emergency happens, and they always happen at inconvenient times, nobody wants to be driving across town to find a piece of paper.

The “Kitchen Table” Talk

Getting organized starts with a conversation, not a scanner. This is the tricky part. Many adults feel awkward asking their parents about wills or bank accounts. It feels intrusive.

But the conversation doesn’t have to be about control. It should be about safety. The approach matters. Framing it as, “We need to make sure the doctors know what you need if you can’t tell them,” works a lot better than, “Give me your passwords.”

The goal is strictly practical: preventing a crisis from becoming a disaster.

Cut the Clutter: What Actually Matters?

A common mistake is trying to save everything. But honestly, nobody needs to digitize a utility bill from 1998. To survive the squeeze, caregivers need to be ruthless about what they keep.

The “Must-Have” list is actually quite short:

- The Legal Shield: Power of Attorney. This is non-negotiable. Without it, an adult child is legally a stranger to their parent’s bank or doctor.

- The Medical Snapshot: A simple, updated list of what pills they take and who their primary doctor is.

- The Money Trail: Just a list of where the accounts are. Not necessarily the balances, but the locations of the banks and insurance policies.

Stop Relying on Physical Folders

Paper is fragile. It burns, it tears, and most importantly, it stays in one place.

If a parent falls ill while the caregiver is on vacation, that physical folder in the hallway closet is useless. This is why moving to a digital system is the only logical step for a modern family.

Using a secure, encrypted platform, like InsureYouKnow.org, solves the geography problem. It puts the information in the cloud, protected by encryption that is tougher than any lock on a filing cabinet. It means the right information is available on a smartphone, right in the hospital lobby, exactly when it is needed.

Don’t Go It Alone

There is a hero complex in the Sandwich Generation. Everyone tries to carry the load solo. But that is a recipe for burnout.

Once the records are digital, they should be shared. A spouse, a reliable sibling, or a family attorney needs access, too. Modern digital vaults allow for this kind of “trusted partner” access. It ensures that if the primary caregiver gets the flu or gets stuck in a meeting, someone else can step in and handle the situation.

Finding Some Peace

At the end of the day, organizing these records isn’t really about paperwork. It is about buying back time.

Every minute saved by not hunting for a lost insurance card is a minute that can be spent actually being a parent or a son or daughter. The paperwork will always be there, but the stress doesn’t have to be. By merging these two chaotic worlds into one secure place, the Sandwich Generation can finally take a breath.

5 Scams Targeting Seniors in 2026 (And How to Lock Down Your Data)

January 1, 2026

Can you believe it is 2026? We have apps for everything and phones that are smarter than the computers we grew up with. But there is a flip side. All this tech has handed crooks a brand new playbook. And let’s be honest, they love targeting seniors.

The scams floating around right now aren’t the sloppy emails we used to laugh at. These new ones are sharp. They use fancy tech and psychological tricks to bypass your gut instincts. But don’t worry. You don’t need to be a tech wizard to stay safe; you just need to know what the red flags look like.

Here is what is happening out there and how to keep your private life private.

1. The “Grandchild” Voice Clone (It’s Not Them)

You might remember the old version of this trick. Someone calls pretending to be a grandson in trouble. Usually, you could tell it wasn’t him because the voice was off.

Well, the game has changed.

Scammers are now grabbing snippets of audio from social media videos. If your grandchild posted a video on TikTok or Instagram, that is all they need. They use AI to clone the voice. When the phone rings, it sounds exactly like them. Same laugh, same tone. They will say they are in jail or stuck in Mexico and need money fast.

What to do:

- The Password Rule: Agree on a secret family password. If “Bobby” calls saying he is in trouble, ask for the password. If he can’t give it, hang up.

- Don’t Panic: Hang up and call their real cell phone number. Verify it yourself.

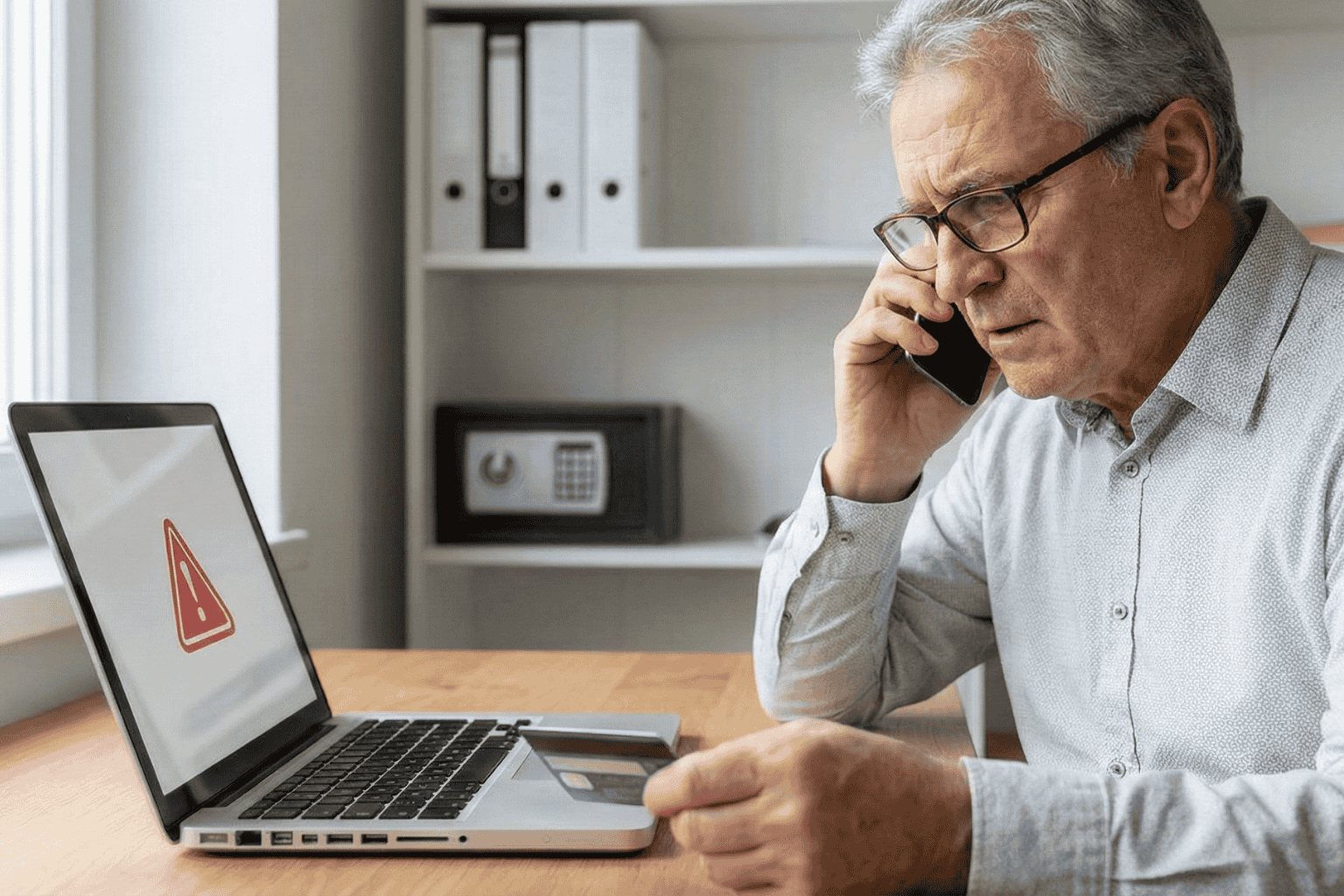

2. The “Computer Meltdown” Pop up

You are just reading the news or looking for a recipe, and suddenly BAM. A siren starts wailing from your speakers. A box pops up on the screen saying your computer is infected and you have to call “Microsoft” immediately.

It is terrifying, right? That is the point.

But here is the truth. It is all smoke and mirrors. Your computer is fine. The person on that phone line isn’t tech support; they are a thief waiting for you to open the front door. If you let them “remote in,” they will swipe your passwords or charge you for fixing a problem that didn’t exist.

What to do:

- Ignore the Number: Real companies like Apple or Microsoft will never put a phone number on a warning pop up. Never.

- The Hard Reset: If your mouse freezes, just hold the power button down until the screen goes black. Turn it back on, and the “virus” will be gone.

3. The Medicare “Chip Card” Trap

Medicare rules are a maze, and scammers know it. The latest trick? A friendly phone call telling you that you are due for a “refund” or a new “chip card.”

It sounds great, doesn’t it? But then comes the catch. To get the goods, they say they just need to “verify” your Social Security Number or your current Medicare ID.

What to do:

- Guard It: Treat your Medicare number like the combination to a safe.

- Check Your Vault: Don’t take a stranger’s word for it. If you keep your insurance details stored in a secure spot, like the InsureYouKnow.org portal, you can just log in and check your official policy. Call the number on your documents, not the one the stranger gave you.

4. The “Pig Butchering” Long Game

This one is nasty because it pulls on heartstrings. It usually starts with a “wrong number” text or a random message on Facebook. The person is nice. You start chatting. Over weeks, maybe even months, you become friends.

Then, they mention money. They are making a killing in crypto or gold, and they want to help you do the same. You might even put a little money in and see it grow on a website they send you. But the moment you invest a serious amount? The website vanishes, and so does your “friend.”

What to do:

- Keep Wallets Closed: Never take financial advice from someone you have only met through a screen.

- Do Your Homework: If they send a photo, run it through a Google Image search. You will probably find that picture belongs to a model or someone else entirely.

5. The Fake Government Threat

Fear is a powerful tool. Scammers love to pretend they are the IRS or the Social Security Administration. You will get a text or voicemail saying your account is “suspended” or you owe back taxes.

They will threaten arrest if you don’t pay right now. And weirdly, they often want payment in gift cards.

What to do:

- Gift Cards equal Scam: The government will never ask you to pay a fine with an Amazon gift card. That just doesn’t happen.

- Slow Down: They want you to panic so you stop thinking. Take a breath. It is almost certainly fake.

The Secret Weapon? Getting Organized.

Why do these scams work? Because they rely on chaos. They hope you don’t know where your real policy is. They hope you can’t find the right phone number to check if the story is true.

If you have your house in order, they can’t touch you.

When you have your vital info, like IDs, policies, and bank contacts, locked in a secure, encrypted hub, you have the power. If someone calls about your life insurance, you don’t have to guess. You log in, look at the real document, and you see the truth.

Stay Safe Out There:

- Verify, Verify, Verify: Don’t trust Caller ID.

- Lock It Up: Use a secure service to store your life’s paperwork.

- Buddy System: Share access to that digital vault with a family member you trust. It helps to have backup.

You don’t have to be paranoid to be safe in 2026. You just have to be organized.

Divorce & Data: How to Split Your Digital Life Safely

December 26, 2025

The Digital Aftermath

Breaking up used to mean splitting the vinyl collection and deciding who keeps the couch. Simple. Tangible. But today? The most complicated part of a separation isn’t sitting in the living room; it’s floating in the cloud.

We live online. A marriage in 2025 is basically a massive web of shared Netflix logins, joint bank apps, Amazon purchase histories, and thousands of photos on a server somewhere. This is the “Digital Split,” and honestly, it is messy. If people ignore it, they risk more than just awkwardness. They risk security leaks, drained accounts, and losing memories that actually matter.

Untangling this web takes a bit of grit, but it has to be done. Here is the playbook for separating a digital life without everything crashing down.

1. The Audit (Or: Seeing the Mess)

Before changing a single password, stop. Take a breath. You can’t fix what you can’t see. Most couples are far more digitally enmeshed than they realize. The first move is a simple audit.

Sit down and write it out. All of it.

- The Money: It’s not just the big bank account. Think Venmo, PayPal, crypto wallets, and those “buy now, pay later” apps.

- The Boring Stuff: Who pays the electric bill? Whose email is on the mortgage portal?

- The Fun Stuff: Spotify duos, Netflix profiles, gaming accounts.

- The Doorstep: Uber, Lyft, DoorDash.

Imagine the chaos if one person kills a shared credit card on Amazon without saying a word. Subscriptions bounce. Deliveries get canceled. It’s a headache nobody needs right now. Awareness is the best defense.

2. Locking the Virtual Doors

Once the list is ready, it’s time to secure the perimeter. Financial data is vulnerable, and emotions can make people do rash things.

For personal accounts like email, private checking, and social media, the passwords need to change. Today. And please, no more using the dog’s name or that old anniversary date. Pick something random.

This is also the moment to turn on Two-Factor Authentication (2FA) everywhere. It’s annoying, sure, but it’s a lifesaver. Even if an ex-partner guesses the new password, they can’t get in without the code sent to the phone. Also, dig into credit card apps and check for “authorized users.” If that isn’t cleared up, one person could be stuck paying for the other’s post-breakup therapy shopping.

3. The Photo Dilemma: Keep, Don’t Delete

This hurts the most. Who gets the pictures? The wedding video? The baby photos? Unlike a physical album, nobody has to lose out here.

The rule is strict: Duplicate, don’t delete.

Legally, wiping a hard drive or deleting a cloud account can be seen as destroying assets. It’s a bad look in court. Instead, buy a big external hard drive. Download everything, every shared memory, and hand the drive over. Or, use Google Photos to make a massive shared album, let them download it all, and then cut the link. Everyone walks away with their memories intact. No data lost.

4. Cutting the Invisible Ties

Then there are the things running in the background. The invisible tethers.

Check location sharing. Apps like “Find My” or Google Maps are great for knowing when a spouse is home for dinner, but after a split? It’s just surveillance. Unless there’s a solid reason to keep it on, like co-parenting coordination, shut it down.

The smart home is another trap. If one partner moves out, they shouldn’t still have the code to the front door or access to the Nest cameras. Watching an ex-partner come and go via a phone screen isn’t healthy for anyone.

5. The “Legacy” Check

It’s dark, but it matters. Check the beneficiaries.

Life insurance, 401(k)s, and investment apps all have that little “Transfer on Death” field. People fill it out once and forget it exists. If it isn’t updated, an ex-spouse could technically inherit money meant for kids or a new family ten years from now. It takes five minutes to fix, but it saves a lifetime of legal trouble later.

Final Thoughts

Separating a life is heavy work. But in this era, the digital separation is just as heavy as the physical one. It’s about privacy, security, and eventually, peace of mind. By locking down the data and safely copying the memories, the path forward gets a little bit clearer.

Pull the last three months of bank statements. That’s usually where the hidden subscriptions are hiding. Good luck.

Why Emailing Files to Yourself Is Not a Secure Strategy

December 17, 2025

It happens. A tax return needs saving. A passport needs copying. Time is short. The solution seems obvious: attach the file, type in the email address, and hit send.

Done. Safe. Accessible from anywhere.

Or so it seems.

That “Sent” folder feels like a private archive. In reality, it is a ticking time bomb. Cybersecurity pros don’t view email as a vault. They view it as a sieve. It leaks. And when it comes to the blueprints of a person’s life, wills, deeds, insurance policies, using email for storage isn’t just a bad habit. It is a security nightmare.

The Glass Envelope

Here is the thing about email. It feels private. It requires a password to log in, after all. But once a message leaves the draft folder, it travels across the open web. It hops from server to server.

Think of it less like a sealed letter and more like a postcard. The postman can read it. The sorting clerk can read it. Anyone who intercepts the mail truck can read it.

While big tech companies lock the front door, the data inside often sits in plain text. If a hacker guesses a password, or if the email provider has a breach, those attachments aren’t encrypted. They are just sitting there. Open. Readable. Ready to be stolen.

The Trap of “Searchability”

The best feature of email is also its biggest flaw. It is searchable.

Type “tax” into the search bar, and boom: five years of returns appear. Convenient for the user? Absolutely. But it is even more convenient for a thief.

When cybercriminals crack an account, they don’t scroll through boring updates from Netflix or Amazon. They run bots. These automated scripts hunt for gold. They scan for keywords like “SSN,” “Scan,” “Medical,” or “Deed.”

In three seconds flat, a hacker can scrape a decade of sensitive life data. That PDF of a driver’s license sent in 2019? The user forgot it. The hacker found it. And now, identity theft is just a few clicks away.

The “Whoops” Factor

Then there is the human element. We are clumsy.

Predictive text is great until it isn’t. A user starts typing “Sarah” to send a financial statement to a spouse. The computer autofills “Sarah” the realtor from four years ago. The “Send” button is hit before the brain catches up.

Too late.

There is no taking it back. A total stranger now holds the keys to a private financial life. It happens constantly. It is messy. And it is completely preventable.

The Fix: A Real Vault

If the inbox is a postcard, a Secure Digital Vault is a steel fortress.

This is why platforms like InsureYouKnow.org exist. They don’t just “store” files. They lock them down.

The difference lies in the math. Real security uses AES-256 encryption. Imagine taking a document and putting it through a shredder that turns it into millions of mathematical shards. The only person with the glue to put it back together is the account owner. Even if a thief stole the server, they would get nothing but digital noise.

Plus, a vault brings order to chaos.

When a crisis hits, a fire, a sudden hospital trip, nobody wants to dig through a mountain of spam to find an insurance policy. A vault keeps things sorted. Medical. Legal. Financial. Everything in its right place.

The Bottom Line

Convenience is a trap. Saving ten seconds by emailing a file is not worth the misery of untangling a stolen identity.

Vital documents don’t belong in the “Sent” folder. They belong behind a lock. So, go ahead. Search the inbox for “scan.” Delete the results. And put those files somewhere they actually belong.

Why Freelancers Need Vault for Business, Insurance and Personal Docs

December 3, 2025

Running a small business or working independently as a freelancer can be incredibly rewarding, but it also comes with a unique kind of pressure. There is no support team to handle accounts, filing, legal paperwork or insurance policies. Everything falls on one person. And when documents get scattered across laptops, email inboxes, envelopes, and drawers, that pressure doubles.

Many professionals don’t realise the value of having one organised vault for business, insurance, and even personal documents until something goes wrong like a tax review, a lost invoice, a sudden medical emergency or an unexpected client dispute. Situations like these can turn a normal week into chaos if the necessary files aren’t available when they’re needed.

The Hidden Risk Behind Scattered Paperwork

Almost every freelancer or business owner ends up collecting a long list of important documents over time:

- Contracts and NDAs

- Tax records and GST filings

- Business registration and licenses

- Insurance policies

- Personal documents like PAN / Aadhaar / passport copies

- Client invoices and payment proofs

When these are stored in different places some printed, some emailed, some saved on a mobile phone, some forgotten on a hard drive it becomes hard to track what exists and what is missing. Searching for one paper in the middle of work is stressful and wastes valuable time that could be spent earning money.

It is not just about convenience scattered documents increase the chances of financial loss, missed tax claims, denied insurance claims and even legal trouble.

Why a Single Vault Makes Life Easier

Keeping all important documents in one vault (preferably digital) can completely transform the way a business operates. A well-organised vault helps in:

Faster Access When Needed

Instead of digging through old emails or piles of files, documents are found in seconds. During tax season, project negotiations, audits or emergencies, this makes an unbelievable difference.

Confidence with Clients and Authorities

Being able to quickly retrieve contracts, invoices or payment receipts shows professionalism. It also protects the business during disputes or late payments.

No More Panic During Emergencies

If a device breaks, a document goes missing or an accident occurs, a vault ensures that everything is backed up and safely stored.

Clear Separation of Personal and Business Finances

Many freelancers mix personal and business papers by accident. Keeping them in labelled folders inside one vault keeps everything organised without confusion.

Which Documents Should Be Included?

A good vault should include every document that is hard to replace, legally important or financially relevant. For example:

Business-related documents

- Licenses and registrations

- Client contracts and project agreements

- Invoices sent and payment receipts

- Expense proofs bills, subscriptions, travel, utilities

- Bank statements and annual reports

Insurance-related documents

- Health insurance policies

- Life insurance details

- Business and asset insurance

- Renewal receipts and claim history

Personal documents

- Identity proofs such as Aadhaar, PAN, Passport

- Important legal documents

- Nominee details

Keeping everything in one vault does not mix the documents it simply allows them to be stored together but categorised, making access extremely efficient.

Digital Vault vs Physical Storage Which Is Better?

Some business owners still rely on physical files, and while that is familiar, it has limitations. Paper can be misplaced, damaged by water or fire and is hard to access when travelling or working remotely.

A digital vault has several advantages:

- Documents can be accessed anytime, even while travelling or from another device

- Multiple categories and labels reduce confusion

- Search options make it easy to locate files quickly

- Backup storage ensures documents are not lost

- Sensitive information can be password protected

For professionals who work across locations or serve international clients, digital access becomes even more valuable.

Real-World Scenarios Where a Vault Saves the Day

A secure, organised vault may feel like an optional system until the moment it becomes essential:

- A client wants to verify payment for an old invoice

- A large company payroll team requests old tax receipts for onboarding

- A medical emergency requires quick access to insurance details

- A visa form needs a scanned copy of passport and financial proof

- A GST or income tax review asks for expense records from previous years

Having everything stored neatly in one place turns stressful events into simple tasks.

A Small Habit That Leads to Big Stability

Building a vault doesn’t require complicated software or a huge investment. It only needs a habit: every time an important document arrives, store it in the vault immediately. Small, consistent organisation protects both personal and professional life in the long run.

For freelancers and small business owners, a vault is not just storage. It is preparation. It is peace of mind. It is a safety net during the uncertain moments that every business eventually faces.

Final Thought

Success in business isn’t only about skills or marketing. It is also about stability and preparedness. Keeping business, insurance and personal documents in one secure vault gives a professional the confidence to grow without fear of losing control over paperwork. With organised records, business becomes smoother, income becomes predictable and stressful situations become manageable.

What Happens If You Don’t Keep Your Insurance Info Updated?

November 19, 2025

Most of us buy insurance with good intentions. We sign the papers, file them away, and honestly, we don’t think much about them again. Life gets busy. Updating insurance info is the kind of task that quietly slips off the radar. But here’s the thing: life changes constantly, and your insurance doesn’t magically keep up.

If your policy stays the same while everything else in your life shifts around, you might end up with coverage that doesn’t match your situation anymore. And that usually shows up at the worst possible time.

Why Keeping Info Updated Actually Matters

Insurance companies depend on accurate details. They decide coverage and pricing based on the information you gave them at the start. If something meaningful changes and you don’t tell them, the policy may not reflect reality anymore.

Think about how often little changes happen: moving to a different place, adding someone new to the family, buying things you’d be upset to lose, fixing up your house, or even having changes at work. None of these moments seem “insurance-worthy” at the time, but they actually matter.

What Could Happen If Nothing Gets Updated

A lot of people assume that as long as premiums are paid, everything is fine. Unfortunately, insurance doesn’t exactly work that way.

1. Claims Might Not Go Smoothly

If something goes wrong and you file a claim, the insurer will check whether your information matches your real situation. If they find a big difference, the claim might get delayed, reduced, or rejected. For example, if your home is worth more because of renovations and you didn’t update the policy, the payout probably won’t cover the full damage.

2. You Might Not Have Enough Coverage

People often don’t realize their coverage is outdated until something happens. Maybe your family has grown, or you’ve bought more valuable items. A policy that once fit perfectly might not come close now.

3. The Policy Could Be Cancelled

Insurance companies expect major details to be accurate. If something important wasn’t updated, they can cancel the policy. In rare cases, they may even say it was never valid.

4. Renewal Might Become Expensive

Sometimes outdated details cause confusion during reviews. Even if the claim goes through, renewal might come with a higher price tag.

5. Stress Piles Up When You Least Want It

Insurance is supposed to offer relief during stressful times. Outdated information can turn that relief into more stress, more paperwork, more delays, and more frustration.

Things Worth Reviewing From Time to Time

It helps to check these once in a while:

- Where you live

- Changes in your family

- Any expensive new purchases

- Home improvements or upgrades

- Vehicle changes or new drivers

- Major health or job changes

- Beneficiaries

A simple yearly check is enough for most people.

Easy Ways to Keep Everything Updated

You don’t need to make this complicated. A few easy habits can help:

- Glance over your policies once a year.

- Whenever something big happens, just send a quick update.

- Keep all your insurance documents in one place so you don’t forget what you have.

- Make a short list of things that typically change over time.

- Ask the insurer when you’re unsure; they’re used to these questions.

Final Thoughts

Insurance is meant to support you when life gets tough, but it can only do that if the information behind the policy reflects your current situation. When details sit unchanged for too long, the coverage weakens and sometimes disappears when you need it most.

A few minutes of updating here and there can save you from a lot of trouble later. It doesn’t take much, but it makes a big difference when life throws something unexpected your way.