Category: Paperwork

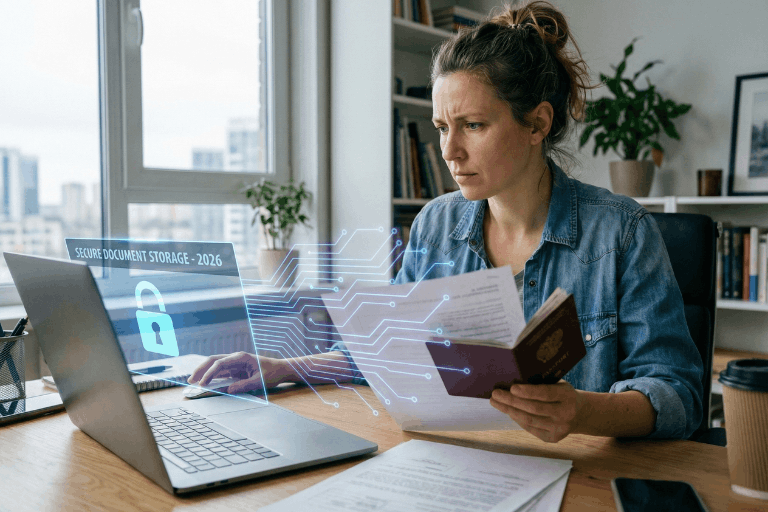

AI and Data Privacy in 2026: Securing Vital Information

February 19, 2026

Forget the old sci-fi movies. Today, artificial intelligence practically runs the show. It handles everything from spotting diseases to balancing checkbooks. Every major industry uses these tools to save time and cut corners. But there is a massive catch. This entire system runs on one specific fuel. That fuel is personal information.

Understanding how these powerful computer networks handle private details matters more today than ever before. The tech moves incredibly fast. The ways companies grab and store digital footprints change right along with it.

The AI Data Appetite: How Information is Used

Machine learning models are hungry. These systems require an unbelievable amount of raw material to actually function. Sometimes, a program chews through billions of data points just to learn a single, simple pattern. A fast screen swipe, a late-night online purchase, or a routine doctor’s chart update, they all leave a permanent mark.

Code then sifts through this massive pile of details to customize what people see online. Sure, that makes picking a streaming movie or getting a quick cash loan way easier. But it comes at a cost. Big corporations constantly harvest and tag private details. These software tools connect the dots between things that seem totally unrelated. Next thing you know, a retailer is predicting what a customer will buy next Tuesday, or even guessing their secret health conditions.

Emerging Privacy Risks in the AI Era

This massive leap in technology brings a totally new set of privacy headaches. People have to deal with these threats every single day.

- Sophisticated Cyber Threats: Hackers rarely waste time guessing passwords anymore. Why bother? They use generative code to craft perfect phishing emails and hyper-realistic deepfakes instead. These modern scams blow right past old-school security filters. Because of this, bank records and identities sit directly in the firing line.

- The Rise of “Agentic” AI and Shadow Apps: Smart software agents operate on their own now. They move files and make choices at crazy speeds. When employees or everyday folks rely on unregulated “shadow” tech tools, highly sensitive documents often bleed right into public training models. The worst part? Nobody usually notices until the damage is fully done.

- Algorithmic Bias and Automated Decisions: As computers take over boring office work, invisible biases easily sneak into the mix. A broken piece of code might quietly trash a mortgage application or throw away a great resume. It bases the choice on a hidden profile. The person gets a rejection letter, usually with absolutely zero explanation.

The 2026 Regulatory Landscape

Lawmakers worldwide are finally pushing back hard. This year marks a massive turning point for digital rules and corporate behavior.

Huge rulebooks like the European Union’s AI Act are fully active right now. They slap heavy limits on dangerous technology. Meanwhile, dozens of US states rolled out tough privacy laws that demand total honesty from tech companies. Businesses face strict legal orders to tell the public whenever a machine makes a major choice about a human life. Consumers actually hold real power again. They can demand a look at their files, force fixes, or completely scrub their names from corporate servers.

AI as a Digital Defender

Strangely enough, the exact same tech causing these nightmares also acts as the ultimate shield. Artificial intelligence is completely rewriting the cybersecurity rulebook.

Modern data defense relies heavily on smart threat detection. Clever networks watch internet traffic around the clock. They spot weird behavior and shut down hacks long before human security guards even finish their morning coffee. It also drives better ways to hide identities. Companies can track big shopping trends without ever seeing a specific name or street address.

Strategies for Protecting Vital Information

With the internet getting messier by the minute, folks need solid plans to lock down their critical records. Tossing important papers into a messy email folder or a dusty metal filing cabinet is just asking for trouble. Those old methods simply cannot survive modern cyber attacks. They also fail completely during sudden physical emergencies.

Switching to secure, encrypted digital storage offers a much stronger defense. Platforms offering independent, password-protected electronic safe deposit boxes keep life insurance policies, legal contracts, and medical histories totally out of reach from snooping data scrapers. Putting this vital information inside a heavily locked cloud vault guarantees families can grab exactly what they need during a crisis. At the exact same time, the data stays totally hidden from digital thieves.

The Future of Digital Privacy

The collision between smart machines and data privacy stands as the defining tech battle of 2026. The everyday perks are super obvious. But the background risks demand real attention. Staying updated on legal rights gives regular people a fighting chance. Plus, leaning on heavily encrypted storage for major documents lets individuals walk through this new era safely. Taking a few smart steps right now protects immediate privacy while securing a solid, long-term digital legacy.

Preparing for Tax Season

February 15, 2026

Taxes aren’t usually a task people look forward to. If anything, many procrastinate or put the chore off completely. In fact, about 5% of taxpayers fail to file their taxes each year, the top two reasons being that it’s overwhelming or they simply object to paying income taxes. But skipping your taxes is a bad idea.

“It does catch up to you, and the penalties and interest are huge,” says David Ragland, a certified financial planner and CEO of IRC Wealth. “If you don’t file your return, you’re going to have to pay interest on any unpaid taxes.”

The penalty for failing to file is 5% of unpaid taxes for each month a filing is late, capped at 25%. So a taxpayer who owes $10,000 would owe $500 each month, with a maximum owed of $2,500.

Filing your taxes can be intimidating and tedious, but by forming a plan and gathering the documents you need in advance, it can go quite smoothly. Here’s everything you can do to make filing your taxes easier this year.

Gather Paperwork First

Get together all of the information you’ll need for your taxes ahead of filing to save time and reduce stress.

The IRS recommends gathering personal information, including:

- Your Social Security number, as well as those of anyone else on your tax return, such as spouses and dependents

- Your bank account and routing numbers, if you wish to receive your refund by direct deposit

- Your adjusted gross income or AGI and the exact refund amount from last year‘s tax return, if you filed

Anyone who paid you during the year is required to report the payments to the IRS. They must file their information and return forms with the IRS and send a copy to you. You should receive these electronically or by mail in January or February.

These forms include:

- Forms W-2, which show your wages from employers

- Form W-2G for lottery and gambling winnings

- Any Form 1099, including from government payments, freelance and contract work, and retirement plan distributions

- Form SSA-1099 for Social Security benefits

- Form 1095-A, Health Insurance Marketplace Statement

If you are self-employed, have multiple jobs, or have a small business, then you’ll need:

- Bank statements and other payment collection records

- Receipts for potential deductions, such as from travel, car expenses, and business supplies

- Proof of training and further schooling

Anything that you spent on investing in your business is a potential deduction and should be collected as a reference for filing.

Deductions to Know

There’s always the chance that the IRS will file your taxes on your behalf if you fail to file on time yourself. “Just because you don’t file the return doesn’t mean you can escape the IRS long term,” says Ragland. If this happens, you’ll likely miss out on deductions that you yourself would have likely claimed.

Other documents for potential deductions include:

- Childcare and dependent expenses

- Mortgage and property tax records

- Any donations made to charity

- Healthcare expenses, including Health Savings Accounts or HSAs

- Retirement contributions

- Specific education and career expenses, such as those with students and teachers

- Student loan interest statements

The One Big Beautiful Bill Act (OBBB) was signed into law in July 2025 and makes significant changes to the tax code. It makes the 2017 tax cuts (like the seven income tax brackets from 10%–37%) effectively permanent while adjusting many bracket thresholds for inflation and substantially increasing the standard deduction (e.g., $15,750 for singles, $31,500 for joint filers). It also adds new deductions (like for tips, overtime, seniors, and certain auto loan interest), raises the SALT deduction cap, and modifies credits such as the Child Tax Credit. Study the more than 60 tax provisions that IRS has adjusted to keep deductions, tax brackets, and other items aligned with the cost of living. For those filing taxes in 2026 (for the 2025 tax year), these adjustments have increased by about 2.8%.

The Right Filing Status

Your filing status is used to determine your correct tax rate, standard deduction, and certain credits. Whether or not you are married, are the head of household, or have dependents are all factors in determining your filing status. The IRS offers a tool to help you choose the filing status that will result in the lowest amount of tax.

It pays to do a little research and know which status is best for your given situation. For instance, filing jointly as a married couple rather than separately comes with certain benefits, such as the most significant standard deduction, tax credits, and a higher income threshold. But if your spouse owes tax penalties, then that’s a situation where filing separately makes more sense.

How to File

When you can claim tax credits or otherwise have money owed to you, filing taxes can be a great thing. The IRS now offers Free File, a way to do your taxes online for free. People with potentially complex tax situations, such as multiple business ventures or multiple streams of income, may opt to work with a Certified Public Accountant (CPA). There are also many companies, like TurboTax that offer both free and fee-based services.

With Insureyouknow.org, you can get in the habit of storing this information throughout the year. That way, when it comes time to file, everything you need will be in one place.

Medical ID Wallet Cards vs. Digital Access: Which is Better?

February 11, 2026

The Emergency Question

Picture someone collapsing in a store, unable to talk. Paramedics rush over but need answers. What allergies does this person have? What medications? Any serious health problems? Should these details live on a card in their wallet or sit on their phone?

Here’s the thing: picking just one isn’t the best move.

Medical ID Wallet Cards

Advantages

- Battery? What battery? These cards just work, period.

- First responders get it: About 95% of EMTs know to check wallets.

- Zero connectivity needed: Mountains, basements, middle of nowhere. Doesn’t matter.

- Won’t break the bank: Spend maybe $5-10 once, that’s it.

Disadvantages

- There’s only so much room on a tiny card.

- Wallets get misplaced or left at home sometimes.

- People forget to scratch out old info and add new stuff.

- Cards get wet, fade, or become hard to read after a while.

Digital Smartphone Medical IDs

Advantages

- Room for everything: Write down every single medication and condition.

- Updates take two seconds: New prescription? Changed doctors? Fixed instantly.

- Talks to 911: iPhones automatically send this stuff when someone dials emergency.

- Costs nothing: Already sitting in the phone waiting to be used.

Disadvantages

- Dead phone equals zero help.

- Some paramedics haven’t learned the tricks for every phone type yet.

- Accidents crack screens and destroy phones pretty often.

- Weird fact: Only about 1 in 4 people actually bother setting this up.

The Smart Choice: Use Both

- Medical Alert Jewelry: Get a bracelet stamped with the biggest health concern plus “SEE WALLET CARD”.

- Wallet Card: The most important stuff, right there in physical form.

- Digital Medical ID: Everything else stored on the phone (make sure it shows without unlocking).

- Backup Copies: Stick extras in the glove box, desk drawer, with Mom or a close friend. Consider using a secure digital vault like InsureYouKnow to store copies of medical cards, insurance information, and emergency contacts that family members can access when needed.

Quick Setup

Wallet Card:

- Write down allergies, health conditions, meds, who to call.

- Get it laminated so it lasts.

- Make a few copies.

iPhone:

- Open Health app → Find Medical ID → Turn on “Show When Locked”.

Android:

- Go to Settings → Look for Safety & Emergency → Switch on “Show on Lock Screen”.

Total time needed: about 10 minutes.

Real Examples

- Diabetic collapse: Woman’s wallet card listed her insulin information. Paramedics knew exactly what to do.

- Allergic reaction: Guy’s phone shattered during his fall. Good thing his wallet card mentioned that penicillin allergy.

- Lost senior: Older woman wandered off, couldn’t remember her name. Her iPhone Medical ID had her daughter’s number right there.

Who Needs This?

People dealing with:

- Health stuff like diabetes, seizures, heart trouble.

- Bad allergies that could turn dangerous.

- Pills they take every day.

- Pacemakers, implants, that kind of thing.

Common Mistakes

- Picking one method and ignoring the other.

- Setting it up once and never looking at it again.

- Leaving the lock screen access turned off on phones.

- Keeping it secret from family members.

The Bottom Line

Why choose? Wallet cards save the day when phones quit. Digital files hold way more detail than any card could. Together, they’ve got each other’s backs.

- Money spent: Less than fifty bucks

- Time invested: Ten minutes

- Potential payoff: Might literally save someone’s life

Action Steps

- Today: Get that phone Medical ID set up (takes 5 minutes).

- This week: Print out a wallet card (another 5 minutes).

- Twice a year: Check both and update anything that changed.

When things go wrong, having a backup plan makes all the difference.

Storing Everything Securely

Beyond wallet cards and phone apps, keeping digital copies of medical information in a secure vault ensures family members can access critical details during emergencies. Platforms like InsureYouKnow provide encrypted storage for medical records, insurance policies, medication lists, and emergency contacts. This creates another layer of protection, especially when someone needs to share information with multiple family members or caregivers.

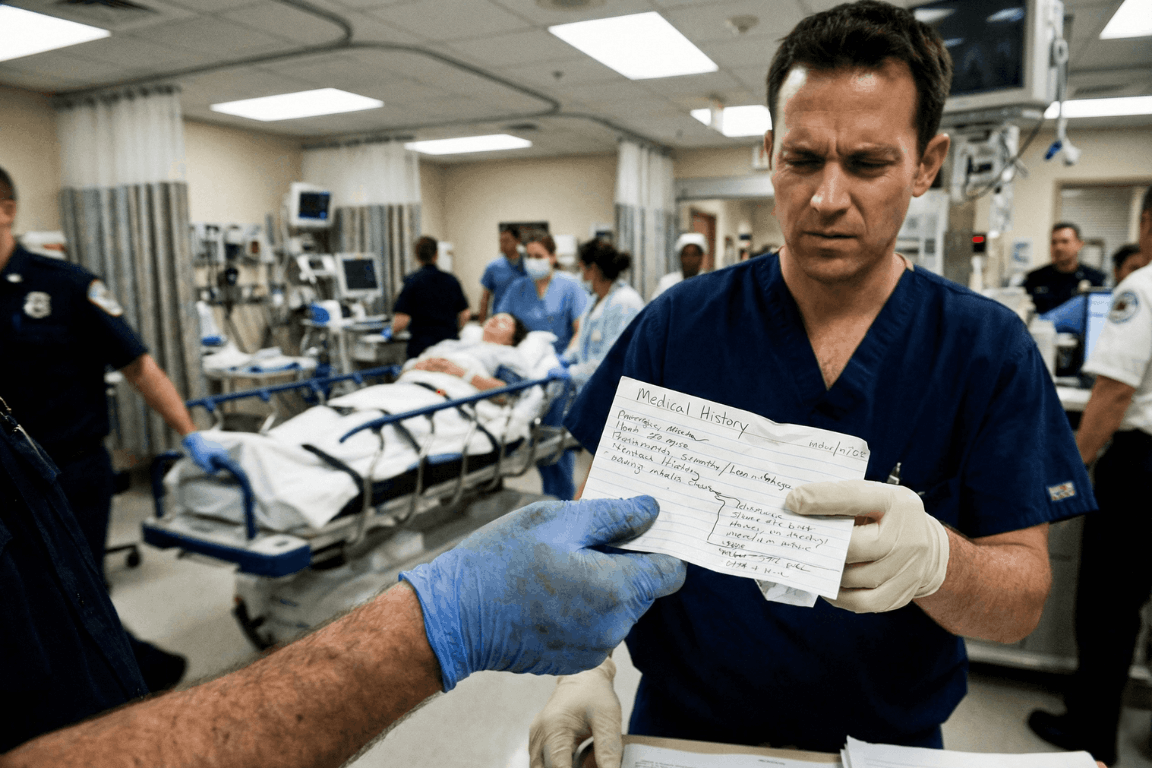

Medical History Cheat Sheet: What ER Doctors Need

February 4, 2026

The “Golden Hour” Gap

The Emergency Room is a storm. Noise. Chaos. Speed. Doctors and nurses fight the clock. They chase the “Golden Hour.” That tiny window where fast action beats death.

But silence is the enemy. Ambulances dump patients who can’t talk. Shock takes over. Or they are out cold. In that high-pressure moment, a missing detail, a drug allergy, an old surgery, sends the team down the wrong road. That road ends badly.

Ask any ER staffer. They agree on one thing. A simple “cheat sheet” is the best tool a person can bring through those doors.

Why Memory Fails in a Crisis

People think they will remember. “I know my meds,” they say. They are wrong. Trauma wipes the brain clean. Pain and fear take over. A patient knows they take a “heart pill.” The name? Gone. The dose? Forgotten.

A written paper fixes this. It talks when the mouth cannot. It stops the guessing game between a frantic arrival and safe care.

The ER Doctor’s Wish List: 6 Essentials

What goes on the paper? Forget the thick file. Medical teams want facts. Facts that change the plan right now.

1. The “Big Picture” Demographics

Before the IV goes in, the team must know who they are treating. They need to know who signs the forms.

- Full Legal Name and Date of Birth: This finds old records in the computer.

- Blood Type: Vital for fast transfusions.

- Emergency Contacts: A spouse. A parent. Someone who answers “yes” or “no” to surgery when the patient can’t.

2. The Medication List (Crucial)

This part kills people if it’s wrong. Drug interactions cause huge messes in hospitals. Be exact:

- Prescription Drugs: The name. The dose (like 50mg). The schedule.

- Over-the-Counter (OTC) Meds: Aspirin. Ibuprofen. They seem safe. They aren’t. They thin blood. They hit kidneys.

- Supplements and Vitamins: Herbal pills often fight with anesthesia.

Note: Never write “Take as directed.” That tells the doctor zero.

3. The Allergy Alert

Does the patient hate penicillin? Latex? Contrast dye? The team needs to know. Now. The wrong drug turns a broken bone into a breathing emergency. List the allergen and the reaction. “Penicillin: Hives.” “Peanuts: Throat shuts.”

4. Past Medical History (PMH)

Context is king. A stomach ache in a healthy teen is one thing. In a Crohn’s patient, it’s another.

- Chronic Conditions: Diabetes. Asthma. Epilepsy. High blood pressure. Heart issues.

- Implants: Pacemakers. Metal rods. Artificial joints. The team must know this before an MRI scan starts.

- Past Surgeries: A quick list. “Appendectomy, 2015.” “C-Section, 2020.”

5. Recent History

Sometimes the clue is new. A note about travel, especially overseas, helps. So does a note about recent hospital stays. This helps doctors spot weird infections.

6. Insurance and Directives

Life comes first. But paperwork causes headaches later. List Insurance Policy and Group Numbers. Also, check for an Advance Directive or DNR (Do Not Resuscitate) order. A copy must exist. Otherwise, the patient’s wishes get ignored.

Paper vs. Digital: The Accessibility Problem

Old advice? Keep a card in a wallet. But paper sucks. It fades. It tears. It gets lost. Or it sits in a kitchen drawer while the car crash happens three towns over.

Digital vaults like InsureYouKnow.org changed the game. Storing this “Cheat Sheet” in a secure cloud keeps data safe. It stays ready. A trusted partner pulls up the vault on a phone. Seconds later, the ER team has the facts.

The Final Diagnosis

Being ready isn’t paranoia. It is smart. A Medical History Cheat Sheet takes ten minutes. It pays off in safety. It lets doctors work faster. It stops bad errors. And it gives families peace. They know the health story is clear. Even when the room is silent.

What Small Businesses Should Do in January: 10 Key Accounting Tasks

January 29, 2026

January can shape a small business’s financial trajectory. The new year brings a chance to complete year-end obligations and an opportunity to refresh your understanding of your finances. Done right, January accounting work can reduce stress and improve clarity for the entire year.

Here are ten accounting tasks every small business should complete in January.

1. File W-2 and W-3 Forms

January is when employers issue W-2 forms to employees for the prior tax year and file the W-3 transmittal with the Social Security Administration by January 31. This task confirms accurate wage reporting and tax withholdings and ensures employees can file their personal returns on time. Consistency with this deadline helps avoid IRS penalties and preserves goodwill with your team.

2. Issue 1099s to Contractors

January also means preparing and sending Form 1099-NEC to contractors and other eligible payees. If your business paid an independent contractor $600 or more last year, you must file this form with the IRS and deliver a copy to the contractor by the end of the month. Timely filing of forms supports compliance and helps contractors meet their personal tax obligations.

3. Make Final Estimated Tax Payments

For many business owners, the fourth quarter estimated tax payment for the previous year is due in January. Paying this by the due date helps reduce potential underpayment penalties. Beyond compliance, it supports accurate cash-flow planning as you begin a new tax cycle.

4. Reconcile Bank and Credit Card Accounts

Reconciliation is a key step in validating your books. It means ensuring that your internal records match your bank and credit card statements. When discrepancies are identified and resolved promptly, your cash balances reflect actual activity.

5. Close Out the Previous Year’s Books

Closing your books means recording all year-end transactions and adjustments so your financial statements reflect a complete year of activity. This includes depreciation entries, accruals, corrections, and categorization of uncoded transactions. With the year closed, your profit and loss and balance sheet become reliable reference points for tax filing and planning.

6. Review Financial Statements

Once the books are fully reconciled and closed, generate your key financial statements: the profit and loss, balance sheet, and cash flow report. These documents help you assess performance and financial position at a glance. Reviewing them with your accountant or trusted advisor can uncover patterns or opportunities you might not see otherwise.

7. Revisit Your Budget and Forecast

Finalized financials offer a stronger foundation for your budget and forecasts. Compare actual results with your projections from the prior year and adjust assumptions for the coming year. This practical reflection ensures that your financial plan aligns with reality rather than optimism alone.

8. Verify Accounts Receivable and Collect Past-Due Invoices

Assess and follow up on outstanding invoices. Uncollected receivables can constrain cash flow early in the year, and January is an effective window to address overdue accounts. Efficient collections improve your liquidity and make financial reporting more accurate.

9. Prepare for Tax Filing Season

January signals the start of tax filing season. Organize essential tax documents and receipts so you aren’t scrambling to gather them in March or April. Early coordination with your CPA can also clarify updated tax rules or opportunities to plan strategically.

10. Review Your Accounting Systems and Tools

January is also the moment to evaluate your accounting systems. Are you using tools that support reporting and compliance? Cloud-based accounting software can make recordkeeping more accurate and easier to share with advisors. Investing time here can reduce manual work and errors throughout the year.

Completing these accounting tasks in January brings order to your business’s finances so you can spot trends, anticipate challenges, and make decisions with confidence.

Public WiFi vs. Your Data: Why You Need a Secure Vault

January 28, 2026

The Open Window

A traveler sits at a crowded airport gate. The flight is delayed. Boredom sets in. The phone comes out, and there it is: “Free Airport WiFi.”

Click. Connected.

It feels like a small victory. A chance to check a bank balance, pay a credit card bill, or look up a policy number.

But that click? It is the digital equivalent of leaving a house key under the doormat and hoping no one looks.

In 2026, we treat our phones like fortresses. We lock them with faces and fingerprints. Yet, the moment we connect to an open network, we lower the drawbridge. We invite the world in. And the world is watching.

The Invisible Eavesdropper

Here is the ugly truth about public internet: it is loud.

When data leaves a phone on a secure home network, it whispers. On public WiFi, it screams.

The danger isn’t usually some master criminal in a hoodie. It is often just software. Simple, cheap scripts running on a laptop three seats away. These programs are like digital vacuums. They suck up everything floating through the air.

- The Man-in-the-Middle: A hacker cuts in line. The user sends a password to the bank. The hacker catches it, copies it, and then passes it to the bank. The login works. The user has no idea they just handed over their keys.

- The Fake Twin: You see a network called “Coffee_Shop_Free.” It looks real. It isn’t. A scammer set it up five minutes ago. Connect to it, and the device effectively belongs to them until you disconnect.

The “Inbox” Mistake

Fear makes people do silly things. When travelers get nervous about logging in, they turn to an old, bad habit: The Email Search.

“I won’t log in,” they think. “I’ll just find that PDF I emailed myself.”

This is a disaster.

An email inbox is not a safe. It is a glass box. Email accounts are the most hacked targets on the planet. If a thief gets into an email account, they don’t just read letters. They find the tax returns from 2024. They find the scan of the child’s birth certificate. They find the list of “backup codes.”

Using an inbox to store life’s vital documents is like hiding jewelry in a clear plastic bag. It doesn’t work.

The Real Fix: A Digital Vault

So, what is the answer? Carry a filing cabinet? Never go online?

No. The answer is a Secure Digital Vault.

This is where platforms like InsureYouKnow.org step in. They aren’t storage bins. They are armored trucks.

1. It Shreds the Data A real vault uses encryption that mimics the banking world, like Amazon Cloud security. If a hacker snatches a file from the air, they don’t get a readable document. They get noise. A jumbled mess of code that means nothing. The thief gets the envelope, but they can never read the letter.

2. Nobody Knows the Code Privacy matters. The best systems run on “zero-knowledge” rules. That means the company holding the data doesn’t have the password. Even if they wanted to look, they couldn’t. The user holds the only key.

3. Get In, Get Out With a vault, the data lives in the cloud, not on the device. A user can log in on a hotel computer, check a passport number, and vanish. No files left in the “Downloads” folder. No trail for the next guest to find.

Peace of Mind

Security usually feels like a headache. Extra steps. More passwords.

But actually? It is freedom.

It is the ability to lose a wallet in Paris and not fall apart. Why? Because the backup copies of every card and ID are sitting behind an iron door in the cloud. Accessible. Safe. Ready.

Public WiFi is fine for reading gossip columns or checking the weather. But for the heavy stuff like the money, the legacy, and the identity, stay off the open road. Put the valuables in a vault. Lock it up. Then go enjoy the coffee.

Swedish Death Cleaning for Your Digital Life: A Simple Guide

January 15, 2026

The mess you can’t see

There is a Swedish concept that has been making the rounds lately called döstädning. In English, it translates to “Swedish Death Cleaning.” It sounds a bit dark on the surface. Maybe even depressing. But the idea is actually pretty practical: you clear out your physical belongings, the dusty boxes, the clothes that don’t fit, the broken furniture, so your family isn’t stuck dealing with a mountain of junk when you are gone.

But here is the thing about modern life in 2026: the biggest mess isn’t in the garage. It’s floating in the cloud.

People are walking around right now with thousands of blurry photos, email accounts from ten years ago, and passwords that exist only in their heads. It is a silent chaotic mess. And if something happens, that digital chaos becomes a massive headache for the people left behind. Applying a little döstädning to the online world isn’t just about being tidy. It is about saving loved ones from a nightmare.

First, stop the bleeding

Before trying to organize the important stuff, the useless noise has to go.

Think about the average inbox. It is usually stuffed with newsletters that haven’t been opened since 2019 and receipts for things long thrown away. The first step of the clean-up is arguably the best part: hitting unsubscribe. If a subscription hasn’t provided value in the last six months, cut it loose.

Then look at the bank statement. How many streaming services or random apps are charging five dollars a month for nothing? Canceling those doesn’t just save cash today; it stops a confusing financial web from forming later. It is less for the family to untangle.

And then, the photos. Digital hoarding feels safe because it doesn’t take up room in the house. But leaving someone 50,000 screenshots to sort through is rough. Deleting the junk helps the real memories stand out.

The problem with passwords

Imagine cleaning up a whole house, locking the front door, and then throwing the key into a river. That is basically what happens when a digital life is organized but locked down.

In the past, important documents lived in a filing cabinet. A physical key could be found. Today? The “key” is a complex password or a face scan. If nobody else has those credentials, the assets inside, bank accounts, sentimental emails, crypto wallets, might as well not exist. They are locked in a digital vault with no door.

Scribbling passwords on a sticky note is risky. But keeping them entirely memorized is worse.

A smarter way to store it

Once the trash is deleted, what is left? The vital stuff. The deeds, the insurance policies, the wills, the vet records for the dog. These are the papers families panic over during an emergency.

Leaving these files scattered across three different cloud drives and a laptop desktop is a recipe for disaster. The strategy has to shift from “saving” to “managing.”

This is why platforms like InsureYouKnow.org are picking up steam. They aren’t just storage drives. They are digital safety deposit boxes. It gives people a single, encrypted place to put the things that actually matter. And unlike a regular hard drive, it bridges the gap. It keeps the data safe from hackers but ensures a trusted person can actually get to it when they need to.

It answers the question “Where is the policy?” before anyone even has to ask.

A lighter load

Calling it “Death Cleaning” makes it sound heavy. But honestly? It feels more like life cleaning.

There is a real sense of relief that comes from knowing the digital house is in order. No more background stress about lost files or forgotten logins. Just the calm knowledge that if life throws a curveball, the family won’t be stuck fighting with customer support to get into an account. They will have everything they need, right there, ready to go.

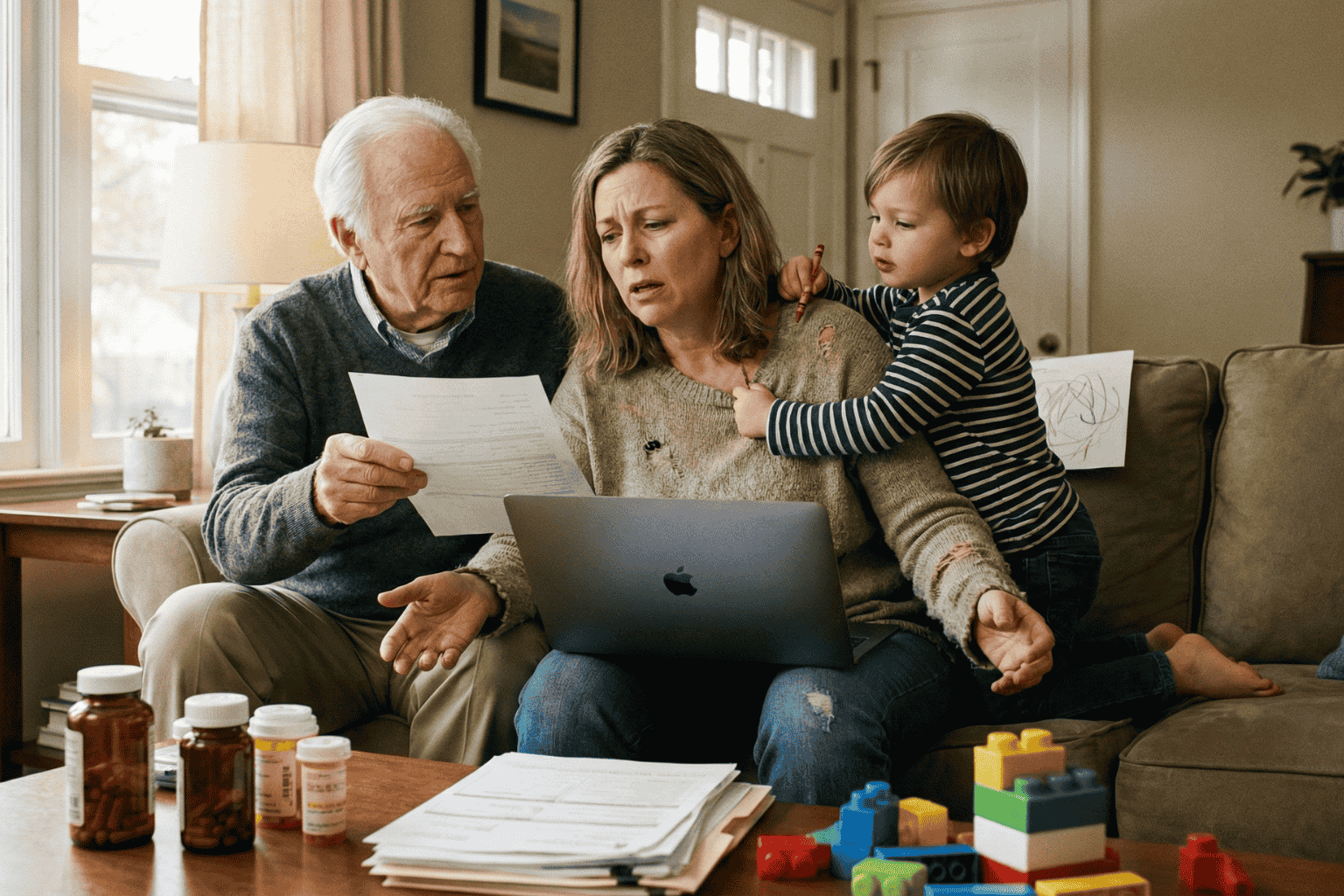

Sandwich Generation Guide: Organize Parents’ & Kids’ Records

January 8, 2026

The Squeeze is Real

The term “Sandwich Generation” sounds polite, almost clinical. But for the millions of adults living it, the reality feels a lot more like a pressure cooker. They are squeezed tight. On one side, there are children needing help with homework, permission slips, and growing pains. On the other, aging parents need support with doctors, medications, and a lifetime of accumulated paperwork.

It is exhausting.

The hardest part usually isn’t the physical caregiving. It is the administration. It is being the unpaid, overworked secretary for two different households. One minute, a parent is hunting for a vaccination card for summer camp; the next, they are frantically searching for Mom’s Medicare supplement number because a receptionist is waiting on the line.

When these worlds collide, chaos wins. Unless, of course, there is a system in place.

Two Households, One Overloaded Brain

The main problem isn’t a lack of effort. It is a lack of centralization. The “Sandwich” caregiver is trying to run two different operating systems at once.

Consider the children. Their documentation is constant and urgent:

- Social Security cards (usually lost in a drawer somewhere).

- Immunization records that schools demand every September.

- Birth certificates for sports or travel.

Then look at the parents. Their paper trail is decades long and much heavier:

- Wills, Trusts, and Deeds (often hidden in “safe” places that no one can find).

- Complex lists of daily medications.

- Insurance policies that need to be renewed.

- The dreaded “In Case of Emergency” contacts.

Keeping the kids’ files in a backpack and the parents’ files in a dusty filing cabinet across town simply doesn’t work. Not in 2026. When an emergency happens, and they always happen at inconvenient times, nobody wants to be driving across town to find a piece of paper.

The “Kitchen Table” Talk

Getting organized starts with a conversation, not a scanner. This is the tricky part. Many adults feel awkward asking their parents about wills or bank accounts. It feels intrusive.

But the conversation doesn’t have to be about control. It should be about safety. The approach matters. Framing it as, “We need to make sure the doctors know what you need if you can’t tell them,” works a lot better than, “Give me your passwords.”

The goal is strictly practical: preventing a crisis from becoming a disaster.

Cut the Clutter: What Actually Matters?

A common mistake is trying to save everything. But honestly, nobody needs to digitize a utility bill from 1998. To survive the squeeze, caregivers need to be ruthless about what they keep.

The “Must-Have” list is actually quite short:

- The Legal Shield: Power of Attorney. This is non-negotiable. Without it, an adult child is legally a stranger to their parent’s bank or doctor.

- The Medical Snapshot: A simple, updated list of what pills they take and who their primary doctor is.

- The Money Trail: Just a list of where the accounts are. Not necessarily the balances, but the locations of the banks and insurance policies.

Stop Relying on Physical Folders

Paper is fragile. It burns, it tears, and most importantly, it stays in one place.

If a parent falls ill while the caregiver is on vacation, that physical folder in the hallway closet is useless. This is why moving to a digital system is the only logical step for a modern family.

Using a secure, encrypted platform, like InsureYouKnow.org, solves the geography problem. It puts the information in the cloud, protected by encryption that is tougher than any lock on a filing cabinet. It means the right information is available on a smartphone, right in the hospital lobby, exactly when it is needed.

Don’t Go It Alone

There is a hero complex in the Sandwich Generation. Everyone tries to carry the load solo. But that is a recipe for burnout.

Once the records are digital, they should be shared. A spouse, a reliable sibling, or a family attorney needs access, too. Modern digital vaults allow for this kind of “trusted partner” access. It ensures that if the primary caregiver gets the flu or gets stuck in a meeting, someone else can step in and handle the situation.

Finding Some Peace

At the end of the day, organizing these records isn’t really about paperwork. It is about buying back time.

Every minute saved by not hunting for a lost insurance card is a minute that can be spent actually being a parent or a son or daughter. The paperwork will always be there, but the stress doesn’t have to be. By merging these two chaotic worlds into one secure place, the Sandwich Generation can finally take a breath.

Divorce & Data: How to Split Your Digital Life Safely

December 26, 2025

The Digital Aftermath

Breaking up used to mean splitting the vinyl collection and deciding who keeps the couch. Simple. Tangible. But today? The most complicated part of a separation isn’t sitting in the living room; it’s floating in the cloud.

We live online. A marriage in 2025 is basically a massive web of shared Netflix logins, joint bank apps, Amazon purchase histories, and thousands of photos on a server somewhere. This is the “Digital Split,” and honestly, it is messy. If people ignore it, they risk more than just awkwardness. They risk security leaks, drained accounts, and losing memories that actually matter.

Untangling this web takes a bit of grit, but it has to be done. Here is the playbook for separating a digital life without everything crashing down.

1. The Audit (Or: Seeing the Mess)

Before changing a single password, stop. Take a breath. You can’t fix what you can’t see. Most couples are far more digitally enmeshed than they realize. The first move is a simple audit.

Sit down and write it out. All of it.

- The Money: It’s not just the big bank account. Think Venmo, PayPal, crypto wallets, and those “buy now, pay later” apps.

- The Boring Stuff: Who pays the electric bill? Whose email is on the mortgage portal?

- The Fun Stuff: Spotify duos, Netflix profiles, gaming accounts.

- The Doorstep: Uber, Lyft, DoorDash.

Imagine the chaos if one person kills a shared credit card on Amazon without saying a word. Subscriptions bounce. Deliveries get canceled. It’s a headache nobody needs right now. Awareness is the best defense.

2. Locking the Virtual Doors

Once the list is ready, it’s time to secure the perimeter. Financial data is vulnerable, and emotions can make people do rash things.

For personal accounts like email, private checking, and social media, the passwords need to change. Today. And please, no more using the dog’s name or that old anniversary date. Pick something random.

This is also the moment to turn on Two-Factor Authentication (2FA) everywhere. It’s annoying, sure, but it’s a lifesaver. Even if an ex-partner guesses the new password, they can’t get in without the code sent to the phone. Also, dig into credit card apps and check for “authorized users.” If that isn’t cleared up, one person could be stuck paying for the other’s post-breakup therapy shopping.

3. The Photo Dilemma: Keep, Don’t Delete

This hurts the most. Who gets the pictures? The wedding video? The baby photos? Unlike a physical album, nobody has to lose out here.

The rule is strict: Duplicate, don’t delete.

Legally, wiping a hard drive or deleting a cloud account can be seen as destroying assets. It’s a bad look in court. Instead, buy a big external hard drive. Download everything, every shared memory, and hand the drive over. Or, use Google Photos to make a massive shared album, let them download it all, and then cut the link. Everyone walks away with their memories intact. No data lost.

4. Cutting the Invisible Ties

Then there are the things running in the background. The invisible tethers.

Check location sharing. Apps like “Find My” or Google Maps are great for knowing when a spouse is home for dinner, but after a split? It’s just surveillance. Unless there’s a solid reason to keep it on, like co-parenting coordination, shut it down.

The smart home is another trap. If one partner moves out, they shouldn’t still have the code to the front door or access to the Nest cameras. Watching an ex-partner come and go via a phone screen isn’t healthy for anyone.

5. The “Legacy” Check

It’s dark, but it matters. Check the beneficiaries.

Life insurance, 401(k)s, and investment apps all have that little “Transfer on Death” field. People fill it out once and forget it exists. If it isn’t updated, an ex-spouse could technically inherit money meant for kids or a new family ten years from now. It takes five minutes to fix, but it saves a lifetime of legal trouble later.

Final Thoughts

Separating a life is heavy work. But in this era, the digital separation is just as heavy as the physical one. It’s about privacy, security, and eventually, peace of mind. By locking down the data and safely copying the memories, the path forward gets a little bit clearer.

Pull the last three months of bank statements. That’s usually where the hidden subscriptions are hiding. Good luck.

Why Emailing Files to Yourself Is Not a Secure Strategy

December 17, 2025

It happens. A tax return needs saving. A passport needs copying. Time is short. The solution seems obvious: attach the file, type in the email address, and hit send.

Done. Safe. Accessible from anywhere.

Or so it seems.

That “Sent” folder feels like a private archive. In reality, it is a ticking time bomb. Cybersecurity pros don’t view email as a vault. They view it as a sieve. It leaks. And when it comes to the blueprints of a person’s life, wills, deeds, insurance policies, using email for storage isn’t just a bad habit. It is a security nightmare.

The Glass Envelope

Here is the thing about email. It feels private. It requires a password to log in, after all. But once a message leaves the draft folder, it travels across the open web. It hops from server to server.

Think of it less like a sealed letter and more like a postcard. The postman can read it. The sorting clerk can read it. Anyone who intercepts the mail truck can read it.

While big tech companies lock the front door, the data inside often sits in plain text. If a hacker guesses a password, or if the email provider has a breach, those attachments aren’t encrypted. They are just sitting there. Open. Readable. Ready to be stolen.

The Trap of “Searchability”

The best feature of email is also its biggest flaw. It is searchable.

Type “tax” into the search bar, and boom: five years of returns appear. Convenient for the user? Absolutely. But it is even more convenient for a thief.

When cybercriminals crack an account, they don’t scroll through boring updates from Netflix or Amazon. They run bots. These automated scripts hunt for gold. They scan for keywords like “SSN,” “Scan,” “Medical,” or “Deed.”

In three seconds flat, a hacker can scrape a decade of sensitive life data. That PDF of a driver’s license sent in 2019? The user forgot it. The hacker found it. And now, identity theft is just a few clicks away.

The “Whoops” Factor

Then there is the human element. We are clumsy.

Predictive text is great until it isn’t. A user starts typing “Sarah” to send a financial statement to a spouse. The computer autofills “Sarah” the realtor from four years ago. The “Send” button is hit before the brain catches up.

Too late.

There is no taking it back. A total stranger now holds the keys to a private financial life. It happens constantly. It is messy. And it is completely preventable.

The Fix: A Real Vault

If the inbox is a postcard, a Secure Digital Vault is a steel fortress.

This is why platforms like InsureYouKnow.org exist. They don’t just “store” files. They lock them down.

The difference lies in the math. Real security uses AES-256 encryption. Imagine taking a document and putting it through a shredder that turns it into millions of mathematical shards. The only person with the glue to put it back together is the account owner. Even if a thief stole the server, they would get nothing but digital noise.

Plus, a vault brings order to chaos.

When a crisis hits, a fire, a sudden hospital trip, nobody wants to dig through a mountain of spam to find an insurance policy. A vault keeps things sorted. Medical. Legal. Financial. Everything in its right place.

The Bottom Line

Convenience is a trap. Saving ten seconds by emailing a file is not worth the misery of untangling a stolen identity.

Vital documents don’t belong in the “Sent” folder. They belong behind a lock. So, go ahead. Search the inbox for “scan.” Delete the results. And put those files somewhere they actually belong.