Author: Gerry Acuna

2026 Student Loan Defaults: Secure Your Financial Records

March 6, 2026

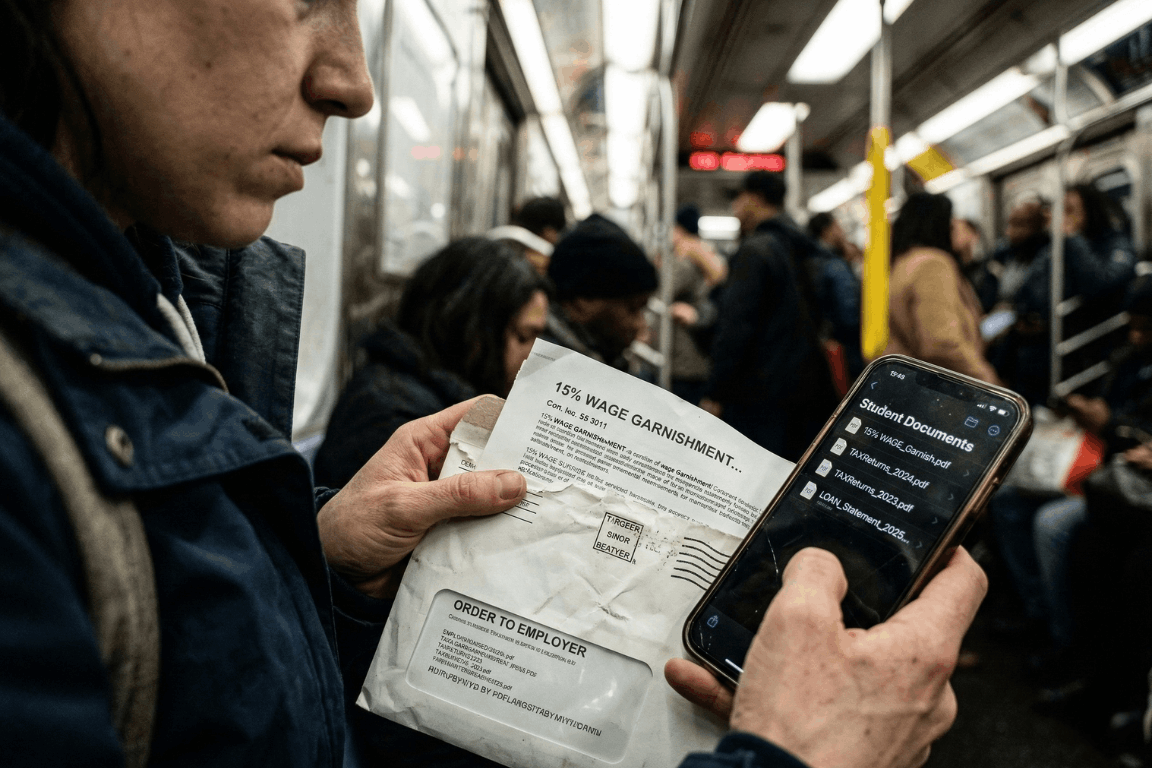

A massive financial wall hit millions of Americans earlier this year. Pandemic payment pauses are officially ancient history. The temporary relief programs dried up entirely. After months of messy court battles regarding income-driven repayment plans, the federal government decided to bring back its heaviest collection tools. Starting in early 2026, the U.S. Department of Education began sending administrative wage garnishment letters to defaulted borrowers. The numbers from major credit bureaus, like Experian, look pretty grim. The entire country is watching a massive wave of loan delinquencies happen in real time. People are suddenly staring down severe financial penalties. Getting through this economic squeeze requires a lot more than just reading news updates. It demands immediate, highly organized access to specific financial paperwork.

The 2026 Student Loan Landscape: A Shocking New Data Trend

So, who is actually defaulting right now? Historically, student loan defaults mostly hammered sub-prime borrowers. That whole narrative flipped completely upside down in 2026. Recent reports from credit bureaus reveal something entirely unexpected. Nearly a quarter of newly defaulted borrowers belong in the “prime” credit tier or even higher. These are the exact demographics the financial industry usually views as incredibly stable.

With over 5 million borrowers currently sitting in default status, and millions more falling behind every month, the economic pain is obvious. Borrowers are stuck navigating a bizarre maze of constantly changing payment plans. Making things worse, millions of accounts got bounced around between different private servicing companies over the last two years. Monthly payments got lost in the mail. Crucial paperwork simply vanished. Hold times to speak with basic customer service stretched into hours. Once a federal student loan reaches 270 days past due, it hits official default status. At that specific moment, the government gets to use an administrative superpower that regular credit card companies cannot even touch. They can literally take wages without ever stepping foot inside a courtroom.

Understanding Administrative Wage Garnishment: The 15% Reality

The fallout from a federal default happens fast. Through a process called Administrative Wage Garnishment (AWG), the Department of Education can legally force an employer to pull up to 15% of a borrower’s disposable pay. Disposable pay simply means the cash remaining after legally required deductions, like federal and state taxes, come out of the check.

Federal law does leave a very small safety net in place. Borrowers get to keep a weekly take-home amount equal to at least 30 times the federal minimum wage. But for anyone living from one paycheck to the next, suddenly losing 15% of their income is pure disaster. It usually means missing the rent, skipping the grocery store, or defaulting on other credit cards. Before the garnishment actually kicks in, the government must send a 30-day advance written warning. That specific 30-day window is basically everything. It acts as the only real timeframe a borrower gets to object or set up a different payment plan before their paycheck actually shrinks.

How to Stop Garnishment: The Heavy Burden of Proof

Borrowers holding a garnishment notice still carry some legal rights. During those 30 days, individuals can officially demand a hearing to stop the withholding order. They might attempt to prove extreme financial hardship. Or, they could try applying for federal loan rehabilitation. Rehabilitation usually involves agreeing to make nine on-time payments over a 10-month window to get the loan back on track.

Another route involves submitting a formal financial hardship appeal. Winning this appeal means legally proving that a 15% pay cut makes buying basic survival items impossible. The government looks at documented living expenses and compares them against very strict IRS Allowable Living Expense guidelines. If a family spends more on food or housing than the IRS thinks is necessary for that specific family size, the extra amount gets totally ignored. Proving hardship is notoriously difficult. Using these rights is never a walk in the park. It requires gathering highly specific legal and financial records immediately. In these types of administrative hearings, the burden of proof lands squarely on the borrower.

The Critical Role of Organized Financial Documents

Sloppy paperwork turns a bad money situation into an absolute nightmare. When the garnishment letter shows up, the clock ticks fast. Spending hours digging through cluttered email inboxes for old messages from loan servicers wastes valuable time. Tearing up the living room looking for utility bills to prove basic living expenses just fuels the anxiety. If a borrower fails to hand over the correct evidence within 30 days, their employer receives the order. The garnishment starts.

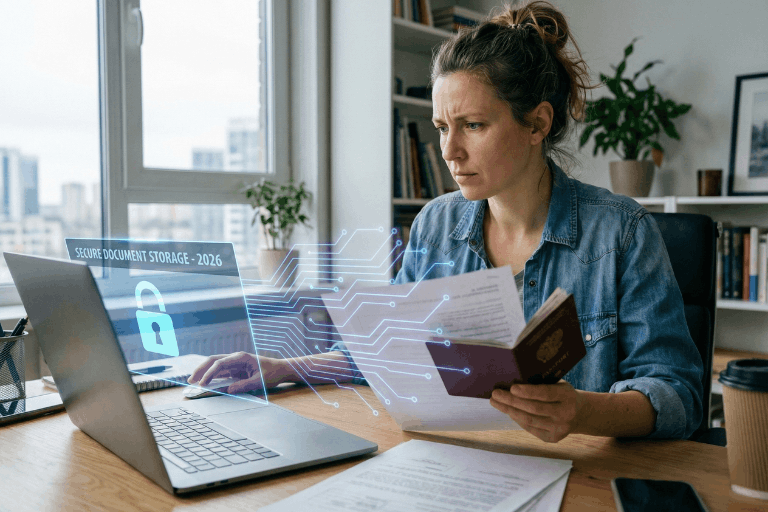

This explains exactly why relying on a secure, independent electronic safe deposit box changes the playing field. Keeping a dedicated digital vault for vital life information ensures nobody gets blindsided by aggressive debt collectors. Storing all important financial, legal, and contractual documents in one simple location gives borrowers a huge advantage. They can instantly grab the exact proof they need to protect their paychecks and negotiate with default resolution teams.

Essential Documents to Secure in a Digital Vault

To build a strong defense against a default warning, individuals should make sure the following documents are digitized, safely uploaded, and ready for action:

- Original Loan Agreements and Master Promissory Notes: Finding original contracts immediately helps verify the true debt amount. It also spots accounting errors and confirms which company actually owns the loan today.

- Complete Tax Returns: Proving financial hardship or enrolling in an income-driven repayment plan means submitting paperwork. The Department of Education demands recent federal and state tax returns before they even start talking.

- Official Pay Stubs: Current pay stubs are absolutely required to figure out actual disposable income. They also help verify that any proposed wage garnishment does not illegally drop below the minimum wage protection limit.

- Household Expense Records: Tracking basic living costs is a strict requirement for hardship appeals. Think about rent agreements, mortgage papers, utility bills, health insurance premiums, and pharmacy receipts. These papers help prove that living expenses are reasonable and fit within tight IRS standards.

- Correspondence with Loan Servicers: A strong paper trail of older payments, approved forbearances, and emails with the loan servicers can literally save the day. This proof is extremely important if someone needs to show a loan was wrongfully thrown into default in the first place.

The Absolute Security of Zero-Knowledge Storage

Privacy is absolutely non-negotiable when dealing with highly sensitive financial details. Relying on physical metal filing cabinets leaves people wide open to lost papers, house fires, or basic theft. Depending on regular, unencrypted email folders or a messy computer desktop basically hands sensitive financial data directly to hackers. Cybercriminals routinely target email servers specifically to find W-2 forms and tax returns. Once they grab those files, identity theft is pretty much guaranteed.

Using a specialized platform built with heavy-duty cloud encryption makes sure financial data stays completely private. The absolute best platforms run on Amazon cloud encryption mixed with a “zero-knowledge” setup. In a zero-knowledge system, only the actual account owner knows the password. The site administrators never get to see it. That means absolutely nobody else can ever gain access, view the files, or mine the stored documents to sell the data.

Strategic Document Sharing with Trusted Partners

Fixing a defaulted student loan is almost never a solo job. Borrowers usually need to bring in certified financial planners, tax accountants, or specialized student loan lawyers to help decode the messy federal rules.

Advanced secure portals allow individuals to selectively share specific document folders with these exact trusted partners. Sending unencrypted PDFs of tax returns and pay stubs back and forth through regular email is a massive cybersecurity hazard. Instead, account holders can simply give a legal advisor temporary, secure access to the required files right inside the encrypted vault. This targeted sharing feature speeds up the whole default resolution process, keeps communication secure, and leaves the rest of the vault totally locked down. Setting up automatic monthly reminders inside the portal also helps users routinely update their financial snapshots, keeping their defense strategy completely fresh.

Facing economic uncertainty requires a solid game plan. The return of federal student loan wage garnishments in 2026 creates a massive hurdle. Credit bureau data clearly shows that financial distress is hitting borrowers across every single demographic right now. Surviving this wave of defaults demands aggressive, proactive money management and flawless record-keeping. Centralizing vital financial documents into a secure, encrypted digital safe deposit box lets individuals tackle economic chaos with total confidence. Being prepared is simply the ultimate defense. It ensures that when critical financial information is needed the most, it stays protected, perfectly private, and instantly ready to use.

Colorectal Cancer Awareness: What You Need to Know

March 1, 2026

Colorectal cancer is the second leading cause of cancer death in the United States, behind only lung cancer. In 2025, the National Cancer Institute estimated that 154,270 people in the United States were diagnosed with colon or rectal cancer in 2025 and nearly 53,000 patients passed away from the disease.

Since 2000, March has been National Colorectal Cancer Awareness Month. Awareness of this disease is so important because cancer of the colon or rectum is often preventable. Both a family history of colorectal cancer and conditions like inflammatory bowel disease can increase your risk, but otherwise, about 60% of the disease is driven by modifiable environmental factors.

“The main focus should be on prevention, early detection, and treatment,” says Dr. Li Li, co-director of the Cancer Prevention and Population Health program at the University of Virginia Cancer Center.

Here’s everything you need to know about the rising cases of colorectal cancer and getting an early diagnosis.

Screening for Colorectal Cancer

Screening by colonoscopy helps prevent cancer because precancerous polyps found during the procedure are removed at the same time, while cancer can be diagnosed in early stages, when treatment is more likely to be successful. The five-year relative survival rate for cancer localized to the colon or rectum is 90%, but the survival rate drops significantly as the cancer spreads beyond those organs.

The average age of colorectal cancer diagnosis is 67. But colorectal cancer is increasingly being diagnosed in people under the age of 50, in which it is referred to as “early onset.”

The Rise of Early-Onset Cases

Cases of early-onset colorectal cancer have increased more than 100% since 1990. The well-known American actor from the 90s favorite Dawson’s Creek, James Van Der Beek, passed away in February 2026 from stage III colorectal cancer at the age 48. He received his diagnosis in 2023 at age 46 after noticing a minor change in bowel habits.

“I hope because of his story that others will reevaluate some of the symptoms they may be having,” says Dr. Cathy Eng, the director of the Young Adult Cancers Program at Vanderbilt-Ingram Cancer Center. “Hopefully, they meet with a physician to investigate further to ensure that they can be diagnosed earlier rather than later.”

Delays of four to six months between symptom presentation and diagnosis of colorectal cancer are up to 40% longer in people diagnosed under the age of 50. During this crucial period, the disease may advance to more dangerous stages, making it harder to treat.

“We’re often seeing early-onset patients presenting with stage III or IV cancer,” says Joshua Demb, a health science researcher at the University of California in San Diego. “Perhaps it could have actually been at an earlier stage, had it been detected earlier.”

When to See Your Doctor

According to a study presented at the American College of Surgeons Clinical Congress, rectal bleeding is one of the top indicators of colorectal cancer in people under 50, and another 2024 review published in JAMA Network Open had the same findings. About 45% of those diagnosed with colorectal cancer reported rectal bleeding, while 40% reported abdominal pain and 27% noted a change in their bowel habits.

Rectal bleeding may present as darker-colored stool, which could be a sign of bleeding higher up in the digestive tract, or as bright red blood, including in the toilet or on toilet paper, which often comes from lower in the rectum. There’s no way for someone to tell at home what’s causing the bleeding, so people need to be proactive and see their doctor.

“The take home is, if there’s any blood, people should see their doctor about it,” says Kimmie Ng, director of the Young-Onset Colorectal Cancer Center. “Certainly, if it’s not going away or it’s getting worse, it does need to be worked up further.”

In addition to rectal bleeding, other common symptoms include:

- Unusual stools, including thin and ribbon-like stools

- Changes in bowel movements, such as diarrhea and constipation, lasting more than two weeks

- Tiredness and low energy

- Any change in appetite, like feeling full early

- Unintentional weight loss

- Unexplained abdominal pain

Some people have no symptoms at all, so it’s important to talk to your doctor if colorectal cancer runs in your family.

Lifestyle Changes for Prevention

According to the American Association of Cancer Research Cancer Progress Report 2025, factors that may be contributing to the increase include an unhealthy diet, obesity, environmental toxins, overuse of antibiotics, and a sedentary lifestyle.

To reduce your risk of colorectal cancer:

- Quit smoking and drink alcohol responsibly

- Exercise and remain active

- Lose weight if you are overweight

- Limit red meat consumption to no more than three 12 to 18-ounce servings per week

- Opt for whole foods like fresh fruits and vegetables, nuts, whole grains, and fish

While the average American consumes only 10 to 15 grams of fiber per day, a healthy colon needs 25 grams per day, which can be found in fruits and vegetables, whole grains, and beans.

Raising Awareness

Anita Mitchell, who was battling stage IV colorectal cancer and lost a close friend and father to the disease, saw a need to bring awareness to a cancer that not many people wanted to talk about. So in 2006, she worked with her children’s school to coordinate a recognition day. In 2009, Mitchell brought the Dress in Blue Day concept to the Colorectal Cancer Alliance who took the program nationwide.

By wearing blue on March 6, you can help bring awareness to this disease and honor all of those impacted by colorectal cancer. You may share a photo on social media of yourself in blue with the hashtag #DressInBlueDay.

Other ways to raise awareness include:

- Learn up-to-date colorectal cancer facts and statistics

- Share what you learn with close friends and family

- Talk to your doctor about any concerns, as well as early screening options

- If you’ve been diagnosed or affected by the disease, consider sharing your story

You may also access this free toolkit from the Fight Colorectal Cancer organization for even more ways to get involved.

If you or a loved one has been recently diagnosed and needs support, you can call the Colorectal Cancer Alliance at (877) 422-2030 to speak with a certified patient and family support navigator.

Whether you’re seeking care or raising awareness, everyone needs to know about the symptoms of colorectal cancer and the benefits of early screening. With Insureyouknow.org, you can keep symptom logs, medical records, treatment research, and advocacy resources in one place, giving you peace of mind and helping you stay organized.

Passkeys vs. Passwords: Why It’s Time to Switch Now

February 26, 2026

We all do it. Every morning. You grab your coffee, sit down, and try to log into your bank. Or maybe your insurance portal. You type in a password. Maybe it’s a strong one. Maybe it’s… well, let’s be real. It’s probably the same one you use for Netflix. But here is the hard truth: relying on a secret code just doesn’t cut it anymore. Not when your entire financial life is sitting behind it. Fast forward to 2026, and there is finally a better option that people are actually using: the passkey.

If you are the one stuck managing the heavy stuff for your family – wills, health records, the “in case of emergency” file – knowing the difference between a passkey and a password isn’t just tech trivia. It is a survival skill. It’s about keeping the wolves at the door away from the things that actually matter.

This guide breaks down exactly what passkeys are, how they smash the old-school password system, and why making the switch is probably the smartest move you can make right now.

What Is a Password – And Why Is It No Longer Enough?

Think about it. A password is just a string of letters you made up. It’s a secret handshake between you and a computer. And for a long time? That was fine.

But here is the snag: humans are involved. And humans? We are messy. The stats are pretty rough – something like 70% of hacks start because of a weak or stolen login. We reuse passwords because we’re lazy. We pick easy ones because we’re forgetful. Or we get tricked by a fake email and hand them over on a silver platter.

Common password headaches include:

- Brute-force attacks: Hackers have computers that can guess billions of passwords a second. If yours is simple, it’s gone before you can blink.

- The Dark Web: If one random site you use gets breached, your password ends up for sale. Suddenly, the bad guys have the keys to your whole life.

- Phishing: It is terrifyingly easy to get fooled by a fake email or website that looks real. You type it in, and poof – they have it.

- Fatigue: You have dozens of accounts. Remembering unique codes for all of them? Impossible. So we reuse them. And that is dangerous.

- SMS flaws: Even those text message codes aren’t bulletproof. Hackers can swap SIM cards and steal those codes right out of the air.

There is a saying in the security world that haunts me: Hackers don’t break in – they log in. If they have your password, they are you.

What Is a Passkey – And How Does It Work?

Passkeys are a total rewrite of the rules. Forget typing. A passkey uses public-key cryptography. Imagine a digital key that is split in two. One half sits on the website. The other half stays locked inside your phone or laptop.

When you want to log in, your phone and the website have a quick, silent chat. You prove it’s you by just unlocking your screen – Face ID, fingerprint, whatever. You don’t type a single letter. Nothing gets sent over the internet for a hacker to steal.

Think of it like a puzzle. The website has a piece. Your phone has a piece. They only fit together when you – the real you – are holding the device.

Key facts about passkeys:

- They run on the FIDO2 standard. Basically, the big tech companies all agreed on a better way to do things.

- Everyone is jumping on board: Google, Apple, Amazon, Chase Bank. They all support it.

- Millions of people are already using them without even realizing it.

- You can’t phish them. You can’t guess them.

- If you have a smartphone from the last few years, you are already ready to go.

Passkeys vs. Passwords: A Side-by-Side Comparison

Why is everyone making such a big deal about this? You have to look at the differences side-by-side to really get it.

1. Security

- Passwords: Weak. They can be stolen, guessed, or fished out of you with a fake email.

- Passkeys: Rock solid. The private key never leaves your phone. Even if a hacker breaks into the bank’s server, they can’t steal your key because it isn’t there.

2. Ease of Use

- Passwords: A pain. You forget them. You reset them. You type them wrong.

- Passkeys: Easy. You look at your phone, or touch the sensor. Done. It works 98% of the time and it’s way faster.

3. Phishing Resistance

- Passwords: Terrible. If a fake site looks real, you’ll probably type your password in.

- Passkeys: Perfect. A passkey is tied to the real website. If you land on a fake site, your phone knows. It simply won’t let you log in.

4. Device Dependency and Flexibility

- Passwords: You can use them anywhere, but that’s also why they are risky.

- Passkeys: They live on your device. But don’t worry – Apple and Google sync them to the cloud. So your passkeys are on your phone, your tablet, and your laptop automatically.

5. Risk in a Data Breach

- Passwords: If a company gets hacked, your password is leaked.

- Passkeys: If a company gets hacked, the hackers get… nothing useful. They just get a public key that can’t unlock anything without your phone.

Why This Matters for Protecting Vital Life Records

We usually don’t think about this stuff until it’s too late. You get hacked, or a family member passes away and nobody can get into their accounts. That is a nightmare scenario.

The accounts that hold your life’s work – insurance, savings, wills – need better protection than “123456.” If these get breached, it’s not just annoying. It’s identity theft. It’s losing money.

The banks know this. That’s why Chase and Wells Fargo are pushing passkeys. They want you safe.

If you are using a digital vault to keep your family’s info organized, turning on passkeys is the single best thing you can do today.

How to Set Up a Passkey (It Is Simpler Than It Sounds)

You don’t need to be a tech wizard. It takes two minutes.

Step 1: Go to your account settings (Google, Amazon, whatever).

Step 2: Look for “Passkeys” or “Security.”

Step 3: Click “Create Passkey.” Your phone will ask for your face or fingerprint. Do it.

Step 4: You’re done. Next time, just click “Use Passkey.”

Step 5: If you want to be extra safe, use a password manager like 1Password to keep them all organized.

Expert Tip: Start with the big ones. Email. Bank. Insurance. Get those locked down first.

Should Passwords Be Abandoned Entirely?

Not yet. We’re in a transition phase. Lots of old websites still need passwords. So here is the game plan:

- Switch to passkeys for anything important.

- Use a password manager to generate crazy long passwords for the junk sites that don’t support passkeys yet.

- Stop using SMS codes if you can help it. Use an app instead.

- Get a hardware key (like a YubiKey) if you are really paranoid about your email security.

- Check back often. More sites are adding this every month.

Microsoft went passkey-first last year and it’s been huge. By the end of 2026, typing passwords will feel like using a flip phone.

What Happens If a Device Is Lost?

Everyone asks this. “If I lose my phone, am I locked out forever?”

No. You’re fine.

- Cloud Sync: If you use an iPhone, your keys are in iCloud. Get a new phone, sign in, and they are back. Same for Android.

- Backup: You can still use other ways to get into your account if you absolutely have to.

- Thieves can’t use them: Even if someone steals your phone, they don’t have your face or fingerprint. They can’t use your passkeys.

Passkeys and the Future of Secure Document Storage

For families storing wills and financial docs online, security is everything. A digital vault is pointless if the key is under the mat.

Passkeys fix the human error part. You can’t accidentally give away your passkey. It solves the biggest problem in security: us.

Experts at Gartner and big tech firms are calling this the biggest shift in security in decades. The password era is ending. Finally.

Key Takeaways

- Passwords are weak. They are too easy to steal or guess.

- Passkeys are strong. They use heavy-duty encryption and your own biometrics.

- It’s happening now. Major banks and tech giants are already using them.

- Mix it up. Use passkeys where you can, strong passwords where you must.

- Don’t worry about lost phones. Cloud sync has your back.

- Protect your legacy. If you store vital records, this is a must-have upgrade.

Conclusion: The Lock Is Getting an Upgrade

Switching to passkeys isn’t just about cool new tech. It’s about peace of mind. Passwords put all the pressure on you to be perfect. Passkeys let your device handle the security so you don’t have to.

If you are serious about keeping your family’s future safe, stop waiting. Passkeys are here. They work. And they are way better than what you’re using now.

The best time to switch was yesterday. The second best time is today.

Protect What Matters Most

InsureYouKnow.org provides a secure, encrypted electronic safe deposit box for life’s most important information – insurance policies, financial records, healthcare documents, and more. Storing vital records in one organized, protected location means families are never left searching when they need information most. Start protecting what matters today at InsureYouKnow.org.

AI and Data Privacy in 2026: Securing Vital Information

February 19, 2026

Forget the old sci-fi movies. Today, artificial intelligence practically runs the show. It handles everything from spotting diseases to balancing checkbooks. Every major industry uses these tools to save time and cut corners. But there is a massive catch. This entire system runs on one specific fuel. That fuel is personal information.

Understanding how these powerful computer networks handle private details matters more today than ever before. The tech moves incredibly fast. The ways companies grab and store digital footprints change right along with it.

The AI Data Appetite: How Information is Used

Machine learning models are hungry. These systems require an unbelievable amount of raw material to actually function. Sometimes, a program chews through billions of data points just to learn a single, simple pattern. A fast screen swipe, a late-night online purchase, or a routine doctor’s chart update, they all leave a permanent mark.

Code then sifts through this massive pile of details to customize what people see online. Sure, that makes picking a streaming movie or getting a quick cash loan way easier. But it comes at a cost. Big corporations constantly harvest and tag private details. These software tools connect the dots between things that seem totally unrelated. Next thing you know, a retailer is predicting what a customer will buy next Tuesday, or even guessing their secret health conditions.

Emerging Privacy Risks in the AI Era

This massive leap in technology brings a totally new set of privacy headaches. People have to deal with these threats every single day.

- Sophisticated Cyber Threats: Hackers rarely waste time guessing passwords anymore. Why bother? They use generative code to craft perfect phishing emails and hyper-realistic deepfakes instead. These modern scams blow right past old-school security filters. Because of this, bank records and identities sit directly in the firing line.

- The Rise of “Agentic” AI and Shadow Apps: Smart software agents operate on their own now. They move files and make choices at crazy speeds. When employees or everyday folks rely on unregulated “shadow” tech tools, highly sensitive documents often bleed right into public training models. The worst part? Nobody usually notices until the damage is fully done.

- Algorithmic Bias and Automated Decisions: As computers take over boring office work, invisible biases easily sneak into the mix. A broken piece of code might quietly trash a mortgage application or throw away a great resume. It bases the choice on a hidden profile. The person gets a rejection letter, usually with absolutely zero explanation.

The 2026 Regulatory Landscape

Lawmakers worldwide are finally pushing back hard. This year marks a massive turning point for digital rules and corporate behavior.

Huge rulebooks like the European Union’s AI Act are fully active right now. They slap heavy limits on dangerous technology. Meanwhile, dozens of US states rolled out tough privacy laws that demand total honesty from tech companies. Businesses face strict legal orders to tell the public whenever a machine makes a major choice about a human life. Consumers actually hold real power again. They can demand a look at their files, force fixes, or completely scrub their names from corporate servers.

AI as a Digital Defender

Strangely enough, the exact same tech causing these nightmares also acts as the ultimate shield. Artificial intelligence is completely rewriting the cybersecurity rulebook.

Modern data defense relies heavily on smart threat detection. Clever networks watch internet traffic around the clock. They spot weird behavior and shut down hacks long before human security guards even finish their morning coffee. It also drives better ways to hide identities. Companies can track big shopping trends without ever seeing a specific name or street address.

Strategies for Protecting Vital Information

With the internet getting messier by the minute, folks need solid plans to lock down their critical records. Tossing important papers into a messy email folder or a dusty metal filing cabinet is just asking for trouble. Those old methods simply cannot survive modern cyber attacks. They also fail completely during sudden physical emergencies.

Switching to secure, encrypted digital storage offers a much stronger defense. Platforms offering independent, password-protected electronic safe deposit boxes keep life insurance policies, legal contracts, and medical histories totally out of reach from snooping data scrapers. Putting this vital information inside a heavily locked cloud vault guarantees families can grab exactly what they need during a crisis. At the exact same time, the data stays totally hidden from digital thieves.

The Future of Digital Privacy

The collision between smart machines and data privacy stands as the defining tech battle of 2026. The everyday perks are super obvious. But the background risks demand real attention. Staying updated on legal rights gives regular people a fighting chance. Plus, leaning on heavily encrypted storage for major documents lets individuals walk through this new era safely. Taking a few smart steps right now protects immediate privacy while securing a solid, long-term digital legacy.

Preparing for Tax Season

February 15, 2026

Taxes aren’t usually a task people look forward to. If anything, many procrastinate or put the chore off completely. In fact, about 5% of taxpayers fail to file their taxes each year, the top two reasons being that it’s overwhelming or they simply object to paying income taxes. But skipping your taxes is a bad idea.

“It does catch up to you, and the penalties and interest are huge,” says David Ragland, a certified financial planner and CEO of IRC Wealth. “If you don’t file your return, you’re going to have to pay interest on any unpaid taxes.”

The penalty for failing to file is 5% of unpaid taxes for each month a filing is late, capped at 25%. So a taxpayer who owes $10,000 would owe $500 each month, with a maximum owed of $2,500.

Filing your taxes can be intimidating and tedious, but by forming a plan and gathering the documents you need in advance, it can go quite smoothly. Here’s everything you can do to make filing your taxes easier this year.

Gather Paperwork First

Get together all of the information you’ll need for your taxes ahead of filing to save time and reduce stress.

The IRS recommends gathering personal information, including:

- Your Social Security number, as well as those of anyone else on your tax return, such as spouses and dependents

- Your bank account and routing numbers, if you wish to receive your refund by direct deposit

- Your adjusted gross income or AGI and the exact refund amount from last year‘s tax return, if you filed

Anyone who paid you during the year is required to report the payments to the IRS. They must file their information and return forms with the IRS and send a copy to you. You should receive these electronically or by mail in January or February.

These forms include:

- Forms W-2, which show your wages from employers

- Form W-2G for lottery and gambling winnings

- Any Form 1099, including from government payments, freelance and contract work, and retirement plan distributions

- Form SSA-1099 for Social Security benefits

- Form 1095-A, Health Insurance Marketplace Statement

If you are self-employed, have multiple jobs, or have a small business, then you’ll need:

- Bank statements and other payment collection records

- Receipts for potential deductions, such as from travel, car expenses, and business supplies

- Proof of training and further schooling

Anything that you spent on investing in your business is a potential deduction and should be collected as a reference for filing.

Deductions to Know

There’s always the chance that the IRS will file your taxes on your behalf if you fail to file on time yourself. “Just because you don’t file the return doesn’t mean you can escape the IRS long term,” says Ragland. If this happens, you’ll likely miss out on deductions that you yourself would have likely claimed.

Other documents for potential deductions include:

- Childcare and dependent expenses

- Mortgage and property tax records

- Any donations made to charity

- Healthcare expenses, including Health Savings Accounts or HSAs

- Retirement contributions

- Specific education and career expenses, such as those with students and teachers

- Student loan interest statements

The One Big Beautiful Bill Act (OBBB) was signed into law in July 2025 and makes significant changes to the tax code. It makes the 2017 tax cuts (like the seven income tax brackets from 10%–37%) effectively permanent while adjusting many bracket thresholds for inflation and substantially increasing the standard deduction (e.g., $15,750 for singles, $31,500 for joint filers). It also adds new deductions (like for tips, overtime, seniors, and certain auto loan interest), raises the SALT deduction cap, and modifies credits such as the Child Tax Credit. Study the more than 60 tax provisions that IRS has adjusted to keep deductions, tax brackets, and other items aligned with the cost of living. For those filing taxes in 2026 (for the 2025 tax year), these adjustments have increased by about 2.8%.

The Right Filing Status

Your filing status is used to determine your correct tax rate, standard deduction, and certain credits. Whether or not you are married, are the head of household, or have dependents are all factors in determining your filing status. The IRS offers a tool to help you choose the filing status that will result in the lowest amount of tax.

It pays to do a little research and know which status is best for your given situation. For instance, filing jointly as a married couple rather than separately comes with certain benefits, such as the most significant standard deduction, tax credits, and a higher income threshold. But if your spouse owes tax penalties, then that’s a situation where filing separately makes more sense.

How to File

When you can claim tax credits or otherwise have money owed to you, filing taxes can be a great thing. The IRS now offers Free File, a way to do your taxes online for free. People with potentially complex tax situations, such as multiple business ventures or multiple streams of income, may opt to work with a Certified Public Accountant (CPA). There are also many companies, like TurboTax that offer both free and fee-based services.

With Insureyouknow.org, you can get in the habit of storing this information throughout the year. That way, when it comes time to file, everything you need will be in one place.

Medical ID Wallet Cards vs. Digital Access: Which is Better?

February 11, 2026

The Emergency Question

Picture someone collapsing in a store, unable to talk. Paramedics rush over but need answers. What allergies does this person have? What medications? Any serious health problems? Should these details live on a card in their wallet or sit on their phone?

Here’s the thing: picking just one isn’t the best move.

Medical ID Wallet Cards

Advantages

- Battery? What battery? These cards just work, period.

- First responders get it: About 95% of EMTs know to check wallets.

- Zero connectivity needed: Mountains, basements, middle of nowhere. Doesn’t matter.

- Won’t break the bank: Spend maybe $5-10 once, that’s it.

Disadvantages

- There’s only so much room on a tiny card.

- Wallets get misplaced or left at home sometimes.

- People forget to scratch out old info and add new stuff.

- Cards get wet, fade, or become hard to read after a while.

Digital Smartphone Medical IDs

Advantages

- Room for everything: Write down every single medication and condition.

- Updates take two seconds: New prescription? Changed doctors? Fixed instantly.

- Talks to 911: iPhones automatically send this stuff when someone dials emergency.

- Costs nothing: Already sitting in the phone waiting to be used.

Disadvantages

- Dead phone equals zero help.

- Some paramedics haven’t learned the tricks for every phone type yet.

- Accidents crack screens and destroy phones pretty often.

- Weird fact: Only about 1 in 4 people actually bother setting this up.

The Smart Choice: Use Both

- Medical Alert Jewelry: Get a bracelet stamped with the biggest health concern plus “SEE WALLET CARD”.

- Wallet Card: The most important stuff, right there in physical form.

- Digital Medical ID: Everything else stored on the phone (make sure it shows without unlocking).

- Backup Copies: Stick extras in the glove box, desk drawer, with Mom or a close friend. Consider using a secure digital vault like InsureYouKnow to store copies of medical cards, insurance information, and emergency contacts that family members can access when needed.

Quick Setup

Wallet Card:

- Write down allergies, health conditions, meds, who to call.

- Get it laminated so it lasts.

- Make a few copies.

iPhone:

- Open Health app → Find Medical ID → Turn on “Show When Locked”.

Android:

- Go to Settings → Look for Safety & Emergency → Switch on “Show on Lock Screen”.

Total time needed: about 10 minutes.

Real Examples

- Diabetic collapse: Woman’s wallet card listed her insulin information. Paramedics knew exactly what to do.

- Allergic reaction: Guy’s phone shattered during his fall. Good thing his wallet card mentioned that penicillin allergy.

- Lost senior: Older woman wandered off, couldn’t remember her name. Her iPhone Medical ID had her daughter’s number right there.

Who Needs This?

People dealing with:

- Health stuff like diabetes, seizures, heart trouble.

- Bad allergies that could turn dangerous.

- Pills they take every day.

- Pacemakers, implants, that kind of thing.

Common Mistakes

- Picking one method and ignoring the other.

- Setting it up once and never looking at it again.

- Leaving the lock screen access turned off on phones.

- Keeping it secret from family members.

The Bottom Line

Why choose? Wallet cards save the day when phones quit. Digital files hold way more detail than any card could. Together, they’ve got each other’s backs.

- Money spent: Less than fifty bucks

- Time invested: Ten minutes

- Potential payoff: Might literally save someone’s life

Action Steps

- Today: Get that phone Medical ID set up (takes 5 minutes).

- This week: Print out a wallet card (another 5 minutes).

- Twice a year: Check both and update anything that changed.

When things go wrong, having a backup plan makes all the difference.

Storing Everything Securely

Beyond wallet cards and phone apps, keeping digital copies of medical information in a secure vault ensures family members can access critical details during emergencies. Platforms like InsureYouKnow provide encrypted storage for medical records, insurance policies, medication lists, and emergency contacts. This creates another layer of protection, especially when someone needs to share information with multiple family members or caregivers.

Medical History Cheat Sheet: What ER Doctors Need

February 4, 2026

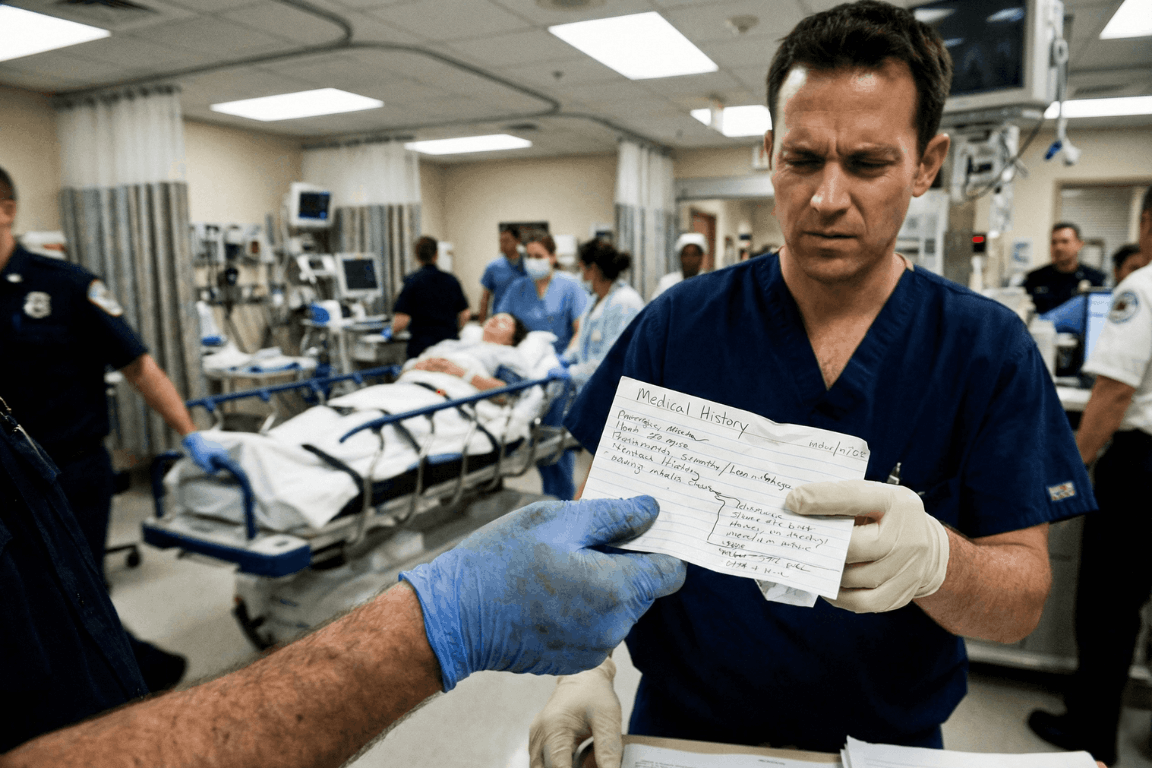

The “Golden Hour” Gap

The Emergency Room is a storm. Noise. Chaos. Speed. Doctors and nurses fight the clock. They chase the “Golden Hour.” That tiny window where fast action beats death.

But silence is the enemy. Ambulances dump patients who can’t talk. Shock takes over. Or they are out cold. In that high-pressure moment, a missing detail, a drug allergy, an old surgery, sends the team down the wrong road. That road ends badly.

Ask any ER staffer. They agree on one thing. A simple “cheat sheet” is the best tool a person can bring through those doors.

Why Memory Fails in a Crisis

People think they will remember. “I know my meds,” they say. They are wrong. Trauma wipes the brain clean. Pain and fear take over. A patient knows they take a “heart pill.” The name? Gone. The dose? Forgotten.

A written paper fixes this. It talks when the mouth cannot. It stops the guessing game between a frantic arrival and safe care.

The ER Doctor’s Wish List: 6 Essentials

What goes on the paper? Forget the thick file. Medical teams want facts. Facts that change the plan right now.

1. The “Big Picture” Demographics

Before the IV goes in, the team must know who they are treating. They need to know who signs the forms.

- Full Legal Name and Date of Birth: This finds old records in the computer.

- Blood Type: Vital for fast transfusions.

- Emergency Contacts: A spouse. A parent. Someone who answers “yes” or “no” to surgery when the patient can’t.

2. The Medication List (Crucial)

This part kills people if it’s wrong. Drug interactions cause huge messes in hospitals. Be exact:

- Prescription Drugs: The name. The dose (like 50mg). The schedule.

- Over-the-Counter (OTC) Meds: Aspirin. Ibuprofen. They seem safe. They aren’t. They thin blood. They hit kidneys.

- Supplements and Vitamins: Herbal pills often fight with anesthesia.

Note: Never write “Take as directed.” That tells the doctor zero.

3. The Allergy Alert

Does the patient hate penicillin? Latex? Contrast dye? The team needs to know. Now. The wrong drug turns a broken bone into a breathing emergency. List the allergen and the reaction. “Penicillin: Hives.” “Peanuts: Throat shuts.”

4. Past Medical History (PMH)

Context is king. A stomach ache in a healthy teen is one thing. In a Crohn’s patient, it’s another.

- Chronic Conditions: Diabetes. Asthma. Epilepsy. High blood pressure. Heart issues.

- Implants: Pacemakers. Metal rods. Artificial joints. The team must know this before an MRI scan starts.

- Past Surgeries: A quick list. “Appendectomy, 2015.” “C-Section, 2020.”

5. Recent History

Sometimes the clue is new. A note about travel, especially overseas, helps. So does a note about recent hospital stays. This helps doctors spot weird infections.

6. Insurance and Directives

Life comes first. But paperwork causes headaches later. List Insurance Policy and Group Numbers. Also, check for an Advance Directive or DNR (Do Not Resuscitate) order. A copy must exist. Otherwise, the patient’s wishes get ignored.

Paper vs. Digital: The Accessibility Problem

Old advice? Keep a card in a wallet. But paper sucks. It fades. It tears. It gets lost. Or it sits in a kitchen drawer while the car crash happens three towns over.

Digital vaults like InsureYouKnow.org changed the game. Storing this “Cheat Sheet” in a secure cloud keeps data safe. It stays ready. A trusted partner pulls up the vault on a phone. Seconds later, the ER team has the facts.

The Final Diagnosis

Being ready isn’t paranoia. It is smart. A Medical History Cheat Sheet takes ten minutes. It pays off in safety. It lets doctors work faster. It stops bad errors. And it gives families peace. They know the health story is clear. Even when the room is silent.

What Small Businesses Should Do in January: 10 Key Accounting Tasks

January 29, 2026

January can shape a small business’s financial trajectory. The new year brings a chance to complete year-end obligations and an opportunity to refresh your understanding of your finances. Done right, January accounting work can reduce stress and improve clarity for the entire year.

Here are ten accounting tasks every small business should complete in January.

1. File W-2 and W-3 Forms

January is when employers issue W-2 forms to employees for the prior tax year and file the W-3 transmittal with the Social Security Administration by January 31. This task confirms accurate wage reporting and tax withholdings and ensures employees can file their personal returns on time. Consistency with this deadline helps avoid IRS penalties and preserves goodwill with your team.

2. Issue 1099s to Contractors

January also means preparing and sending Form 1099-NEC to contractors and other eligible payees. If your business paid an independent contractor $600 or more last year, you must file this form with the IRS and deliver a copy to the contractor by the end of the month. Timely filing of forms supports compliance and helps contractors meet their personal tax obligations.

3. Make Final Estimated Tax Payments

For many business owners, the fourth quarter estimated tax payment for the previous year is due in January. Paying this by the due date helps reduce potential underpayment penalties. Beyond compliance, it supports accurate cash-flow planning as you begin a new tax cycle.

4. Reconcile Bank and Credit Card Accounts

Reconciliation is a key step in validating your books. It means ensuring that your internal records match your bank and credit card statements. When discrepancies are identified and resolved promptly, your cash balances reflect actual activity.

5. Close Out the Previous Year’s Books

Closing your books means recording all year-end transactions and adjustments so your financial statements reflect a complete year of activity. This includes depreciation entries, accruals, corrections, and categorization of uncoded transactions. With the year closed, your profit and loss and balance sheet become reliable reference points for tax filing and planning.

6. Review Financial Statements

Once the books are fully reconciled and closed, generate your key financial statements: the profit and loss, balance sheet, and cash flow report. These documents help you assess performance and financial position at a glance. Reviewing them with your accountant or trusted advisor can uncover patterns or opportunities you might not see otherwise.

7. Revisit Your Budget and Forecast

Finalized financials offer a stronger foundation for your budget and forecasts. Compare actual results with your projections from the prior year and adjust assumptions for the coming year. This practical reflection ensures that your financial plan aligns with reality rather than optimism alone.

8. Verify Accounts Receivable and Collect Past-Due Invoices

Assess and follow up on outstanding invoices. Uncollected receivables can constrain cash flow early in the year, and January is an effective window to address overdue accounts. Efficient collections improve your liquidity and make financial reporting more accurate.

9. Prepare for Tax Filing Season

January signals the start of tax filing season. Organize essential tax documents and receipts so you aren’t scrambling to gather them in March or April. Early coordination with your CPA can also clarify updated tax rules or opportunities to plan strategically.

10. Review Your Accounting Systems and Tools

January is also the moment to evaluate your accounting systems. Are you using tools that support reporting and compliance? Cloud-based accounting software can make recordkeeping more accurate and easier to share with advisors. Investing time here can reduce manual work and errors throughout the year.

Completing these accounting tasks in January brings order to your business’s finances so you can spot trends, anticipate challenges, and make decisions with confidence.

Public WiFi vs. Your Data: Why You Need a Secure Vault

January 28, 2026

The Open Window

A traveler sits at a crowded airport gate. The flight is delayed. Boredom sets in. The phone comes out, and there it is: “Free Airport WiFi.”

Click. Connected.

It feels like a small victory. A chance to check a bank balance, pay a credit card bill, or look up a policy number.

But that click? It is the digital equivalent of leaving a house key under the doormat and hoping no one looks.

In 2026, we treat our phones like fortresses. We lock them with faces and fingerprints. Yet, the moment we connect to an open network, we lower the drawbridge. We invite the world in. And the world is watching.

The Invisible Eavesdropper

Here is the ugly truth about public internet: it is loud.

When data leaves a phone on a secure home network, it whispers. On public WiFi, it screams.

The danger isn’t usually some master criminal in a hoodie. It is often just software. Simple, cheap scripts running on a laptop three seats away. These programs are like digital vacuums. They suck up everything floating through the air.

- The Man-in-the-Middle: A hacker cuts in line. The user sends a password to the bank. The hacker catches it, copies it, and then passes it to the bank. The login works. The user has no idea they just handed over their keys.

- The Fake Twin: You see a network called “Coffee_Shop_Free.” It looks real. It isn’t. A scammer set it up five minutes ago. Connect to it, and the device effectively belongs to them until you disconnect.

The “Inbox” Mistake

Fear makes people do silly things. When travelers get nervous about logging in, they turn to an old, bad habit: The Email Search.

“I won’t log in,” they think. “I’ll just find that PDF I emailed myself.”

This is a disaster.

An email inbox is not a safe. It is a glass box. Email accounts are the most hacked targets on the planet. If a thief gets into an email account, they don’t just read letters. They find the tax returns from 2024. They find the scan of the child’s birth certificate. They find the list of “backup codes.”

Using an inbox to store life’s vital documents is like hiding jewelry in a clear plastic bag. It doesn’t work.

The Real Fix: A Digital Vault

So, what is the answer? Carry a filing cabinet? Never go online?

No. The answer is a Secure Digital Vault.

This is where platforms like InsureYouKnow.org step in. They aren’t storage bins. They are armored trucks.

1. It Shreds the Data A real vault uses encryption that mimics the banking world, like Amazon Cloud security. If a hacker snatches a file from the air, they don’t get a readable document. They get noise. A jumbled mess of code that means nothing. The thief gets the envelope, but they can never read the letter.

2. Nobody Knows the Code Privacy matters. The best systems run on “zero-knowledge” rules. That means the company holding the data doesn’t have the password. Even if they wanted to look, they couldn’t. The user holds the only key.

3. Get In, Get Out With a vault, the data lives in the cloud, not on the device. A user can log in on a hotel computer, check a passport number, and vanish. No files left in the “Downloads” folder. No trail for the next guest to find.

Peace of Mind

Security usually feels like a headache. Extra steps. More passwords.

But actually? It is freedom.

It is the ability to lose a wallet in Paris and not fall apart. Why? Because the backup copies of every card and ID are sitting behind an iron door in the cloud. Accessible. Safe. Ready.

Public WiFi is fine for reading gossip columns or checking the weather. But for the heavy stuff like the money, the legacy, and the identity, stay off the open road. Put the valuables in a vault. Lock it up. Then go enjoy the coffee.

Crypto Estate Planning: How to Protect Your Digital Assets

January 21, 2026

Introduction: The Hidden Tragedy of Lost Cryptocurrency

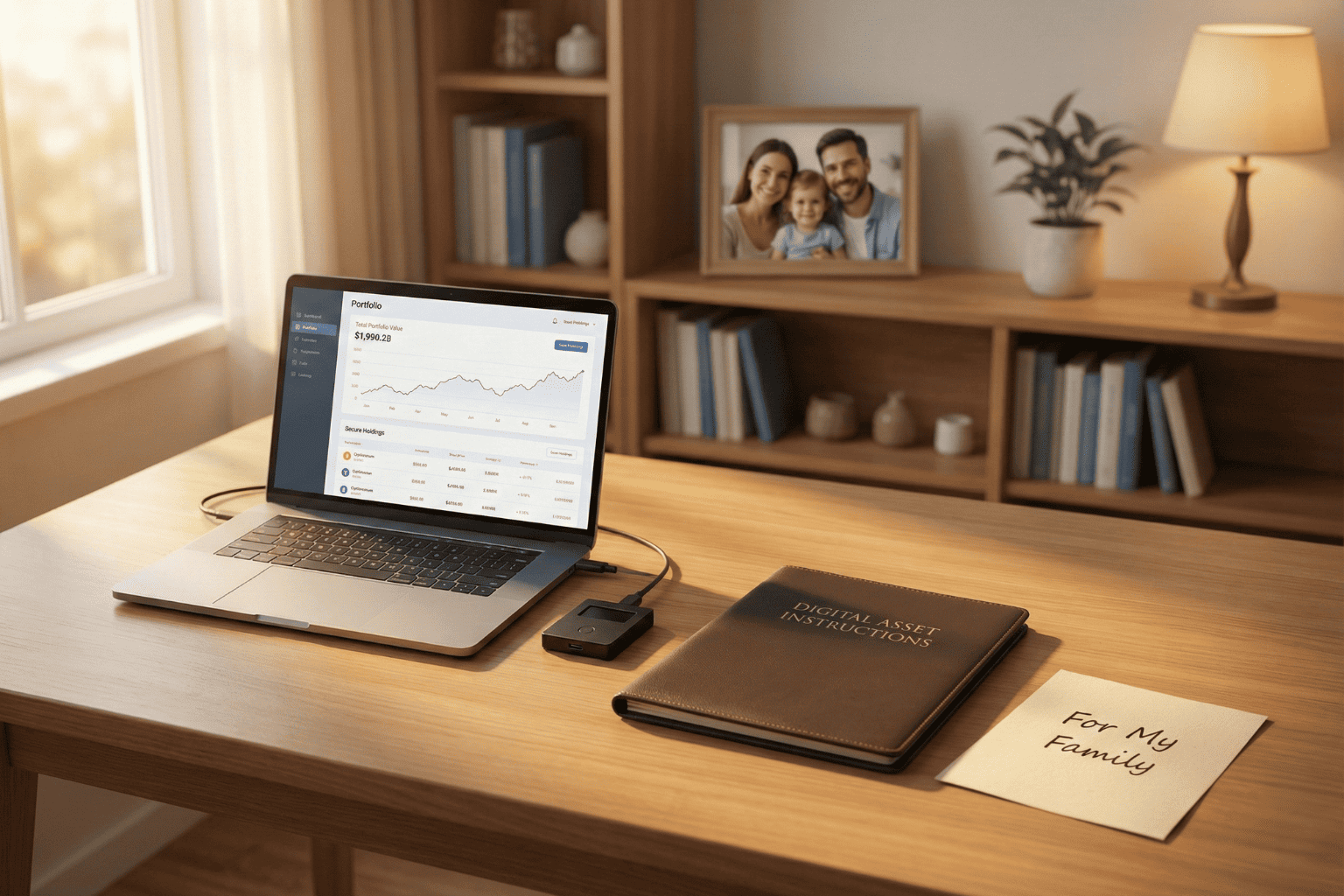

Billions in cryptocurrency are currently lost in digital limbo. It wasn’t hackers or scams. Owners simply passed away without sharing the password.

Crypto is unforgiving compared to a bank. There is no “Forgot Password” button or help desk to call. If the login details vanish, the money vanishes with them.

This puts families in a bind. Most executors aren’t tech-savvy, so handing them a hardware wallet without instructions is like leaving a locked safe without the key.

The fix is simple. You don’t need to be a tech expert. You just need a secure, central place to leave a clear “treasure map” that guides your family to the assets.

Why a Will Alone Isn’t Enough for Cryptocurrency

A lot of people assume that as long as their cryptocurrency is mentioned in their will, everything is taken care of. In practice, that rarely works out.

1. Privacy vs. Access

When someone dies, their will typically becomes a public document. If wallet details or crypto account information are written into it, that sensitive data can be seen by anyone who pulls the record. That’s an obvious security risk.

But putting detailed login instructions into a will isn’t safe either. Anyone who gets a copy of the will intentionally or not could try to use that information to get into the accounts.

2. The Custody Problem: Exchange vs. Private Wallet

How and where cryptocurrency is stored changes the situation completely:

On an exchange (like Coinbase or Binance):

The executor would usually need:

- The username and password

- Access to the linked email account

- Access to the phone used for two-factor authentication (2FA)

In a private wallet (like Ledger or Trezor):

The executor would usually need:

- The physical device

- The PIN code

- The 12- or 24-word seed phrase

If even one of these is missing, there’s a real chance the assets will never be recovered.

The “Treasure Map” Strategy (Safety First)

Before anything else, one rule must be clear:

Never upload a 12- or 24-word seed phrase to the internet. Not even to a secure portal.

Those words are the master key to the wallet. If someone gets them, they can steal everything.

So what should be stored instead?

Breadcrumbs, not the key.

The goal is to leave a clear, simple map that tells loved ones:

- What assets exist

- Where they are located

- How to access them safely

Examples of What to Store in a Secure Digital Vault

- A document stating:

“My Ledger wallet is taped under the bottom drawer of my desk.”

“The seed phrase is stored in a sealed envelope in the bank safety deposit box.”

- A list of exchanges used:

“Accounts exist on Coinbase and Kraken.”

This step is critical. Family members cannot claim assets if they don’t even know which website or platform to look at.

Device Access Instructions

Most crypto accounts use two-factor authentication. That code is usually sent to a phone or email.

A simple note explaining:

- How to unlock the phone or laptop

- Where the phone is kept

- Which email account receives security codes

can make the difference between recovery and total loss.

How InsureYouKnow.org Solves the Executor Gap

This is where InsureYouKnow.org becomes essential.

A Centralized Digital Vault

InsureYouKnow.org acts as the bridge between a complex digital life and non-technical family members. It allows users to securely store:

- Letters of instruction

- Lists of crypto exchanges

- Locations of hardware wallets

- Guidance for accessing phones, emails, and computers

All in one place.

Secure Document Uploads and Shared Access

Users can upload documents such as a “Crypto How-To Guide” or “Letter of Instruction” and grant access to a trusted partner or executor.

This ensures the right person has the right information at the right time.

Strong Encryption for Peace of Mind

InsureYouKnow.org uses Amazon cloud encryption, making it a safe place to store sensitive account lists and location maps for physical crypto keys.

While private seed phrases should always remain offline, everything else needed for recovery can be organized securely inside the platform.

A Step-by-Step Checklist for Every Crypto Owner

This simple checklist helps ensure cryptocurrency doesn’t vanish after death.

Step 1: Inventory All Crypto Assets

List every place where crypto is stored:

- Exchanges

- Hardware wallets

- Software wallets

Note whether each is online or offline.

Step 2: Write a “Letter of Instruction”

This letter should explain everything in plain language.

Write it as if explaining to a fifth grader.

Include:

- What cryptocurrency is

- Which platforms are used

- Where devices are located

- Where passwords and seed phrases are stored physically

- How two-factor authentication works

Step 3: Secure Seed Phrases Offline

Write seed phrases on paper or metal plates.

Store them in:

- A safe

- A bank safety deposit box

- A sealed envelope with a trusted attorney

Never store them digitally.

Step 4: Upload Instructions to InsureYouKnow.org

Upload:

- The Letter of Instruction

- Lists of exchanges

- Device locations

- Access instructions for email and phone

This becomes the digital “treasure map.”

Step 5: Share Access With a Trusted Partner

Grant access to a spouse, adult child, executor, or attorney.

They don’t need crypto knowledge.

They only need clear instructions and a secure place to find them.

Conclusion: Don’t Let Digital Wealth Disappear

Cryptocurrency represents the future of finance. But protecting it still requires old-school organization.

Without a plan, digital assets can vanish forever.

With a simple treasure map and a secure vault, families can inherit what was meant for them.

No one should leave behind money that loved ones can never reach.