5 Scams Targeting Seniors in 2026 (And How to Lock Down Your Data)

January 1, 2026

Can you believe it is 2026? We have apps for everything and phones that are smarter than the computers we grew up with. But there is a flip side. All this tech has handed crooks a brand new playbook. And let’s be honest, they love targeting seniors.

The scams floating around right now aren’t the sloppy emails we used to laugh at. These new ones are sharp. They use fancy tech and psychological tricks to bypass your gut instincts. But don’t worry. You don’t need to be a tech wizard to stay safe; you just need to know what the red flags look like.

Here is what is happening out there and how to keep your private life private.

1. The “Grandchild” Voice Clone (It’s Not Them)

You might remember the old version of this trick. Someone calls pretending to be a grandson in trouble. Usually, you could tell it wasn’t him because the voice was off.

Well, the game has changed.

Scammers are now grabbing snippets of audio from social media videos. If your grandchild posted a video on TikTok or Instagram, that is all they need. They use AI to clone the voice. When the phone rings, it sounds exactly like them. Same laugh, same tone. They will say they are in jail or stuck in Mexico and need money fast.

What to do:

- The Password Rule: Agree on a secret family password. If “Bobby” calls saying he is in trouble, ask for the password. If he can’t give it, hang up.

- Don’t Panic: Hang up and call their real cell phone number. Verify it yourself.

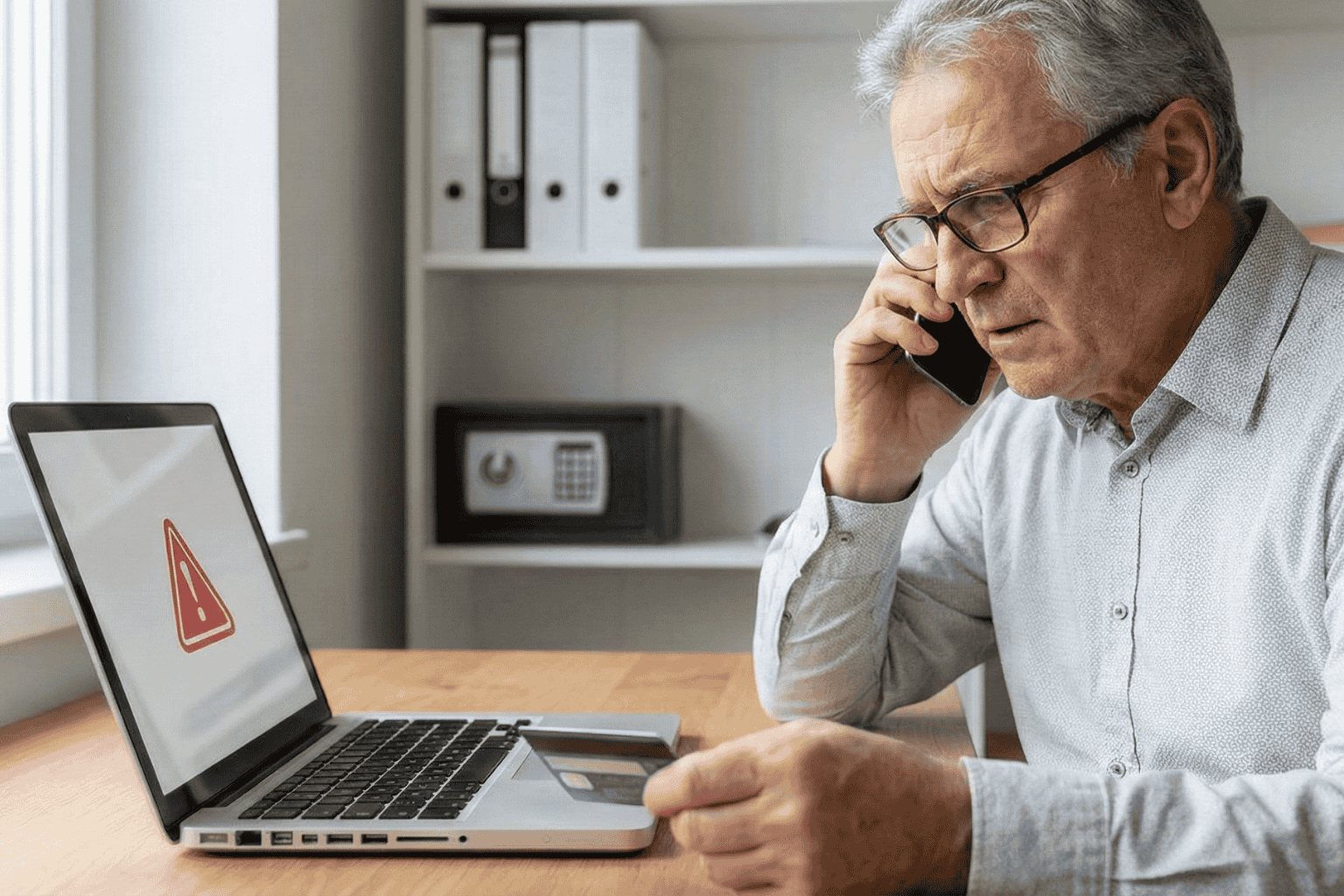

2. The “Computer Meltdown” Pop up

You are just reading the news or looking for a recipe, and suddenly BAM. A siren starts wailing from your speakers. A box pops up on the screen saying your computer is infected and you have to call “Microsoft” immediately.

It is terrifying, right? That is the point.

But here is the truth. It is all smoke and mirrors. Your computer is fine. The person on that phone line isn’t tech support; they are a thief waiting for you to open the front door. If you let them “remote in,” they will swipe your passwords or charge you for fixing a problem that didn’t exist.

What to do:

- Ignore the Number: Real companies like Apple or Microsoft will never put a phone number on a warning pop up. Never.

- The Hard Reset: If your mouse freezes, just hold the power button down until the screen goes black. Turn it back on, and the “virus” will be gone.

3. The Medicare “Chip Card” Trap

Medicare rules are a maze, and scammers know it. The latest trick? A friendly phone call telling you that you are due for a “refund” or a new “chip card.”

It sounds great, doesn’t it? But then comes the catch. To get the goods, they say they just need to “verify” your Social Security Number or your current Medicare ID.

What to do:

- Guard It: Treat your Medicare number like the combination to a safe.

- Check Your Vault: Don’t take a stranger’s word for it. If you keep your insurance details stored in a secure spot, like the InsureYouKnow.org portal, you can just log in and check your official policy. Call the number on your documents, not the one the stranger gave you.

4. The “Pig Butchering” Long Game

This one is nasty because it pulls on heartstrings. It usually starts with a “wrong number” text or a random message on Facebook. The person is nice. You start chatting. Over weeks, maybe even months, you become friends.

Then, they mention money. They are making a killing in crypto or gold, and they want to help you do the same. You might even put a little money in and see it grow on a website they send you. But the moment you invest a serious amount? The website vanishes, and so does your “friend.”

What to do:

- Keep Wallets Closed: Never take financial advice from someone you have only met through a screen.

- Do Your Homework: If they send a photo, run it through a Google Image search. You will probably find that picture belongs to a model or someone else entirely.

5. The Fake Government Threat

Fear is a powerful tool. Scammers love to pretend they are the IRS or the Social Security Administration. You will get a text or voicemail saying your account is “suspended” or you owe back taxes.

They will threaten arrest if you don’t pay right now. And weirdly, they often want payment in gift cards.

What to do:

- Gift Cards equal Scam: The government will never ask you to pay a fine with an Amazon gift card. That just doesn’t happen.

- Slow Down: They want you to panic so you stop thinking. Take a breath. It is almost certainly fake.

The Secret Weapon? Getting Organized.

Why do these scams work? Because they rely on chaos. They hope you don’t know where your real policy is. They hope you can’t find the right phone number to check if the story is true.

If you have your house in order, they can’t touch you.

When you have your vital info, like IDs, policies, and bank contacts, locked in a secure, encrypted hub, you have the power. If someone calls about your life insurance, you don’t have to guess. You log in, look at the real document, and you see the truth.

Stay Safe Out There:

- Verify, Verify, Verify: Don’t trust Caller ID.

- Lock It Up: Use a secure service to store your life’s paperwork.

- Buddy System: Share access to that digital vault with a family member you trust. It helps to have backup.

You don’t have to be paranoid to be safe in 2026. You just have to be organized.